Description

Disclaimer: Copyright infringement not intended.

Context

- Current account deficit (CAD) could, deteriorate this year mainly due to rising trade deficits- Finance Ministry.

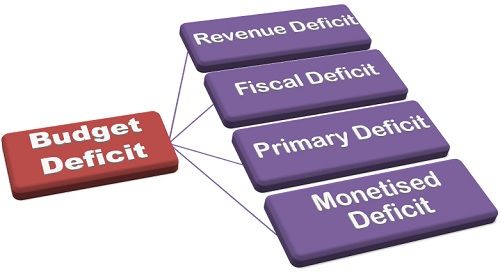

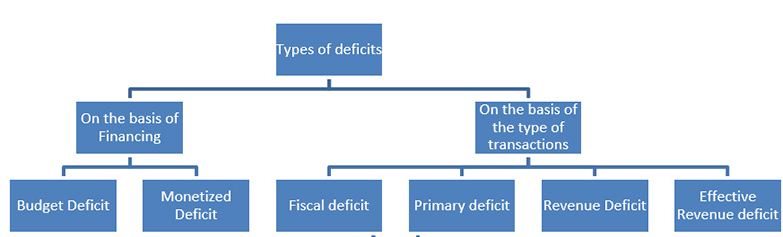

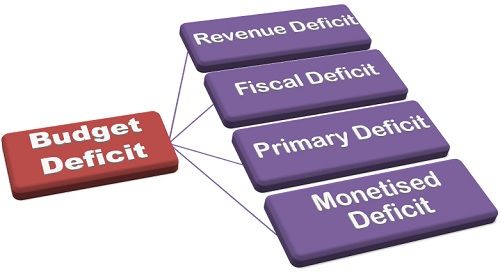

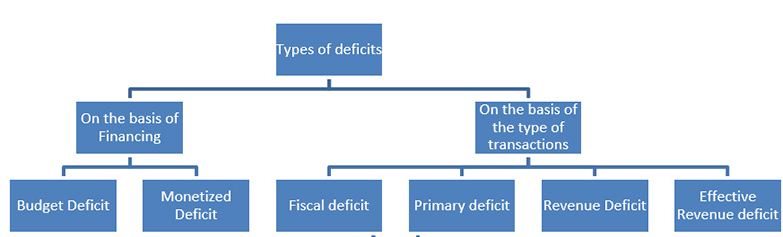

Types of Deficit

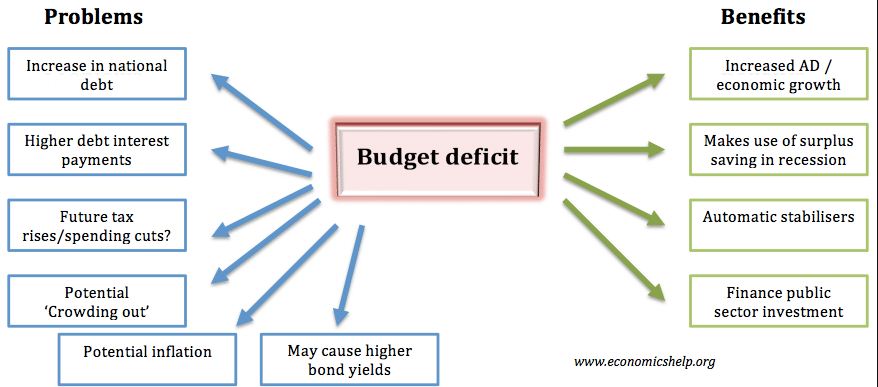

Budget Deficit

Also referred to as simply ‘budget deficit’ is that part of the government’s deficit which is financed through short-term borrowings. These short-term borrowings may be from the RBI or from other sources.

Normally, short-term borrowings from the RBI are through the net issuance of short-term treasury bills (that is, ad-hoc and ordinary treasury bills) and by running-down the central government’s cash balances held by the RBI.

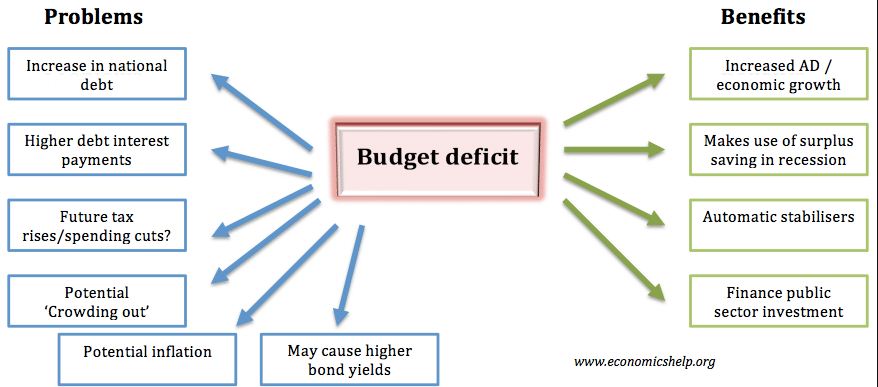

National budget deficits can be caused by a number of factors:

- Tax cuts that decrease revenue, such as those intended to boost large companies’ ability to hire employees

- Low GDP (gross domestic product — the money being made in the country) resulting in low overall revenue, and so low tax revenue

- Poorly-designed tax structures that under-tax high-earners and over-tax low-earners

- High spending on many programs, like Medicare and Social Security

- High military spending

- High spending on subsidies to various industries

How Governments Reduce a Budget Deficit

One thing is certain: the government is often interested in a lower fiscal deficit when it grows too high. And right now, it’s about as high as it’s ever been. That’s led many different political groups to suggest their own methods of reducing the federal deficit. Here are some commonly-floated federal budget deficit solutions:

- Increase taxes. Some groups want to increase federal revenue to offset the deficit. This could largely be achieved by increasing taxes, particularly on the wealthy, who, in spite of the deficit — and pandemic-induced recession — are still doing very well. Tax increases have downsides for politicians, however, as they are often unpopular, and proposing them can sometimes be a political disaster.

- Increase growth. The government can also increase tax revenue by stimulating growth in the economy. When the economy is growing, people are making more money. And when there’s more money being made, there’s more money eligible for taxation, increasing the total tax revenue the government can collect. Increasing growth is tricky. Some believe cutting taxes increases growth, but there’s no evidence that that works. Others believe direct stimulus can help, but this can also put the government into more debt.

- Cut spending. Cutting spending can come in a number of different forms. Some groups advocate for cutting spending on social programs like Social Security, Medicaid, and aid for state-based programs. Some advocate cutting the military budget, which is much higher than any other developed nation. Ultimately, this becomes a hotly contested political matter.

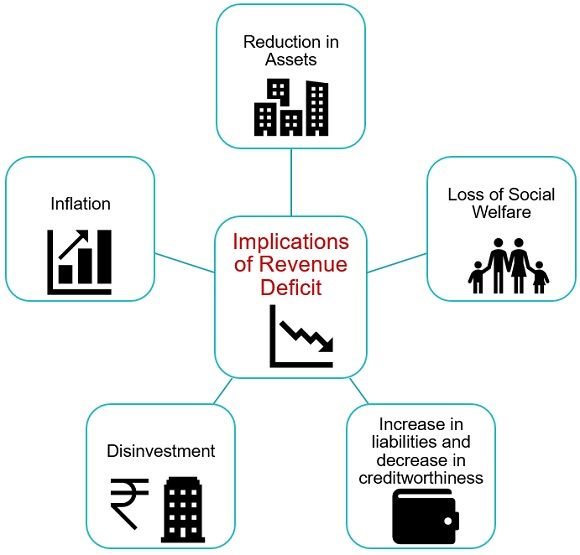

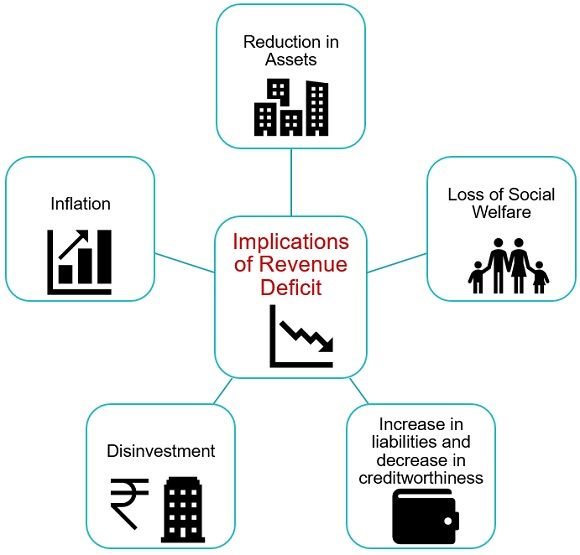

Revenue Deficit:

- Revenue Deficit is the excess of its total revenue expenditure to its total revenue receipts. Revenue Deficit is only related to revenue expenditure and revenue receipts of the government.

- The difference between total revenue expenditure to the total revenue receipts is Revenue Deficit.

What does it mean?

- A revenue deficit indicates that the government doesn't have sufficient revenue for the normal functioning of the government departments. In other words when the government starts spending more than it earns it results in

- Revenue Deficit. Revenue Deficit forces the government to disinvest or cover the shortage by borrowing.

Revenue Deficit: Total revenue receipts – Total revenue expenditure.

Or

Revenue deficit = Total Revenue expenditure – (Tax Revenue + Non Tax Revenue)

- Revenue Deficit deals only with the government’s revenue receipts and revenue expenditures.

- Note that revenue receipts are receipts which neither create liability nor lead to a reduction in assets.

- It is further divided into two heads:

- Receipt from Tax (Direct Tax, Indirect Tax)

- Receipts from Non-Tax Revenue

- Revenue Expenditure is referred to as the expenditure that does not result in the creation of assets reduction of liabilities. It is further divided into two types

- Plan revenue expenditure

- Non-plan revenue expenditure

Remedial measures:

- In the case of Revenue Deficit government usually tries to curtail their expenses or increase its tax and non-tax receipts. This can be done by introducing new taxes or increasing the tax on people in higher-earning slabs.

Effective Revenue Deficit

- Effective Revenue Deficit is the difference between revenue deficit and grants for creation of capital assets. The concept of effective revenue deficit has been suggested by the Rengarajan Committee on Public Expenditure. It is aimed to deduct the money used out of borrowing to finance capital expenditure.

Monetized Fiscal Deficit:

- The part of the fiscal deficit which is covered by the borrowing from the RBI.

Fiscal Deficit:

- The excess of total expenditure over total receipts excluding borrowings is called Fiscal Deficit. In other words, the Fiscal Deficit gives the amount needed by the government to meet its expenses. Thus a large Fiscal Deficit means a large amount of borrowings.

What does it mean?

- Simply put a Fiscal Deficit is a measure of how much the government needs to borrow from the market to meet its expenditure when its resources are inadequate.

Remedial measures:

- Various measures might be taken to reduce Fiscal Deficit, some of them can be reducing public expenditure in the form of subsidies, reduction in expenditure on bonus, LTC, Leaves encashment etc.

- Alternatively, measures to increase the revenue are also taken in forms of broadening tax base restructuring and sale of shares in public sector units etc.

Primary Deficit:

- Primary Deficit is Fiscal Deficit of the current year minus interest payments on previous borrowings. While Fiscal Deficit represents the government's total borrowing including interest payments, Primary Deficit shows the amount of borrowing excluding interest payments.

What does it mean?

- Primary Deficit shows the amount of government borrowings specifically to meet the expenses by removing the interest payments. Therefore, a zero Primary Deficit means the need for borrowing to meet interest payments.

Remedial measures:

- A higher Primary Deficit reflects the amount of new borrowings in the current year. Since this is the amount on top of already existing borrowings (Fiscal Deficit) similar measures can be taken to reduce the amount of borrowings.

Significance of different measures of deficit

|

S.No

|

Deficit Measure

|

Significance

|

|

1

|

Fiscal Deficit

|

Widely used as a summary indicator of the macroeconomic impact of the budget in several industrialized countries. This measure has been adopted by the IMF as the principal policy target in their programmes. In India, the government began to report the fiscal deficit only after 1991.

|

|

|

|

Since the shortfall in receipts over expenditure must be covered through borrowing, therefore, Gross Fiscal Deficit, gives the overall borrowing requirements of the government over a given financial year. And thus shows the net addition to the level of public debt during a financial year.

|

|

2

|

Budget Deficit

|

In the presence of the system of automatic monetization of deficits through issuance of ad-hoc treasury bills, this measure of deficit, becomes an important target to keep in check.

However, in the year 1997, the government discontinued the issuance of ad-hoc and tap treasury bills. As a result of this, now, the concept of budget deficit in the traditional sense has lost its significance in public finance and is now not reported in the Budget documents of the Government of India.

|

|

3

|

Monetized Deficits

|

Monetization of deficits, which increases the money supply, is inflationary if the rate of growth of money supply is greater than the rate of increase of the demand for cash balances arising from the growth of the economy. Thus, monetized deficits are an important indicator of the inflationary impact of the increase in government’s budgetary deficits.

|

|

4

|

Primary Deficits

|

It excludes the burden of the past debt and shows the net increase in the government’s indebtedness due to the current year’s fiscal operations. A reduction in primary deficit is reflective of government’s efforts at bridging the fiscal gap during a financial year.

|

|

5

|

Revenue Deficit

|

A positive revenue deficit implies that the government is resorting to borrowing to finance current consumption.

|

|

|

|

|

https://epaper.thehindu.com/Home/ShareArticle?OrgId=G4NA1JT4J.1&imageview=0

1.png)