Disclaimer: Copyright infringement not intended.

Context

- The Reserve Bank of India (RBI) has recently announced an arrangement for the country’s traders to settle imports and exports in rupees.

- Under this mechanism, the exporters and importers would be able to use a special Vostro account linked to the correspondent bank of the partner country for receipts and payments denominated in rupees.

- A Vostro Account is an account that a correspondent bank holds on the behalf of another bank. Vostro is a Latin word that means ‘your’. For example, the HSBC Vostro account has been held by SBI in India.

- This move is aimed at promoting the growth in external trade with a major emphasis on exports from India and to support the increasing interest of the global trading community in the Indian Rupee. It will also help India with imports by saving foreign currency under the new arrangement.

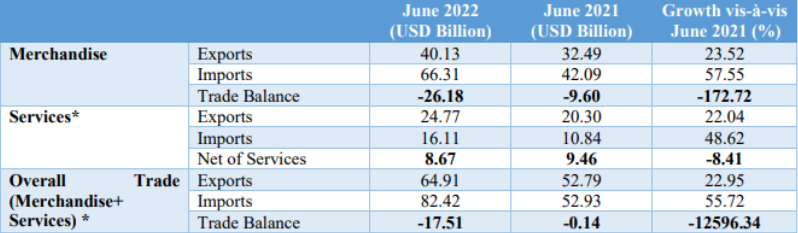

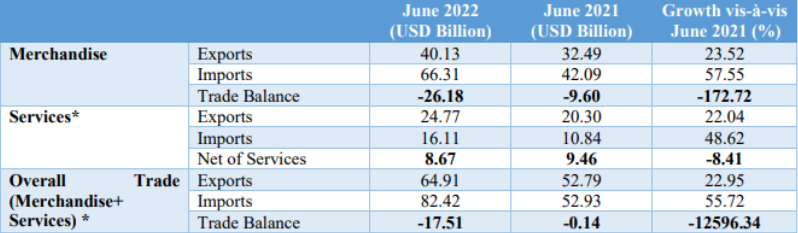

India’s Balance of Trade

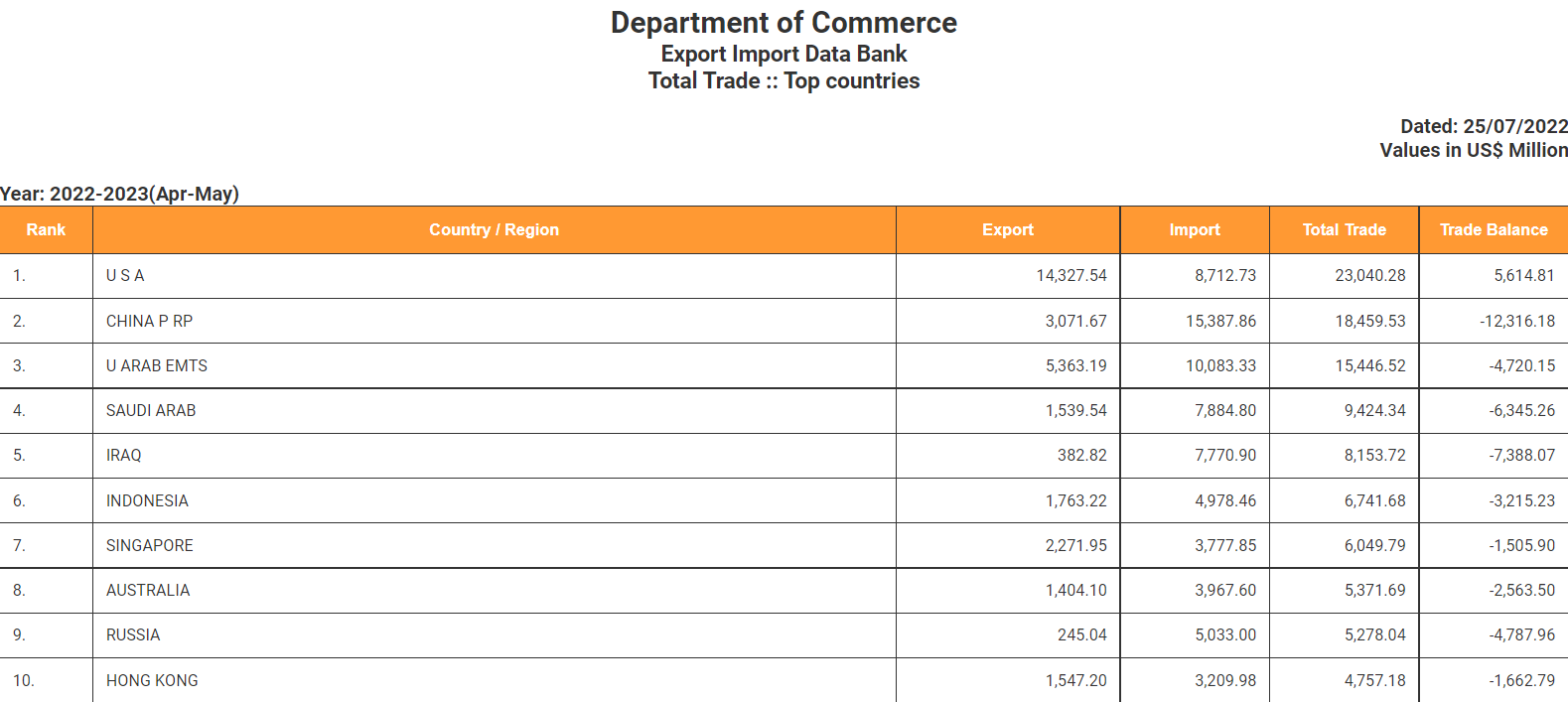

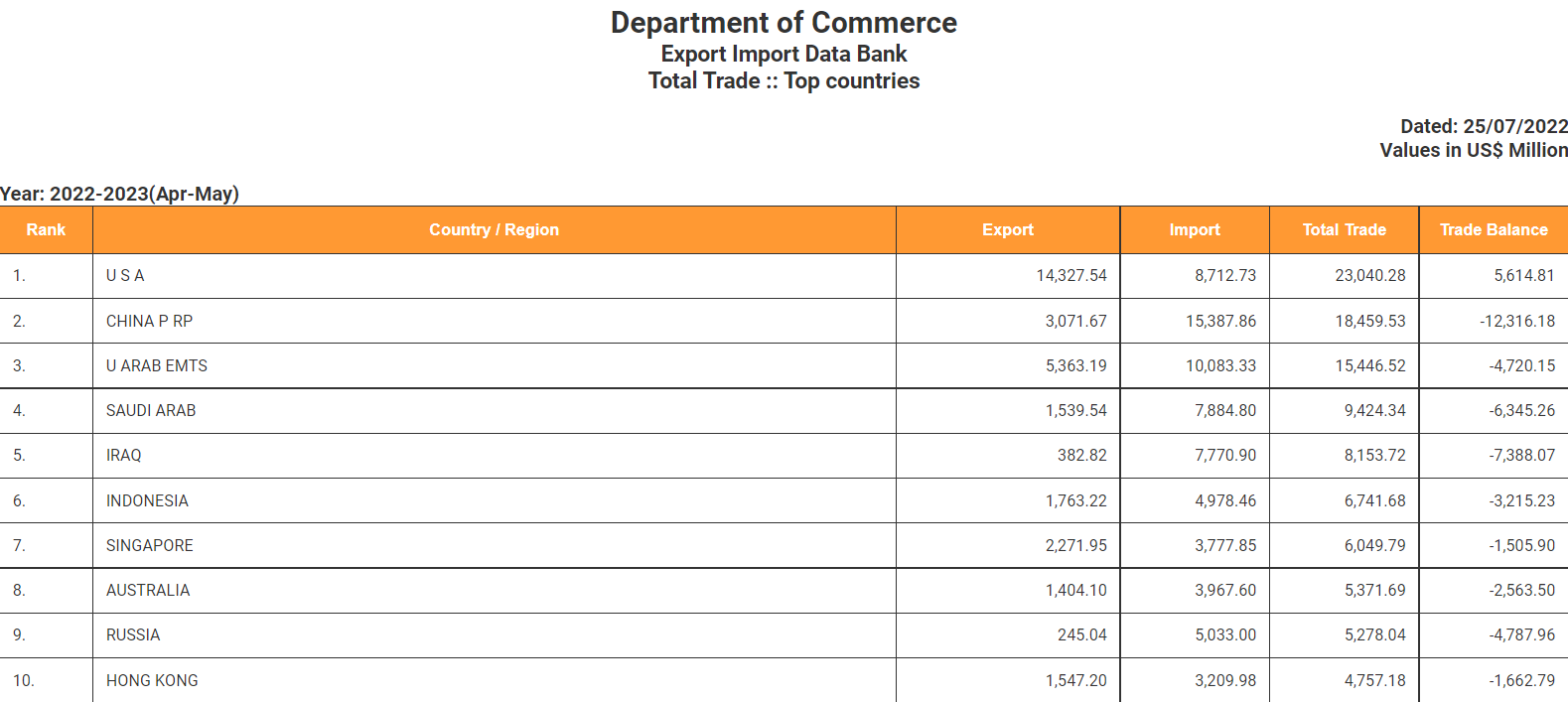

- India’s trade with the top 10 countries is as followed:

What is a balance of payments (BOP)?

- The BOP of a country keeps an account of all economic transactions whether individuals, businesses or the government with the rest of the world during one financial year. These transactions are broadly divided into two:

- Current Account: This covers exports and imports of goods and services, factor income and unilateral transfers. Its convertibility refers to the ability or freedom to convert domestic currency into foreign currencies and vice versa for current account transactions.

- Capital Account: This records the net change in foreign assets and liabilities of a country. Its convertibility refers to the ability or freedom to convert domestic currency into foreign currencies and vice versa for capital account transactions.

- Convertibility means the ability or the freedom to convert the domestic currency into foreign currencies and vice versa to make payments for BOP transactions.

What was the need of bringing this new mechanism by the RBI and how does it work?

- The working of this mechanism is very simple, whenever an Indian importer or exporter is paying for their transaction with a foreign principal in any currency, the RBI will provide a facility where a trader can also settle the trade in the Indian rupee.

- An Indian oil importer, for instance, will be able to pay for that transaction in rupees at the market exchange rate.

- This mechanism will expand the applicability of the use of the Indian rupee in international trade to put in perspective most of the national trade. This will help India maintain its foreign exchange reserve.

- RBI also explained that the importer undertaking imports through this mechanism shall be able to make payment in rupees which shall be credited into the Special Vostro account of the correspondent bank of the partner country and vice versa for exporters.

What changes with this new mechanism for Indian traders?

- Exchange of invoice in Indian rupee was already permitted but from now onwards the invoice, as well as the settlement, will be permitted in Indian rupee concerning foreign trade.

- The settlement in the Indian rupee will help in promoting the apparel trade with many countries at a time when a lot of countries facing foreign shortages, not just Nepal and Sri Lanka but even countries in Africa and Latin America are in dire need of foreign currencies.

- In the environment of trade sanctions (like CAATSA), if India has to maintain the level of trading, it has to look into an arrangement in the local currencies.

- This mechanism will be good for the indigenisation of Indian currency and also a move towards the complete convertibility of currency.

- As far as exports are concerned, India has to look at how profitable would be this mechanism because even under the dollar-denominated transactions exporter have some forward premium (a measure of expected movement for the local currency in exchange for a dollar i.e., a gap between the prevailing exchange rate and the higher level used in forwarding currency exchange deals). For importers, it will be a good choice as they will know in advance how much is their liability.

- This will ultimately help businesses; small or big and e-commerce or transport. In the era of globalisation, this new mechanism will make things easier than before.

Two aspects can be understood that necessitated this move by RBI; first, the Russia-Ukraine conflict led to disruption in the global supply chain which also led to the development of the scenario of sanctions. Second, the RBI is trying to build a reputation for the Indian currency in the global trading ecosystem.

Why RBI has adopted this new mechanism?

- In the ongoing global turmoil, the RBI has adopted a longer-term perspective. Not every foreign trader needs to accept Indian Rupee as a currency of exchange. But the present volatility in the global market has forced many developing and under-developed countries to look for alternative international currencies other than the US dollar.

- Hence, this new initiative by RBI will expand the role of the Indian currency in international trade. It will create an environment where traders will not feel the heat of fluctuations in exchange rates.

- RBI by not intervening in the exchange rate mechanism and letting the rupee settle in an orderly manner also reflects that India is looking for full capital account convertibility of the Indian rupee. The rupee already has current account convertibility, earlier the government of India also announced a series of steps like introducing the rupee into global bond indices to make the rupee an internationally interesting currency.

- Also, despite recent volatility in the global market, the Indian rupee has performed better as compared to other developing/emerging and developed countries’ currencies except for the US dollar.

Putting the Indian rupee in the international market in terms of increasing its reputation, from the industry perspective is going to be much easier for Indian importers and exporters.

From a long-term perspective, how will it work out?

- This mechanism would be ideal to deal with the countries with whom India has an adverse balance of trade and they are willing to invest in India. This move will not only address the challenges of the trade but will also give a flip to the investment.

- Whereas, a country like Russia, with whom India has a surplus balance of trade its investment will be a win-win situation for India.

- Hence, it will be extremely important to choose the country with whom India will cover this mechanism.

- One of the challenges which will be faced because of this mechanism is the fact that at present all the export benefits are available only when the transactions are finally settled in free foreign currency. Now, if transactions are settled in Indian rupees, the export benefit like ‘duty drawback’ will not be available. For example, similar kinds of benefits have come down with export to Iran.

- There is a need for clarification from the government of India so that the exporters could plan for taking a long-term position. Initially, it is assumed that India will start this mechanism with one or two countries or may be a limited number of transactions and soon with experience the RBI will roll it out for many other countries.

- Ever since independence, Indian policymakers have formulated policies to maintain or preserve foreign exchange, especially in the aftermath of 1991. With India aspiring to become a $10 trillion economy by 2035 (as suggested by former RBI Governor Raghuram Rajan), it has to come out of the conservative mindset and should adopt a long-term approach in working toward making the Indian rupee a hard currency that would be used all over the world.

- In comparison to the Chinese Yuan, the Indian rupee is much more friendly and being a democratic country, it is more valued by the West.

What has been done to make the Indian rupee a hard currency?

- Over the year the successive committees on such issues have offered RBI several steps required for the Indian rupee to move towards the hard currency.

- Two major steps have been taken by RBI:

- Earlier, with an increase in foreign exchange outflow, the RBI used to adopt the defensive mode like; the foreign earnings of importers and exporters cannot be held outside India and several restrictions on external commercial borrowing (ECB) clearances. But now, RBI is not intending to interrupt the flow of business instead, RBI is considering the fluctuations of the exchange rate as an opportunity to make the Indian rupee more interesting to the traders.

- Secondly, concerning Foreign Currency Non-Resident (FCNR) deposits made by the NRIs in Indian banks, RBI made it clear that the concerned banks will not need to maintain the cash reserve ratio (CRR) and Statutory Liquidity Ratios (SLR). This means, there will be better interest rates that apply to both rupee and dollar-denominated currency.

- Such initiatives will give more space to the Indian currency and as expected the RBI will contain the rising domestic inflation; the rupee will perform better in future. This will further motivate the policymakers to keep on taking steps to make the rupee more attractive to traders across the world.

How the value of the rupee will affect other currencies?

- In the recent geopolitical crisis, the rupee has performed better than other currencies like Euros or Yen. This shows that the value of the Indian currency is itself rising.

- The benefits India gets from the rupee-denominated shipments from Russia or Iran will gradually emerge from global trade.

- These steps will eventually increase the dominance of the Indian currency in the coming times.

What would be the way ahead from the RBI?

- The RBI should certainly work now on Central Bank Digital Currency (CBDC) and that will be important because the Indian CBDC will be significant in terms of the size of transactions. Hence, this will be watched by foreign currency holders.

- Simultaneously, as the Financial Stability Report, the commercial banks in India have now lowered their non-performing assets (NPAs), which means the Indian financial system is looking robust and resilient after a long time. This will give RBI more comfort level to take steps initially to let the rupee flow free against foreign currencies.

- RBI does not need to intervene aggressively and this will give it more space to look for the development policy take make the Indian rupee a hard currency.

The recent steps taken by the RBI are indeed significant, not only ensuring that the Indian currency obtains significant value but also in the long-term in building a reputation for the Indian rupee in the global trade ecosystem and also in looking to achieve the short-term targets. The major challenge for the RBI will be to maintain domestic inflation. Addressing this will need coordinated efforts to align the fiscal and monetary policy.

https://sansadtv.nic.in/episode/perspective-global-trade-local-currency-12-july-2022

1.png)

https://t.me/+hJqMV1O0se03Njk9