Disclaimer: Copyright infringement not intended.

Context

- India slashed the windfall tax on domestically produced crude oil to ₹4,100 per tonne from ₹6,400 per tonne.

- The latest revision comes due to the softening in oil prices.

Background

- Windfall tax came into being in the 1970s with the intent to tax the profit of companies generating huge revenue due to an unprecedented event.

What is Windfall Tax?

- Windfall tax is a higher tax levied by the government on specific industries when they experience unexpected and above-average profits.

- As the name suggests, “windfall” refers to a dramatic and unanticipated increase in profits.

- On the other hand, “tax” implies an imposition levied on this dramatic income growth.

- The Government imposes this tax when they notice a sudden rise in an industry’s revenue.

- However, these revenues cannot be linked to anything the company actively pursued, such as its business strategy or expansion. Consequently, a Windfall Tax is imposed on an industry's profits when it experiences a sharp increase in revenue due to unrelated external events.

- For instance, the recent Russia-Ukraine war benefitted oil and gas industries with a sudden rise in their profit. So, the Government imposed a windfall tax on these industries. Their profits are taxed separately, over and above the normal taxes that these companies pay to the governments.

In a nutshell,

Windfall taxes are usually levied on companies judged to have benefited from something that was not the result of their own investment or hard work, at the expense of wider society, so the tax provides a way of redistributing these gains.

.jpeg)

Are windfall taxes widely used?

- Windfall taxes have been used in various forms throughout history and have gained prominence in recent years. However, their use is still relatively rare and depends on the specific circumstances and policy goals of the government in question.

What happened in India?

- The conflict between Russia and Ukraine caused crude oil prices to skyrocket. As a result, India's oil companies recorded their highest net gains ever during the last fiscal year of 2022, making extraordinary profits. Further, among the top revenue producers are ONGC, Oil India, and GAIL.

- Corresponding to this event, the government imposed this Windfall Tax rate on oil producers to cover India's trade deficit and raise spending on food and fertilizers. This tax was proposed in July 2022 and went into effect on September 1 of that same year.

Why did the government impose this tax?

- The levies came as refiners made major gains by boosting fuel exports to countries that were in a deficit like Europe, which has now boycotted oil imports from Russia.

- The government wanted to keep a check on the constant supply of crude oil in the domestic market since many refiners preferred to export crude oil instead of selling it within the country.

- The government mandated oil exporters to fulfill the Indian domestic oil demand first and levied windfall taxes on exports to indirectly make exporting oil more expensive.

Economic Rationale

- The economic rationale for imposing windfall taxes is that India’s trade deficit had increased to record high levels and a weak rupee had increased the value of India’s imports.

- Moreover, the government’s spending has gone up after it recently cut Central Excise Duty and spent more on food and fertilizers. It then decided to levy windfall tax on oil companies to make up for this gap as the windfall tax adds to the government’s earnings.

Drawbacks of Windfall Taxes

Arbitrary Taxation System

- The economic impact of windfall taxation should lead to its immediate rejection. Firstly, such an arbitrary taxation system would increase the risks of investing. As a result, investors will demand a higher return on their investments, or they may choose to stop investing altogether.

May Reduce the Dividend Payout to Investors

- These taxes may reduce the dividend payout to investors investing in for example oil-producing companies.

Spike Energy Costs

- Finally, it would reduce the funds available for investment in sources of fuel, thereby spiking energy costs.

- Windfall tax may affect people; it was created to help and reduce long-term tax income.

Discourages investment

- The main objection to windfall taxes is that they may discourage investment. This could happen for two reasons.

-

- First, windfall taxes reduce the amount of profits companies have left to invest in their businesses. By removing this ready source of financing, the government may reduce the amount that companies invest.

- Second, windfall taxes create uncertainty in the tax system. Companies may, rightly, be suspicious that the tax will be repeated in future. That may discourage them from capital spending (investment in expanding their production and profits) due to concerns that the government could tax away some potential returns. This could in turn slow economic growth – and brings the risk to the government that more internationally established firms take their business elsewhere.

Retrospective taxation is unfair

- There is also the concern that retrospective windfall taxes are unfair – that is, that companies should be told in advance what the tax rules are so they can decide how to behave, rather than having legitimately earned profits taken away.

The potential drawbacks of a windfall tax include the potential for discouraging investment and innovation, as well as concerns about the fairness of taxing individuals or companies for their success.

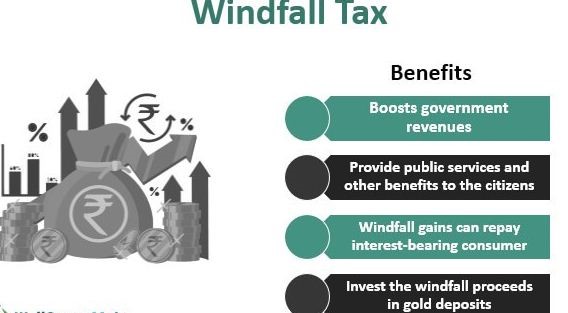

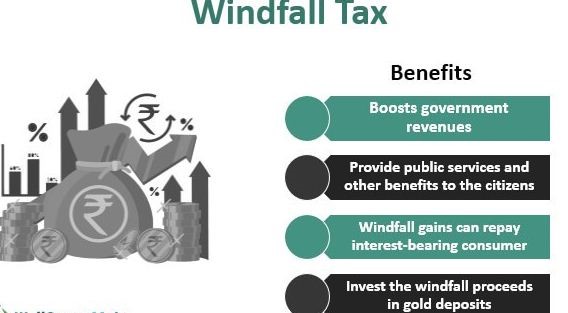

Benefits of Windfall Taxes in general

Boosts Government Revenues

- The most certain benefit of windfall taxes is that it boosts government revenues.

Provide public services to the citizens

- It enables them to substantially provide public services and other benefits to the citizens of the country like building civil infrastructure, health facilities, sanitation, and also building the nation’s military strength.

Service the debts by the countries

- The additional funds raised through this tax can service the debts by the countries to various global financial institutionsand may bolster the national economy. However, it may also act as a disincentive to companies.

Drive for innovating Business Plans

- If companies become aware that windfall gains will be taxed, they may not seek out such profits with innovative business plans.

The potential benefits of a windfall tax include the redistribution of wealth and a reduction in economic inequality, as well as the provision of additional funds for social welfare programs, such as education, healthcare, or infrastructure development.

Closing Remarks

- Windfall taxes provide a good source of revenue to the government as it follows the principle that those who have earned a surplus through windfalls to be taxed and also discourage businesses of the lottery, gambling, horse racing, etc.

- It affects the companies which earn huge profits in the business of oil and gas as they have lesser income in the form of dividends to be distributed to its investors.

- As a way forward, Windfall Taxes can be structured in a way that provides incentives for companies to continue investing in innovation and growth. For example, the tax could be levied at a lower rate if companies use the funds to invest in research and development or to support employee training programs.

|

PRACTICE QUESTION

Q. What is Windfall Tax? What are the benefits and drawbacks of Windfall Taxes? Examine.

|

https://economictimes.indiatimes.com/industry/energy/oil-gas/centre-slashes-windfall-tax-to-rs-4100-per-tonne/articleshow/99917608.cms