Description

Disclaimer: Copyright infringement not intended.

Context

- With global oil prices easing, the Centre slashed the windfall tax levied on crude oil producers, reduced the export tax on Aviation Turbine Fuel (ATF) and diesel and scrapped the duty on petrol exports.

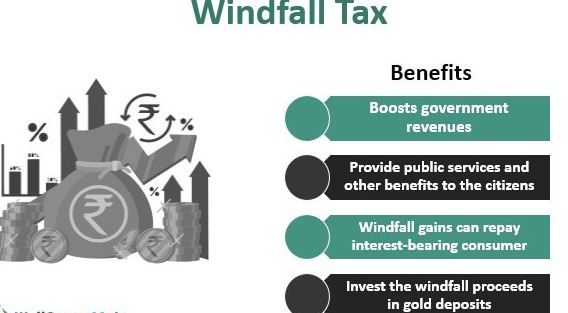

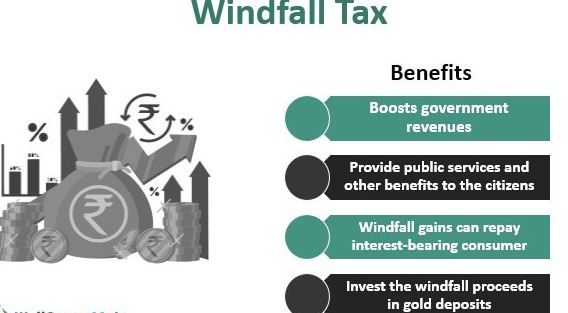

What is a Windfall Tax?

- A windfall tax is a one-off tax imposed by a government on a company. It is levied on an unforeseen or unexpectedly large profit, especially unfairly obtained.

Why did Government Implement Windfall Taxes?

- The central government slapped export duties on petrol and ATF (Rs 6 per litre or USD 12 per barrel) and diesel (Rs 13 a lire or USD 26 a barrel) and imposed a windfall tax on domestic crude production (Rs 23,250 per tonne or USD 40 per bbl). The aim was to garner more revenue and limit export to address the fuel shortage in the country.

Example

- Three of Indian upstream oil companies — ONGC, Oil India and GAIL. All three declared all-time high net profit in the fiscal year 2021-22. ONGC said its net profit grew by 258 per cent to reach Rs 40,306 crore. Oil India announced net profit of Rs 3,887.31 crore, which is 123 per cent higher than in the preceding year. GAIL reported a 112 per cent surge in its net profit, at Rs 10,364 crore. This was possible as crude oil and gas prices shot up due to the Russia-Ukraine conflict.

- Governments, typically, levy a one-time tax over and above the normal rates of tax on such profits and that is called windfall tax.

Will such a tax increase price of fuel?

- Very unlikely, as this tax is not part of the input or output cost, but levied only on profit.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GQ4A2ARIQ.1&imageview=0

1.png)