Description

Disclaimer: Copyright infringement not intended.

Context

- In its latest ‘Monthly Economic Review’, the Ministry of Finance has highlighted two key areas of concern for the Indian economy: the fiscal deficit and the current account deficit (or CAD). So, it is India’s emerging twin deficit problem.

Twin Deficit

- Economies that have both a fiscal deficit and a current account deficit are often referred to as having "twin deficits."

- A fiscal deficit is a budget shortfall. A current account deficit, means a country is sending more money overseas for goods and services than it is receiving.

- Many economists argue that the twin deficits are correlated, but there is no clear consensus on the issue.

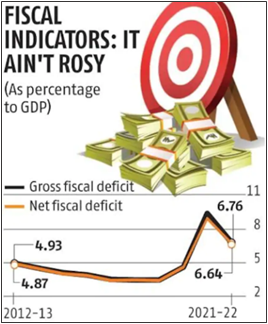

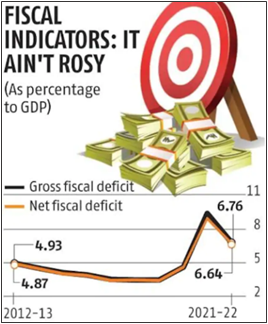

Fiscal Deficit

- Fiscal Deficit is the excess of the total government expenditure over receipts from both tax and non tax sources excluding borrowings, during a fiscal year in both current and capital account.

- It occurs when Government spends more than it earns or beyond its resources.

- Fiscal Deficit shows the extent of borrowings by the government when interest payment is accounted for.

- It represents additional requirement of financial resources to meet government expenditure.

- Fiscal Deficit is an indicator of increase in future liabilities of the government on interest payment and loan payment.

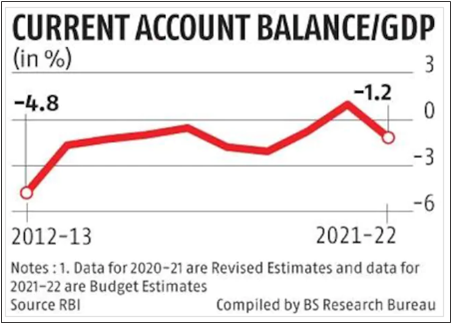

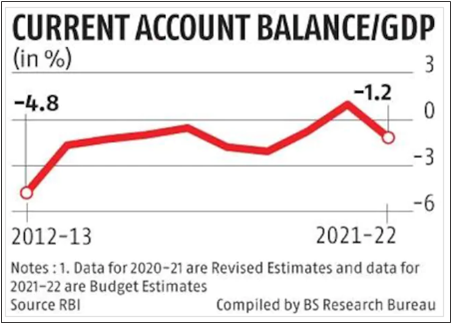

Current Account Deficit

- Current Account Deficit (CAD) is the shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations. If the value of goods and services we import exceeds the value of those we export, the country is said to be in a deficit, and the difference in the two values is CAD.

- The current account includes net income, including interest and dividends, and transfers, like foreign aid

- India’s current account position is largely on the deficit side because of the country's dependence on oil imports.

The current account essentially refers to two specific sub-parts:

* Import and Export of goods — this is the “trade account”.

* Import and export of services — this is called the “invisibles account”.

- If a country imports more goods (everything from cars to phones to machinery to food grains etc) than it exports, it is said to have a trade account deficit. A deficit implies that more money is going out of the country than coming in via the trade of physical goods. Similarly, the same country could be earning a surplus on the invisibles account — that is, it could be exporting more services than importing.

- If, however, the net effect of a trade account and the invisibles account is a deficit, then it is called a current account deficit or CAD. A widening CAD tends to weaken the domestic currency because a CAD implies more dollars (or foreign currencies) are being demanded than rupees.

What is Current Account and how is it different from Balance of Trade?

- Quite similar to the balance of trade, current account maintains a record of the country's transactions with other nations.

- However, the two terms are technically different. While the balance of trade measures only the gap in earnings and expenditure on exports and imports of goods and services, current account also factors in payments from domestic capital deployed overseas.

India’s present Twin Deficit Challenge

- Costlier imports such as crude oil and other commodities will not only widen the CAD but also put downward pressure on the rupee. A weaker rupee will, in turn, make future imports costlier.

- If, in response to higher interest rates in the western economies especially the US, foreign portfolio investors (FPI) continue to pull out money from the Indian markets, that too will hurt the rupee and further increase CAD.

- As government revenues take a hit following cuts in excise duties on diesel and petrol, upside risk to the budgeted level of gross fiscal deficit has emerged. An increase in the fiscal deficit may cause the current account deficit to widen, compounding the effects of costlier imports, and weaken the value of the rupee, thereby further aggravating external imbalances, creating the risk (admittedly low, at this time) of a cycle of wider deficits and a weaker currency.

- As per the report, the recent surge in inflation in EMEs is mainly on due to supply-side shock arising from the Russian-Ukraine conflict.

Way Ahead

- Rationalizing non-capex expenditure has become critical, not only for protecting growth supportive capex but also for avoiding fiscal slippages.

|

Non capital expenditure generally include wage expenses, subsidies among others, which exclude the spending on new development work including infrastructure, health facilities, education and others.

|

- Balancing between maintaining growth momentum, restraining inflation, keeping the fiscal deficit within budgetary target.

- Prioritizing macroeconomic stability over near-term growth.

- Near-term challenges need to be managed carefully without sacrificing the hard-earned macroeconomic stability.

Other Policy options:

Addressing the twin deficits requires emphatic policy measures. These are:

- Improve the efficacy of public spending so that improvements in productivity rather than increases in financial resources drive higher public service delivery.

- Reduce the share of physical savings.

- Empower the States on the basis of their superior fiscal record to become the apex level of government responsible for public service delivery. This can be done by an increase in vertical devolution to the States equivalent to the current plan revenue expenditure. Reducing expenditure on fiscal ‘bads’ like food and fertiliser subsidy would then not trigger expenditure switching, thereby enabling a net reduction in the Central Government revenue deficit.

- The government should focus more on attracting more FDI, create a better environment for businesses, relax some regulations, and build the necessary infrastructure.

- India needs to maintain the balance of payments with its net capital inflow, which means it should focus more on FDIs rather than FPIs as a stable source of income.

Must Read:

Fiscal deficit https://www.iasgyan.in/daily-current-affairs/fiscal-deficit-37

Current Account Deficit: https://www.iasgyan.in/daily-current-affairs/current-account-deficit-16

Trade Deficit: https://www.iasgyan.in/daily-current-affairs/trade-deficit-47

Economic Concepts: https://www.iasgyan.in/blogs/key-economic-concepts-back-to-basics

Monetary Policy: https://www.iasgyan.in/daily-current-affairs/monetary-policy

Inflation: https://www.iasgyan.in/blogs/inflation-all-you-need-to-know

Key Terms: https://www.iasgyan.in/blogs/budget-basics-key-financial-terms-you-need-to-know

https://indianexpress.com/article/explained/everyday-explainers/indias-emerging-twin-deficit-problem-explained-7982895/

1.png)