PERSPECTIVE: INDIAN ECONOMY: SURGING AHEAD

Disclaimer: Copyright infringement not intended.

Context

- India’s economy has scripted a remarkable story over the past decade.

Details:

- Ten years ago, India was considered to be one of the Fragile Five economies- a cause of concern for other nations. In a turnaround that made the world sit up and take notice like never before, India- in September 2022- surpassed the UK to become the fifth-largest global economy.

- According to a recent report by S&P Global Market Intelligence, India is poised to overtake Japan and Germany to become the world's third-largest economy by 2030.

- India’s GDP is expected to rise to 7.3 trillion USD by the end of this decade, says the report, and it will emerge as the second-largest economy in the Asia-Pacific region.

- With the Indian economy surging ahead, the implications have been felt across domains, from India’s social fabric to its innovation ecosystem, and from its manufacturing prowess to its stature on the global stage.

- India’s rise as an economic powerhouse has been lauded by bodies like the International Monetary Fund, which has called the country a hotspot for investment and opportunity.

INTRODUCTION:

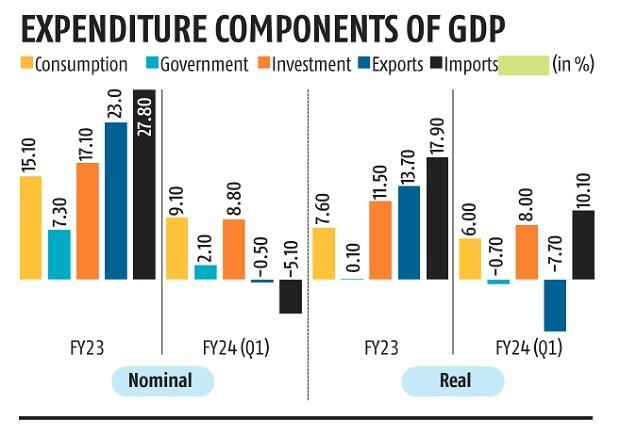

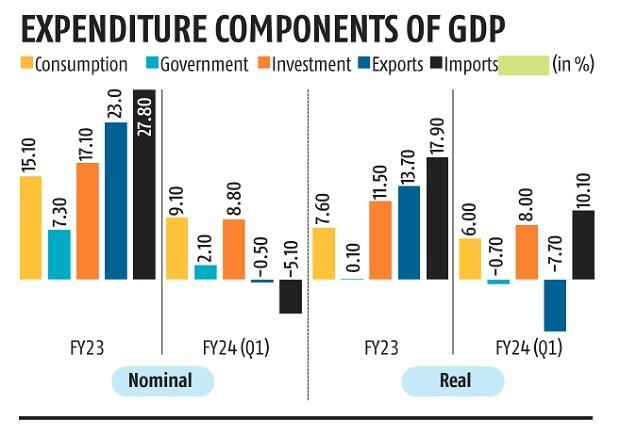

- The Indian economy, in real terms, needs to grow annually from 7% to 7.5% until 2030. On the supply side, the share of manufacturing in total gross value added has to increase from 16% at present to at least 25% of GDP at the expense of agriculture and low-value-added services.

- On the demand side, gross fixed capital formation, or investment, needs to increase from about 28% of GDP to at least 35%. To fund the increasing investment, the domestic savings rate will need to be about 36% of GDP.

- Development of the manufacturing sector and the nature of demand will generate significant employment opportunities, facilitate business opportunities, and improve overall growth potential. This, in turn, will reduce poverty and increase the equitability of income distribution.

.jpg)

Growth Trajectory in the Past:

Mid-2000s Boom:

- GDP Growth: Indian GDP experienced a remarkable annual growth rate of 9% in the mid-2000s, fueled by a global trade upswing.

- Bubble Effect: The financial sector, real estate, and construction bubble contributed to the growth, but concerns arose about the sustainability of this rapid expansion.

Global Financial Crisis Impact (2007-08):

- Slowdown: The global financial crisis led to a swift deceleration in world trade, causing Indian GDP growth to drop to 6%.

Data Revision (2012-15):

- GDP Adjustment: GDP growth dipped to 4.5% by 2012-13 but experienced a sudden jump in the next three years due to a data revision in January 2015, where GDP was calculated on market price instead of factory price.

- Real vs. Nominal Growth: This revision inflated the GDP growth rate in numbers but not in real terms.

Demonetization and GST (2016-2018):

- Slowdown Resumes: The momentum slowed again after the demonetization and GST rollout.

- Bubble Burst: The collapse of the finance-real estate bubble post-IL&FS bankruptcy in 2018 resulted in a GDP growth decrease of 3.9% pre-pandemic.

Pre-Covid Growth Challenges:

- Demand Weakness: Despite reported growth rates, there were underlying challenges, particularly in demand.

- Investment Cutbacks: Private corporate fixed investment dropped significantly from 17% of GDP in 2007-08 to 11% in 2019-20 due to weakened consumer purchasing power and limited foreign demand.

Covid Years:

- Economic Fluctuations: The pandemic years saw sharp falls, modest recoveries, severe slowdowns, and a dead cat bounce from late-2022.

- Assessment Challenges: Assessing this post-Covid phase is complex, with varying growth rates depending on the time frames considered.

Post-Covid Challenges (2021-22):

- Demand Weakness Continues: The post-Covid era witnessed a further decline in private corporate investment to 10% of GDP in 2021-22, indicating persistent demand weakness.

- Analysts' Perspective: Analysts express concerns about the ongoing anemia in private corporate investment in 2022-23.

.jpg)

Primary Reasons behind Decline in Growth Rate in Past Years:

Declining External Demand:

- Export-to-GDP Ratio: The ratio of India's exports to GDP has steadily decreased from 25% in 2011-12 to 18% in 2019-20.

- Factors Contributing to Fall: Reasons include global growth slowdown, rupee appreciation, loss of market share, and the presence of trade barriers impacting international competitiveness.

Low Capital Investment:

- Investment Rate Decline: India's investment rate dropped from 39.8% of GDP in 2010 to an estimated 29.3% in 2021.

- Causes: Lack of economic confidence, demand issues, and structural bottlenecks like land acquisition, environmental clearance, and credit availability contribute to this decline.

Policy Uncertainty and Shocks:

- Mixed Effects of Reforms: Government policy changes, including demonetization, GST, corporate tax cuts, and insolvency and bankruptcy code, have had varied impacts.

- Short-term Disruptions: While some reforms may offer long-term benefits, they have caused short-term disruptions and uncertainties for businesses and consumers.

Rising Inequality and Poverty:

- Income Inequality: The income share of the top 10% increased from 31% in 1980 to 56% in 2016, while the bottom 50% share fell from 24% to 15%.

- Stagnant Poverty Rate: Despite overall economic growth, the poverty rate has stagnated around 20% since 2011, indicating that growth has not been inclusive.

Poor Manufacturing Sector Performance:

- Manufacturing GVA Decline: The manufacturing sector's real gross value added (GVA) declined by about 3% in 2019-20.

- Attributing Factors: Factors include demonetization, GST implementation, global trade tensions, and a lack of competitiveness.

Decline in Consumption:

- Consumption Expenditure Fall: India's consumption expenditure as a share of GDP dropped from 60.5% in 2019-20 to 57.5% in 2021-22.

- Contributing Factors: Factors include low-income growth, high inflation, rural distress, job losses, and reduced credit availability impacting people's purchasing power.

Reduced Savings:

- Savings Rate Decline: Households have reduced their savings rate from 11.9% in 2019-20 to 5.1% of GDP.

- Credit Card Debt Concerns: Individuals eligible for credit cards are accumulating worrying levels of debt, indicating financial strain.

Positive Factors that Can Help India Recover from the Slump:

- Demographic Dividend:

- Population Overview: India boasts a population exceeding 1.4 billion, with over 40% below the age of 25.

- Economic Potential: This demographic structure offers a substantial demographic dividend, indicating a large and expanding workforce and consumer base that can be a driving force for economic growth.

- Human Capital Investment: However, unlocking this potential requires significant investment in human capital development, including education, health, and skills training to ensure a productive and skilled workforce.

- Resilient and Diversified Economy:

- Economic Diversity: India's economy spans various sectors and regions, contributing to a diversified economic landscape.

- Stability Factor: This diversity acts as a buffer against shocks in specific sectors or regions, promoting overall macroeconomic stability.

- Resilience to Crises: India has demonstrated resilience in the face of challenges, successfully navigating through events like the global financial crisis of 2007-08 and the Covid-19 pandemic of 2020-21.

- Reform-Oriented Government:

- Government Commitment: The Indian government is dedicated to implementing reforms and policies aimed at fostering economic growth and development.

- Recent Initiatives: Notable initiatives include the Atmanirbhar Bharat package, the production-linked incentive scheme, the national infrastructure pipeline, and the labor code bills.

- Implementation Challenges: While these initiatives hold potential, their success relies on effective implementation and coordination among various stakeholders. Ensuring streamlined execution is critical for realizing the intended benefits.

What more needs to be done to make India's Growth Rate more Robust?

Boosting Investment:

- Reform Implementation: The government can enhance investment by continuing to implement reforms aimed at reducing policy uncertainty, regulatory hurdles, and interest rates.

- Addressing Bad Loans: Tackling the issue of bad loans is crucial to instilling confidence in the financial sector, and encouraging increased investment.

Stimulating Consumption:

- Income Growth Support: Supporting income growth through measures like job creation, rural development, and credit availability can boost consumer spending.

- Inflation Control: Effective inflation control measures contribute to stable prices, maintaining consumers' purchasing power.

Enhancing Manufacturing and Exports:

- Government Initiatives: Ongoing initiatives like the Atmanirbhar Bharat package, production-linked incentives, and the national infrastructure pipeline can strengthen the manufacturing sector and boost exports.

- Addressing Challenges: The government needs to address challenges such as currency appreciation, market share loss, and trade barriers to ensure the competitiveness of Indian products in the global market.

Investing in Human Capital:

- Program Implementation: Continued implementation of programs focusing on education, health, skills, nutrition, water, sanitation, energy, housing, and healthcare is vital.

- Efficient Delivery: Ensuring efficient delivery of these programs to the target population is essential for maximizing their impact on improving living standards and productivity.

Maintaining Macroeconomic Stability:

- Prudent Fiscal and Monetary Policies: The government can sustain macroeconomic stability by pursuing fiscal and monetary policies that balance growth objectives with inflation control.

- Resilience Against Shocks: Such policies contribute to the resilience of the economy, enabling it to cope effectively with various shocks and uncertainties.

.jpg)

Conclusion

- The trajectory of the Indian economy is poised for advancement, marked by a combination of strengths and challenges. With a large and young population, a resilient and diversified economy, and a government committed to reforms, India has the potential for robust growth.

- To harness this potential, there is a need for sustained efforts in boosting investment and consumption, fostering manufacturing and exports, investing in human capital and social services, and maintaining macroeconomic stability.

- The challenges, including issues in policy implementation, addressing inequality, and navigating external factors, require strategic and coordinated approaches. As India surges ahead, the collective resolve of the government, businesses, and society will play a pivotal role in shaping a dynamic and inclusive economic future.

CITATIONS:

https://sansadtv.nic.in/episode/perspective-indian-economy-surging-ahead-04-november-2023

https://www.washingtonpost.com/opinions/2023/04/28/india-revolutions-economy-growth-future/

https://www.spglobal.com/en/research-insights/featured/special-editorial/look-forward/india-s-future-the-quest-for-high-and-stable-growth

https://www.moneycontrol.com/news/business/economy/indian-rupee-to-trade-near-record-lows-despite-surging-growth-11700211.html

https://www.business-standard.com/opinion/columns/understanding-india-s-growth-rate-is-economy-accelerating-or-decelerating-123091400756_1.html

https://eoi.gov.in/ulaanbaatar/?pdf9644?000