Description

Copyright infringement not intended

Picture Courtesy: en.wikipedia.org

Context: The Chief Economic Adviser has raised concerns regarding the reliance of credit rating agencies on the Worldwide Governance Indicators (WGI) provided by the World Bank for their rating assessments.

Details

- The Chief Economic Adviser has raised concerns about the use of the World Bank's Worldwide Governance Indicators (WGI) in the rating assessment by credit rating agencies, particularly in the context of emerging economies. His remarks highlight issues related to transparency, subjectivity, and the potential impact of these indicators on credit ratings.

Key concerns raised by the Chief Economic Adviser

Transparency Concerns

- The Chief Economic Adviser emphasizes the lack of transparency in how the WGI is used in the credit rating assessment process. He suggests that the influence of the WGI in determining credit ratings is not disclosed by credit rating agencies.

- The opacity in the process raises questions about how much weight these indicators carry in the overall credit rating, and whether there are qualitative overlays that are not adequately revealed.

Subjectivity in WGI

- The Chief Economic Adviser raises concerns about the subjective nature of the WGI. He points out that the sub-indices within the WGI are based on the subjective opinions of expert institutions.

- He criticizes the fact that these expert institutions may lack on-the-ground presence and understanding of the context in which their judgments are being made. This lack of context-specific understanding could lead to assessments that may not accurately reflect the conditions in member countries.

Qualitative Overlays in Credit Rating Assessment

- The Chief Economic Adviser suggests that credit rating agencies might apply qualitative overlays on top of the subjective assessments provided by the WGI. This implies that the credit rating agencies may introduce additional qualitative factors or judgments without transparently disclosing them.

- The lack of clarity on the extent to which these overlays are used and their impact on credit ratings is a cause for concern, as it introduces further opacity into the assessment process.

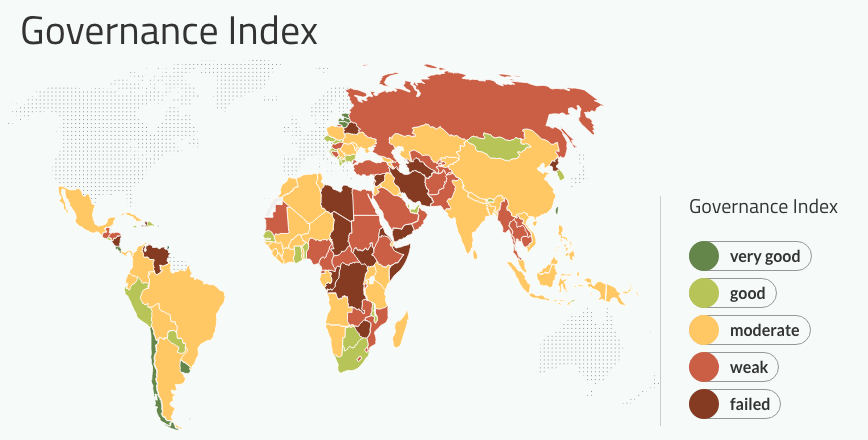

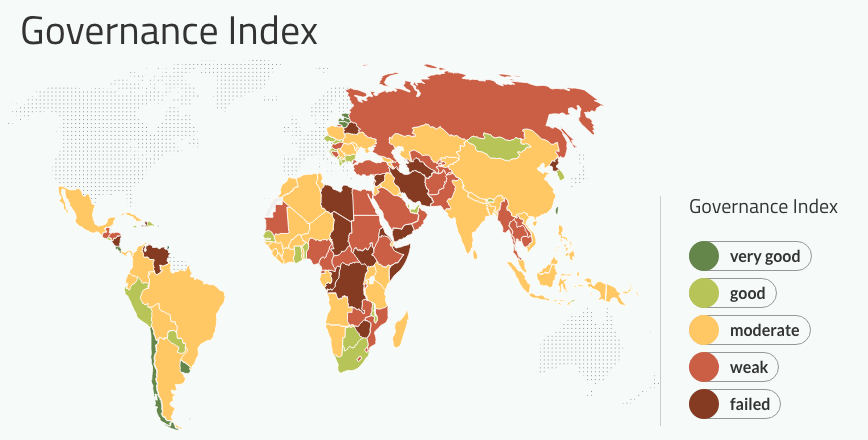

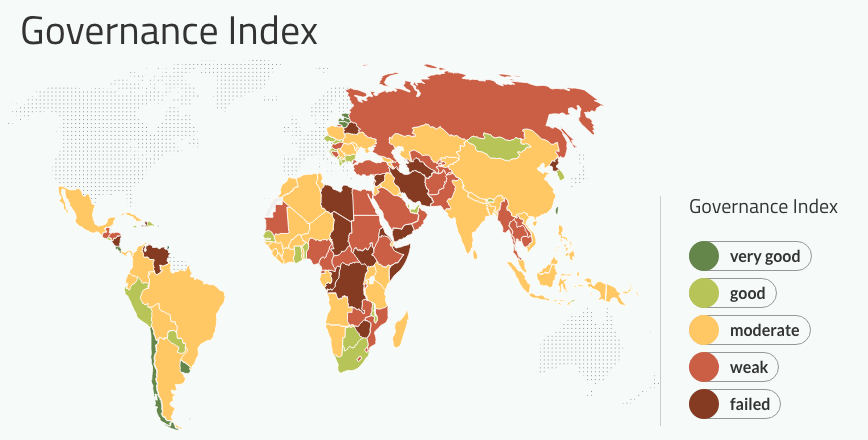

Worldwide Governance Indicators (WGI)

- The World Bank's WGI is a tool designed to assess the quality of governance in various countries. It comprises multiple sub-indices that cover different aspects of governance, such as political stability, government effectiveness, regulatory quality, rule of law, and control of corruption.

- These indicators are often used by credit rating agencies as part of their assessment methodology when assigning credit ratings to member countries, especially in emerging markets.

- The governance indicators are based on data from a variety of sources, such as surveys, expert assessments, and administrative data.

- The governance indicators are widely used by researchers, policymakers, donors, civil society organizations, and the media to benchmark and monitor the progress of governance reforms around the world. They also provide a basis for dialogue and advocacy on improving governance and reducing corruption.

World Bank's governance indicators

- Voice and Accountability: The extent to which citizens can participate in selecting their government, as well as freedom of expression, association, and media.

- Political Stability and Absence of Violence: The likelihood of political instability and/or politically motivated violence, including terrorism.

- Government Effectiveness: The quality of public services, the capacity of the civil service and its independence from political pressures, and the credibility of the government's commitment to policies.

- Regulatory Quality: The ability of the government to provide sound policies and regulations that enable and promote private sector development.

- Rule of Law: The extent to which agents have confidence in and abide by the rules of society, including the quality of contract enforcement, property rights, the police, and the courts.

- Control of Corruption: The extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as "capture" of the state by elites and private interests.

Limitations and challenges

- Data availability and quality: The indicators rely on existing data sources that may have different definitions, methodologies, coverage, and reliability. Some data sources may also be influenced by political or ideological biases or may reflect perceptions rather than realities.

- Aggregation and weighting: The indicators are constructed by aggregating multiple data sources into a single measure for each dimension of governance. This involves making assumptions about how to combine different types of information and how to assign weights to different sources. The aggregation method may affect the results and their interpretation.

- Uncertainty and margins of error: The indicators are estimates that have a degree of uncertainty associated with them. This means that they should be interpreted with caution and not treated as precise or definitive measures. The indicators also have margins of error that reflect the variability of the underlying data sources. These margins should be taken into account when comparing countries or regions, or when assessing changes over time.

- Normative judgments and value choices: The indicators reflect normative judgments and value choices about what constitutes good governance and how it should be measured. Different users may have different views or preferences about these issues, which may affect their acceptance and use of the indicators.

Conclusion

- The concerns raised by the Chief Economic Adviser highlight the need for greater transparency in the use of the World Bank's Worldwide Governance Indicators by credit rating agencies, particularly in the assessment of emerging economies. The issues raised include the subjective nature of the indicators, the lack of on-the-ground understanding by expert institutions, and the potential use of qualitative overlays in the credit rating assessment process.

Must Read Articles:

Good Governance: https://www.iasgyan.in/rstv/perspectivegood-governance

|

PRACTICE QUESTION

Q. How can India enhance transparency and accountability in its governance systems to promote better socio-economic development and serve the diverse needs of its population?

|