Description

Disclaimer: Copyright infringement not intended.

Context

- According to a report by the Confederation of Indian Industries (CII) India has potential to attract $475 billion in FDI in 5 years.

- The report titled ‘Vision—Developed India: Opportunities and Expectations of MNCs’, added that 71% of MNCs working in India consider the country an important destination for their global expansion. The optimism is driven by both short-term as well as long-term prospects.

Background

- MNCs have been playing an important role in the economic growth and development of the country, leveraging on the improving ease of doing business and liberalised regulatory environment.

- The Government on its part has consistently focused on easing the policy and regulatory environment for MNCs in India.

- Among various initiatives, the Government has slashed the corporate tax rates, liberalized Foreign Direct Investment (FDI) policies and norms in a host of sectors and rigorously rationalized regulatory compliances burden for them.

- In most sectors, FDI is now under the automatic route, except for a small negative list, making India one of the most open large economies in the world.

Read all about FDI: https://www.iasgyan.in/daily-current-affairs/fdi

- The reforms undertaken by the Government have started bearing fruits for MNCs at the ground level as the country’s attractiveness as a global investment destination. This is validated by the UNCTAD’s World Investment Report 2020, according to which India was the 9th largest recipient of FDI in 2019, with 51 billion dollars of inflows during the year.

- Large number of MNCs have taken their business to the next level, positioning India both as a business hub serving global clients and as a base for exports. This has created greater employment opportunities for the local nationals, sharing of international best practices and more importantly supporting the local community via CSR initiatives.

- Today, our market has become a priority for foreign companies looking to get a bigger share of the international market and they are continuously adopting strategies to expand their footprint in India. This creates a strong base for the country which is rapidly moving towards strengthening its systems through the initiative of Aatmanirbhar Bharat.

‘Vision—Developed India: Opportunities and Expectations of MNCs’ – Findings of the Report

- The report noted that FDI in India has seen a consistent rise in the last decade, with FY 2021-22 receiving FDI inflow of $84.8 billion despite the impact of the COVID-19 pandemic and geopolitical developments on investment sentiment.

- India is seen as an emerging manufacturing hub in global value chains, as a growing consumer market and as a hub for ongoing digital transformation.

- 71% of MNCs working in India consider the country an important destination for their global expansion. The optimism is driven by both short-term as well as long-term prospects.

- A majority of MNCs feel that the Indian economy will perform significantly better in 3-5 years backed by 96% of respondents being positive about overall India’s potential.

- The confidence in India’s potential, stems from strong consumption trends, digitisation and a growing services sector, along with government’s strong focus on infrastructure and manufacturing.

- Over 60% of MNCs in the report stated improvement in the business environment in the last three years.

Challenges in India’s MNCs Sector

Risks faced by entrepreneurs and corporations

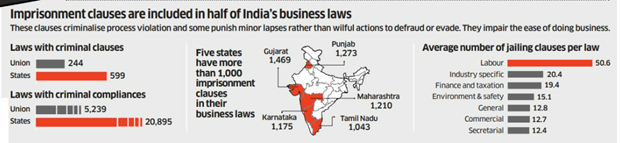

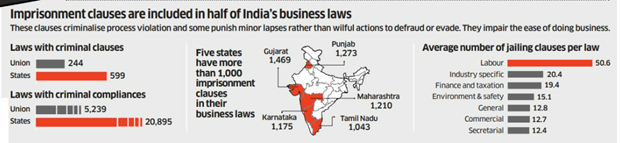

- There are 26,134 imprisonment clauses in India’s business laws, according to an Observer Research Foundation report that highlights the risks faced by entrepreneurs and corporations in doing business in India.

Regulations act as Barriers

- India suffers from ‘regulatory cholesterol’ that is getting in the way of doing business. The legislations, rules and regulations enacted by the union and state governments have over time created barriers to the smooth flow of ideas, organisation, money, entrepreneurship and through them the creation of jobs, wealth and GDP.

Tariff Barriers

- Companies across the globe find India hard to ignore due to its vast population and huge market potential, but doing business here has not been easy for many. India is one of the highest tariff nation in the world.

Regulatory flip-flops

- Regulatory flip-flops have also driven companies out of India. India's struggle has been its inability to simplify regulations. Complex framework causes confusion and proves to be tedious for investors. However, simplification leads to exploitation and tax leakage. India needs to find a healthy balance that will be attractive to MNCs.

Tax issues

- Retrospective taxation (such as in Vodafone's case) prohibits entry.

Low per capita income

- Indian market, in general, is very price sensitive since the majority of the people in India have low per capita income. Price, product and positioning are very important for sustainable growth in the Indian market.

Lack of planning and understanding

- There is definitely a lack of planning or understanding of the Indian markets among MNCs that have failed. The competition is also very high and most foreign companies struggle to meet customer expectations. Cultivating brand loyalty in the Indian market is also very difficult, especially when companies succumb to product modifications i.e., making cheaper substitutes,

Parliamentary Standing Committee report of 2021

- A Parliamentary Standing Committee report of 2021 titled “Attracting investment in post-Covid Economy: Challenges and Opportunities for India” pointed out that foreign companies that shifted their manufacturing bases out of China during the pandemic picked countries such as Vietnam, Taiwan and Thailand, and only a few came to India.

- There are key challenges in attracting investment, including administrative and regulatory hurdles, inadequate and costly credit, tedious land acquisition procedure and inadequate infrastructural facilities, high logistics cost and large unorganised manufacturing sector.

- The policy changes and the incentive schemes brought in by the government to overcome these challenges are welcome measures and are in the right direction. However, success depends on the implementation of the reforms.

Recommendation of Confederation of Indian Industry (CII) National Committee on MNCs

- Introduce a differential slab-based incentive as per FDI size.

- Make the process of the approvals related to FDI time bound.

- Allow FPIs to directly participate in IBC/distressed debt rather than through the route of Asset Reconstruction Companies (ARCs).

Read about IBC: https://www.iasgyan.in/daily-current-affairs/insolvency-and-bankruptcy-code-ibc-2016

- Central Board of Direct Taxes (CBDT) to consider permitting ‘E-site visit’ to be conducted electronically through video conferencing for Advance Pricing Agreement Program Procedures.

|

Advance Pricing Agreement

The Advance Pricing Agreement was introduced in 2012 by the Central Board of Direct Taxes to minimize any confusion regarding the pricing of international transactions through a mutual agreement between the taxpayer and tax authority. Advance pricing can be understood as an agreement between a taxpayer and a tax authority fixing the pricing method that the taxpayer will apply to its related future international transactions of the taxpayer.

Through the APA program, India aims to deliver a non-adversarial tax regime for foreign investors. Other benefits of an APA include avoiding rigorous and burdensome audit requirements while delivering the tax outcome on the basis of agreed terms of the agreement.

Over time, APAs can lower compliance costs of MNCs and substantially reduce the cost of administration and litigation incurred by the tax authorities.

APA provides greater certainty on the transfer pricing method adopted, mitigating the possibility of disputes and facilitating the financial reporting of potential tax liabilities. Importantly, an APA also reduces the incidence of double taxation, and the costs associated with both audit defence and documentation preparation. [Double taxation is the levying of tax by two or more jurisdictions on the same income]

|

- Extend the benefits available under the Interest Equalization Scheme to the domestic suppliers of the manufacturer exporters.

|

What is Interest Equalisation Scheme?

The Interest Equalisation Scheme (IES) was implemented on 1st April 2015 to provide pre and post-shipment export credit to exporters in rupees. Under the IES/Interest Subvention meaning, the government identifies eligible exporters and passes on the interest equalization amount. This scheme, which is also referred to as interest subvention export scheme for exporters, was designed to benefit the MSME segment in particular.

|

- The Government may consider decriminalizing additional provisions under the Companies Act 2013.

- Extend / allow fast-track merger of a group companies with the approval of the regional director instead of the NCLT process in select cases.

Read about NCLT: https://www.iasgyan.in/daily-current-affairs/national-company-law-tribunal-nclt

- To boost investments and encourage domestic production, a designated taskforce may be formed for each sector involving representation from the relevant high-level policy makers from the Government.

- Continuous efforts needed in improving ease of doing business, such as: resolving issues of cumbersome and time-consuming procedures for land acquisition, registering property and land conversion; ensuring that e-courts across states are more effective to enforce contracts; deemed approvals are provided in online single window system (expected early next year), etc.

Looking forward

- As continuing improvement in business environment, way ahead for MNCs would be enhanced effectiveness of the national single window for approval / clearances; greater tax certainty, and stronger contract enforcement mechanism, among other measures.

- Stability in tariff structure is very important to allow MNCs to integrate India in global value chains. Similarly, many laws vary by state and they need to play a proactive role to attract MNCs.

- To ensure the upward growth trajectory in terms of attracting foreign investment and effective capitalization of global geopolitical phenomenon like the ‘Plus one’ strategy, it is crucial to consistently work towards enhancing the efficiency of business processes, improving ease of doing business further, promoting transparency, increasing stakeholders’ engagement, bringing in consistency and predictably in policy developments, adopting international best practices and technological innovation.

- There is a robust and transformational shift in economic globalization and investments and MNCs can play an even stronger role in supporting the Government in realizing its objective of Aatmanirbhar Bharat.

https://www.thehindu.com/business/Economy/india-can-attract-475-billion-in-fdi-in-five-years-says-cii-ey-report/article66017413.ece