Description

Disclaimer: Copyright infringement not intended.

Context

- The Unified Payments Interface or the UPI, processed Rs 10,41,520 crore worth of transactions just in May 2022 in India. More than 40% of all retail digital payments (non-cash and non-paper payments) in India happen through UPI now.

About UPI Service

- Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India (NPCI).

- It facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions.

- The system powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- NPCI launched Unified Payments Interface (UPI) with member banks in 2016.

Features of UPI Service

- Immediate money transfer through mobile device round the clock 24*7 and 365 days.

- Single mobile application for accessing different bank accounts.

- Single Click 2 Factor Authentication – Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

- Virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

- Merchant Payment with Single Application or In-App Payments.

- Utility Bill Payments, Over the Counter Payments, QR Code (Scan and Pay) based payments.

- Donations, Collections, Disbursements Scalable.

- Raising Complaint from Mobile App directly.

Participants in UPI

|

Payment System Player (PSP) —new concept in the UPI world. This is not the same thing as a Payment Bank. This is someone who facilitates payments i.e. can move money.

|

- Payee PSP

- Remitter Bank

- Beneficiary Bank

- NPCI

- Bank Account holders

- Merchants

Steps involved in UPI Payments

- UPI based payments function broadly through three steps:

- First, one’s bank account is mapped to a Virtual Payment Address (VPA). A VPA eliminates the risk of mentioning account details in every transaction. It can be created in a couple of minutes using a UPI app. The only prerequisite is that user’s bank account be linked to a mobile number.

- Secondly, a Payment Service Provider (typically a bank) takes care of the to-and-fro transactions to this VPA (and hence to the underlying bank account) and

- Finally, the UPI software orchestrates the fund movement from a customer’s VPA to a target VPA and completes the transaction.

- This transaction is different from paying with a debit card or credit card as it does not involve a Merchant Discount Rate (MDR). The MDR is a fee that the recipient bank collects from the merchant.

- For UPI transactions, there is no MDR (like in the case of the Indian government’s Rupay card which also does not have an MDR) and hence there is no price to be paid by the merchant.

Evaluation of UPI Ecosystem in India

- The Economic Survey 2021-22 highlighted the growing trend of increasing digital transactions over the years and emergence of Unified Payments Interface (UPI) as the most preferred mode of transactions since its launch in 2016.

- UPI emerged as the single largest retail payment system in India in terms of number of transactions. In December 2021, a whopping 4.6 billion transactions worth Rs 8.26 lakh crore were carried out on the platform.

- Commensurate with growing participating in equity markets, UPI also emerged as a popular method of participation in the primary market by investors. In 2018, SEBI introduced UPI as a payment channel to invest in IPO. Overtime, RBI has increased the transaction limit for IPO participation from Rs 1 lakh to Rs 5 lakh.

- RBI and the Monetary Authority of Singapore announced a project to link UPI and PayNow, which is targeted for operationalisation by July 2022.

- Bhutan recently became the first country to adopt UPI standards for its QR code. It is also the second country after Singapore to have BHIM-UPI acceptance at merchant locations.

- Reserve Bank of India launched a new Unified Payments Interface (UPI) payments solution - ‘UPI123Pay’ for feature phone users. So, UPI service, which was limited to smartphones till date, will be now available for feature phones without internet. The service is expected to benefit 40 crore feature phone users and is likely to increase digital financial inclusion, especially in the rural parts of the country.

|

National Payments Corporation of India (NPCI)

It is an umbrella organization for operating retail payments and settlement systems in India. It is an initiative of Reserve Bank of India (RBI) and Indian Banks’ Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007.

It has been incorporated as a “Not for Profit” Company under the provisions of Section 25 of Companies Act 1956 (now Section 8 of Companies Act 2013).

The ten core promoter banks are State Bank of India, Punjab National Bank, Canara Bank, Bank of Baroda, Union Bank of India, Bank of India, ICICI Bank, HDFC Bank, Citibank and HSBC. In 2016 the shareholding was broad-based to 56 member banks to include more banks representing all sectors.

NPCI is the firm that handles RuPay payments infrastructure, i.e. similar to Visa and MasterCard.

|

Reasons behind penetration of UPI in the country

- The popularity of UPI is evident — from tiny roadside shops to large brands, many merchants accept UPI-based payments.

- The reasons for this kind of penetration of UPI are the following:

- Transaction amount: It accepts transactions as small as one rupee and for merchants,

- Absence of MDR that they have to pay to their banks is a significant incentive to accept UPI payments.

- Simple process: Since just a smart-phone is needed to complete a transaction it makes the process as simple as it can get, instead of using devices like the Point-of-Sale card-swiping machines.

- Ecosystem in which UPI thrives: presence of high-speed internet, cloud computing and modern software engineering technologies that fulfil a transaction in a few seconds.

- Security: The security of a UPI transaction is tied to the user’s authentication with the mobile phone — there is a mobile personal identification number (MPIN) for the UPI application and there is one more layer of security when the bank’s online transaction PIN is to be keyed in as part of every UPI transaction. If a user blocks a mobile number due to theft, for example, then UPI transactions on that mobile number will also be halted.

- Innovation: The NPCI has come up with multiple new innovations over the past few years: recurring payments for monthly bills, international payments, linking UPI to credit cards, 123PAY that allows people without smartphones but with only ordinary mobile phones to use UPI using missed calls, allowing one-time payment by letting a merchant generate a QR (Quick Response) code that is valid for just that specific transaction and many more features.

Cost of running UPI

- There is no extra price to be paid by customer or merchant, but still NPCI manages the cost of running the infrastructure for UPI.

- This is because cost savings from the reduction in hassles and overheads for banks (by supporting UPI) is used to bear the cost of operating UPI in the long run.

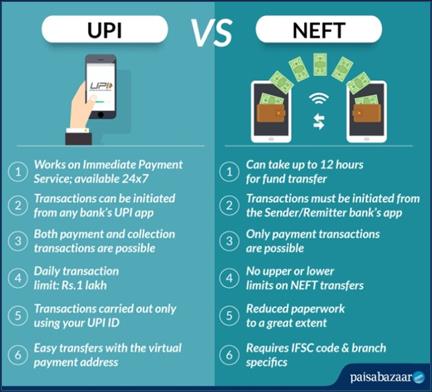

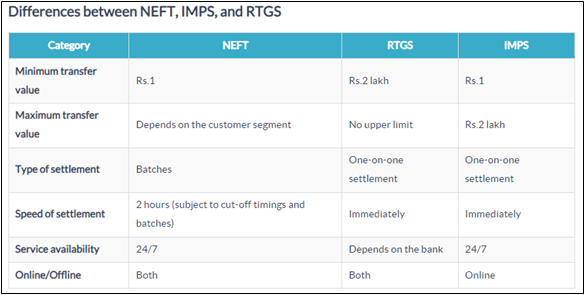

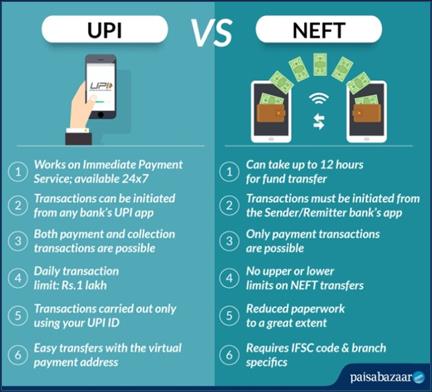

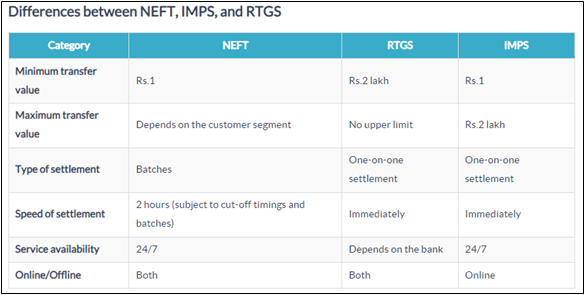

Some Key Differences

Final Thought

- The UPI is a phenomenal Indian technological success story. In 2019, Google requested the U.S. Federal Reserve to develop a solution similar to India’s UPI citing the thoughtful planning, design and implementation behind it.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GP3A0F47M.1&imageview=0

1.png)