Description

Disclaimer: Copyright infringement not intended.

Context

- Recently, the government announced that nine special Vostro accounts have been opened with two Indian banks after permission from the RBI to facilitate trade in the rupee in the wake of sanctions on Russia by the US and European countries.

What is International Trade Settlement in rupees?

- When countries import and export goods and services, they have to settle payments in a foreign currency. Since the US Dollar is the world’s reserve currency, most of the trade occurs in US dollars.

- For example, if an Indian buyer enters into a transaction with a seller from Germany, the Indian buyer has to first convert his rupees into US dollars. The seller will receive those dollars, which is then converted into euro.

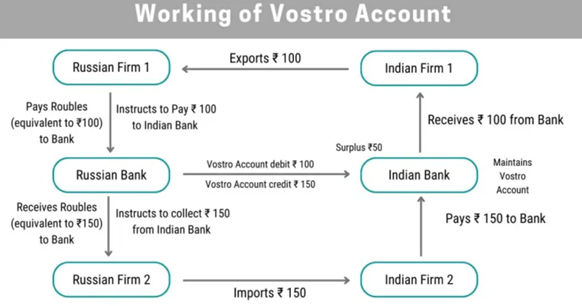

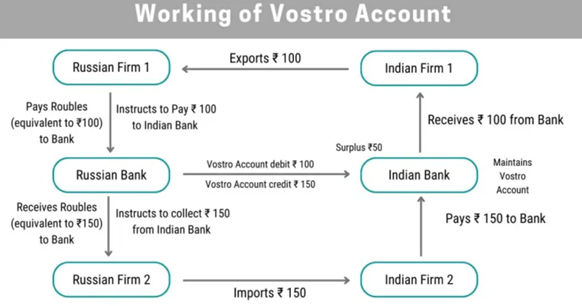

- Here, both the parties involved have to incur the conversion expenses and bear the risk of foreign exchange rate fluctuations. With the help of a Vostro account now, instead of paying and receiving US dollars, the invoice will be made in Indian rupees if the counterparty has a Rupee

Vostro account

- Rupee Vostro Accounts keep a foreign entity's holdings in the Indian bank, in Indian rupees. When an Indian importer wants to make a payment to a foreign trader in rupees, the amount will be credited to this Vostro account, and when an Indian exporter needs to be paid for supplying goods or services, this Vostro account will be deducted, and the amount will be credited to the exporter's account.

- The bank of a partner country; e.g. German banks may approach an AD bank in India for the opening of Special Rupee Vostro account. The AD bank then will seek approval from the RBI with details of the arrangement and subsequent to the approval granted by the RBI, the Special Rupee Vostro account in the Indian AD bank by a German bank shall be opened.

- The trade settlement shall then start between the parties in INR. The exchange rate between the currencies of two trading partner countries may be market determined.

- The RBI allowed nine such accounts, including IndusInd Bank and UCO Bank.

Role of Bank

- The banks are acting in a fiduciary relationship and they share a principal-agent relationship. The correspondent foreign bank is a financial intermediary in the transactions that they are involved in.

- The foreign bank acts as an agent that provides services such as executing wire transfers, performing foreign exchange, enabling deposits, enabling withdrawals and, expediting international trade on behalf of the domestic bank.

- It is most used in settlement of foreign exchanges or foreign trade. No interest will be paid on the Vostro account maintained, as per the directives that have been issued by the RBI in India. An overdraft facility can only be availed if it is specifically sanctioned.

Why is it required?

- In order to promote the growth of global trade with emphasis on exports from India and to support the increasing interest of Global trading community in INR, it has been decided to put in place an additional arrangement for invoicing, payment, and settlement of exports / imports in INR. As such all exports and imports under this arrangement may be denominated and invoiced in Rupee (INR).

- Exchange rate between the currencies of the two trading partner countries may be market determined.

Benefits for India

- The RBI's move could marginally narrow India's widening trade deficit by reducing the price of commodity imports.

- But India would move cautiously on internationalizing the local currency given associated risks for the economy, such as high exposure to global shocks, asset bubbles and exchange rate volatility.

What is a Nostro account?

- A Nostro account is an account held by a bank in another bank. It allows the customers to deposit money in the bank's account in another bank. It is often used if a bank has no branches in a foreign country.

- Let's presume bank "A" does not have any branches in the US, but bank "B" does. Now, to receive the deposits in the US, "A" will open a Nostro account with "B".

- Now, if any customers in the US want to send money to "A", they can deposit it into A's account in "B". "B" will transfer the money to "A".

- The main difference between a deposit account and a Nostro account is that the former is held by individual depositors while foreign institutions hold the latter.

- In the above example, the account will be called a Vostro account for bank "B". The Vostro account accepts payments on behalf of the account holder's bank

- If a person deposits money in the Vostro account, it will be transferred to the account holder's bank.

- Nostro and Vostro accounts are held in a foreign denomination.

- Both Vostro and Nostro are technically the same type of account, with the difference being who opens the account and where.

https://timesofindia.indiatimes.com/business/india-business/explained-what-is-a-vostro-account-and-how-it-can-promote-international-trade-settlements-in-rupees/articleshow/95546482.cms