Description

Disclaimer: Copyright infringement not intended.

Context

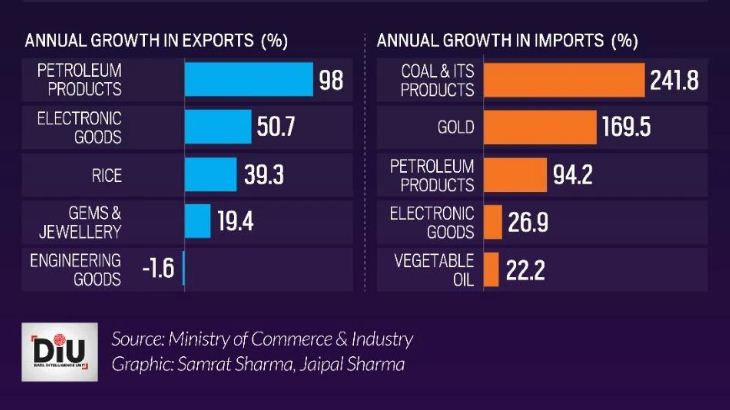

- India's June trade deficit widened to a record $25.63 billion.

Trade deficit

- A trade deficit is an amount by which the cost of a country's importsexceeds its exports.

- It's one way of measuring international trade, and it's also called a negative balance of trade.

- A trade deficit can be calculated by subtracting the total value of a country's exports from the total value of its imports.

What Causes a Trade Deficit?

It can be hard to pinpoint the exact cause of a trade deficit. Typically, multiple factors are at play. Here are some of the leading causes of an increase in a country's trade deficit.

- Economic growth: A large trade deficit can actually indicate economic growth. When the economy of a country grows and strengthens, consumers have more wealth to purchase goods from overseas, which will increase the trade deficit. A strong economy also attracts foreign investors, further enlarging the trade deficit.

- Increased government spending: An increase in government spending can mean a country's savings diminish, increasing the trade deficit.

- Changes in exchange rate: A change in the strength of a country's currency can impact the trade deficit. When a country's currency weakens relative to other nations, trade between other countries becomes more costly. If a country’s currency is strong, it may want to import more goods or services.

- Limits of production: Certain goods simply cannot be produced domestically, or are much cheaper to produce abroad due to climate, natural resources, or other reasons. For example, a small island nation may rely on imports of agricultural products from the mainland.

- Removal of barriers to trade, such as tariffs: Trade policy can have an effect on the trade deficit, but unless the country was previously closed to trade, trade policy mostly serves to shift the trade deficit toward another trading partner, rather than creating or increasing the overall trade deficit.

Potential Effects of a Trade Deficit

Here are some of the ways a trade deficit can affect a country’s economy.

Lower prices

- A country may have a trade deficit because it is cheaper to purchase goods internationally than to produce them at home. This means that prices of consumer goods and services may decrease.

Weakening currency:

- A trade deficit has the potential to weaken a country’s currency.

Deflation:

- A country that has a trade deficit is sending a portion of its currency overseas. This can cause deflation, a state in which reduced demand leads to lower prices.

Changes in employment:

- If a country imports more than it exports, unemployment may increase. For example, if a country shifts from manufacturing cars to importing cars from international car manufacturers, the job market for car manufacturing will be negatively impacted. Some economists argue that the reduced prices caused by a trade deficit can make up for these losses, by allowing resources to be allocated to new jobs, while others suggest that workers displaced by shifts in trade are unlikely to benefit from jobs created in other fields.

Decrease in GDP:

- Trade deficit is one factor used to calculate a country’s Gross Domestic Product (GDP), a measure of the size of the economy. If the trade deficit increases, the GDP decreases.

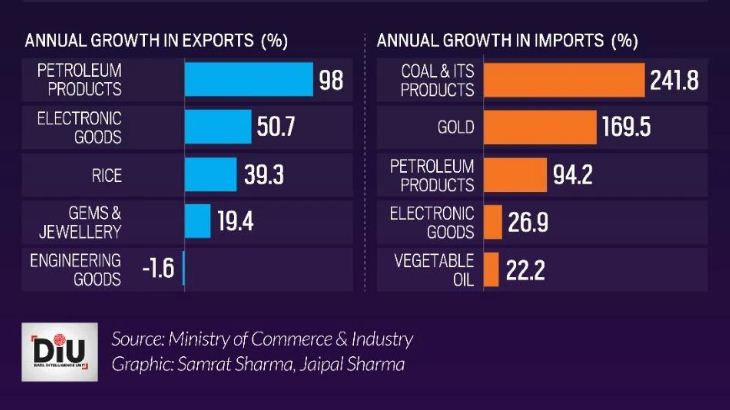

Reasons responsible for the recent record high Trade Deficit

- Rise in crude oil and coal imports.

- A surge in global crude and commodity prices following the Ukraine war, and rising demand for coal and other goods fuelled by the domestic economic recovery.

- Persistence of global uncertainties.

- Slowdown in the world economy is dampening exports.

Scenario

Merchandise Trade Deficit

- June's merchandise trade deficit was the highest ever, according to private economists. Merchandise trade deficit more than doubled to $70.25 billion from $31.42 billion during a year ago period- Ministry of Commerce and Industry.

Currency strength

- Rupee has plunged 6% against the dollar this year as investors retreated from domestic share markets.

Silver line

- A robust surplus in services trade and forex reserves of over $590 billion provides confidence to the government that it can manage external payments.

Must Read

https://www.iasgyan.in/daily-current-affairs/current-account-deficit-16

https://www.iasgyan.in/blogs/key-economic-concepts-back-to-basics

https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

https://www.iasgyan.in/daily-current-affairs/monetary-policy

https://www.iasgyan.in/blogs/budget-basics-key-financial-terms-you-need-to-know

https://indianexpress.com/article/business/economy/current-account-deficit-likely-to-hit-10-year-high-7814251/

https://www.business-standard.com/article/economy-policy/india-s-record-25-6-bn-trade-deficit-in-june-adds-pressure-on-rupee-122070401129_1.html

1.png)