Disclaimer: Copyright infringement not intended.

Context

First thing first,

|

About WTO: ● Intergovernmental organisation which regulates the international trade ● Officially commenced on 1st Jan 1995 under the Marrakesh Agreement ● Signed by 123 nations in 1994 ● WTO had replaced GATT (General agreement on tariffs and trade) ● It deals with agriculture, textiles and clothing, banking, telecommunications, government purchases, industrial standards and product safety, food sanitation regulations, intellectual property and much more. FUNCTIONS OF WTO ● Administering WTO trade agreements ● Forum for trade negotiations ● Handling trade disputes ● Monitoring national trade policies Technical assistance and training for developing countries ● Cooperation with other international organizations PRINCIPLES OF WTO ● Administering WTO trade agreements ● The basic principles of the WTO (According to the WTO): ● Trade Without Discrimination: 1. Most Favoured Nation (MFN): treating other people equally 2. National treatment: Treating foreigners and locals equally ● Freer trade: gradually, through negotiation ● Predictability: through binding and transparency ● Promoting fair competition ● Encouraging development and economic reform. Mechanisms of WTO ● Trade Related Aspects of Intellectual Property Rights (TRIPS) ● Trade Facilitation Agreement ● General Agreement on Trade in Services (GATS) ● Trade Policy Review Mechanism Dispute Settlement Body of WTO ● The General Council convenes as the Dispute Settlement Body (DSB) to deal with disputes between WTO members. ● It decides the outcome of a trade dispute on the recommendation of a Dispute Panel and (possibly) on a report from the Appellate Body of the WTO. Only the DSB can make these decisions: Panels and the Appellate Body are limited to making recommendations. ● Such disputes may arise with respect to any agreement contained in the Final Act of the Uruguay Round. ● The DSB has authority to: Establish dispute settlement panels, Refer matters to arbitration, Adopt panel, Appellate Body and arbitration reports, maintains surveillance over the implementation of recommendations and Authorize suspension of concessions in the event of non-compliance. Appellate Body of the WTO’s Dispute Settlement Body (DSB) ● The Appellate Body was established in 1995 to govern the Settlement of Disputes. ● It is a standing body of seven persons that hears appeals from reports issued by panels in disputes brought by WTO Members. ● These members are appointed by the DSB to serve for four-year terms. ● The members can be reappointed once. ● A panel for appeals comprises three from the seven-member Appellate Body. ● The Appellate Body members shall be persons of recognized authority with demonstrated expertise in law, international trade and the subject matter of the WTO agreements. |

WTO and Trade Subsidies

|

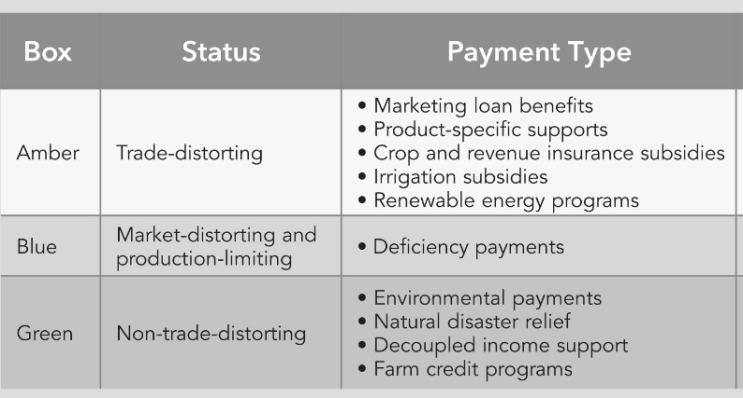

Trade Distortion ● Trade distortion is commonly viewed as any interference that significantly affects prices or market behavior. ● A tax or action that changes the normal characteristics of trade. ● For example, many governments subsidize the agricultural sector, which sometimes makes farming economically feasible, at least for certain products. ● The subsidies can mean farmers gain artificially high prices for their products. ● Some experts believe that trade-distorting agricultural subsidies are partly responsible for increases in global food prices.

|

WTO’s conditions

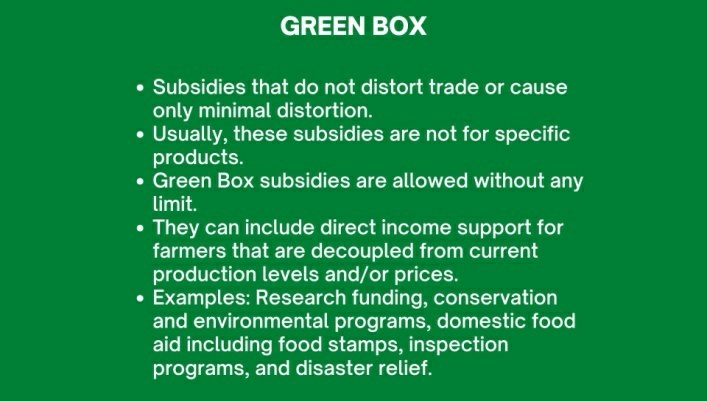

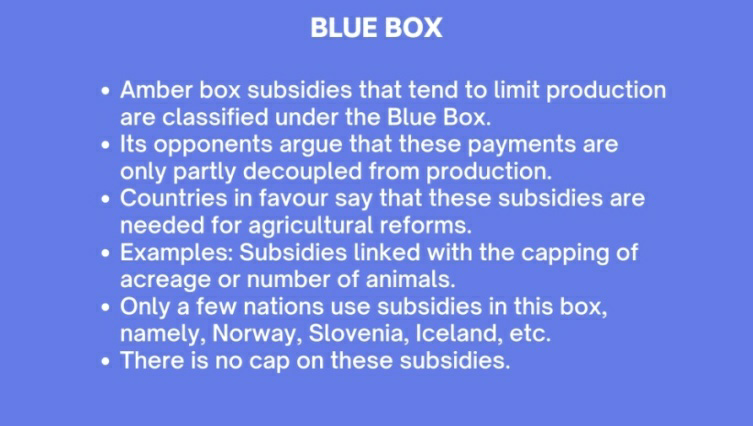

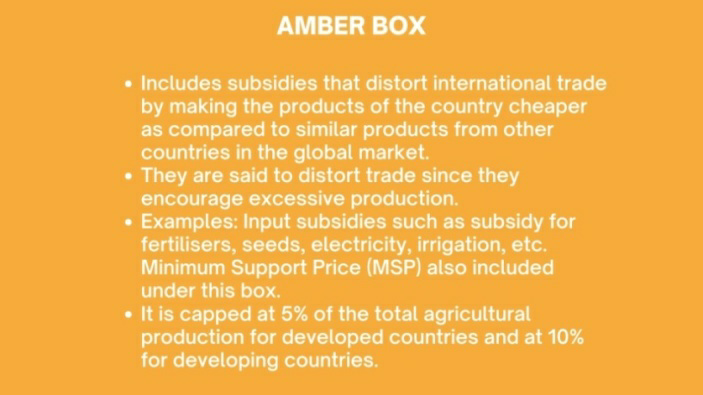

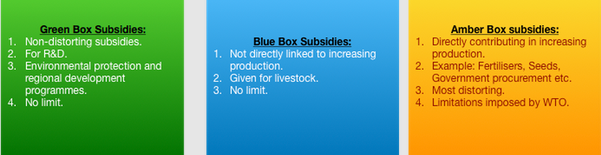

Domestic Support

Market Access

Export Subsidies

Peace Clause (Interim measure at the Bali ministerial meeting)

Recent Issue: Allegation against India

Note: The Agreement on Subsidies and Countervailing Measures (“SCM Agreement”) addresses two separate but closely related topics: multilateral disciplines regulating the provision of subsidies, and the use of countervailing measures to offset injury caused by subsidized imports.

WTO’s ruling and recommendations

India’s counter arguments

What lies ahead?

Challenges faced by WTO

Reforming WTO: The Way ahead

Sugarcane and India: Historical Background

Legislations

Geographical Distribution of Sugar Industry in India

Top 10 Largest Sugarcane Producing States in India

|

S.NO |

STATE |

AREA (LAKH HECTARES) |

YIELD (TONNES/HECTARE) |

PRODUCTION (LAKH TONNES) |

|

1. |

Uttar Pradesh |

21.72 |

62.4 |

1,333 |

|

2. |

Maharashtra |

9.36 |

77.4 |

753 |

|

3. |

Tamil Nadu |

2.32 |

107 |

375 |

|

4. |

Karnataka |

4.10 |

84.6 |

346 |

|

5. |

Andhra Pradesh |

1.91 |

78 |

149 |

|

6. |

Bihar |

2.66 |

56.8 |

122 |

|

7. |

Gujarat |

1.80 |

65 |

95.3 |

|

8. |

Haryana |

1.30 |

73 |

93.4 |

|

9. |

Punjab |

0.96 |

70 |

66 |

|

10. |

Uttarakhand |

1.22 |

61.2 |

64.3 |

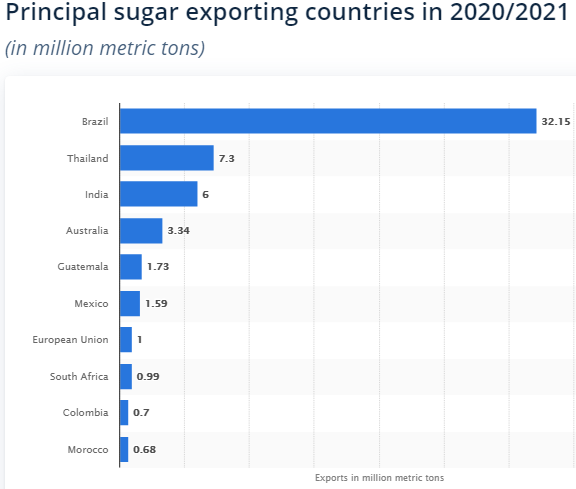

World Trade

Largest Sugar Producers

Top 10 sugar importers in 2020.

North India vs. South India Sugar Industry

For example, crushing season is of nearly four months only in the north from November to February, whereas it is of nearly 7-8 months in the south where it starts in October and continues till May and June.

Problems of Sugar Industry

Low Yield of Sugarcane

Short crushing season

Fluctuating Production Trends

Low rate of recovery

High cost of Production

Small and uneconomic size of mills

Old and obsolete machinery

Competition with Khandsari and Gur

Regional imbalances in distribution

Low per capita consumption

FRP vs SAP

Governments have also right to declare their own price which is called State Advisory Price (SAP).

Generally SAP is more than FRP which pose the conflict that which is fair price for both farmers and mills.

Falling Sugar Prices

Min Distance Criterion

Unpaid dues to Farmers

High Export prices

Measures to resolve the issues

Implementing Rangarajan Committee Recommendations:

Other suggestions

For example, bagasse can be used for manufacturing paper pulp, insulating board, plastic, carbon cortex etc. Molasses comprise another important by-product which can be gainfully used for the manufacture of power alcohol.

Conclusion

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GFE9D7R22.1&imageview=0

© 2025 iasgyan. All right reserved