SPOTLIGHT| Transformation in Indian Banking Sector - Reforms and Achievements

Disclaimer: Copyright infringement not intended.

Context

- In a recent episode of the program "Spotlight", a comprehensive discussion on the transformation in the Indian banking sector, its reforms, and achievements were presented.

Key Details

- Siddharth (an esteemed Economic Analyst) began by discussing the significance of the bankruptcy code introduced in 2016, a landmark legislation that aimed to minimize bank losses.

- The code allowed for insolvency cases to be initiated, and just the fear of being ousted as promoters resulted in the resolution of many cases even before they went to the National Company Law Tribunal.

- This fear factor led to the closure of cases and the resolution of claims for creditors, yielding significant results.

- Notably, banks and creditors were able to recover about 168 to 169% of the liquidation value, proving the effectiveness of the bankruptcy code in improving credit culture and corporate governance.

- In the context of India's vision of becoming a $5 trillion economy and promoting financial inclusion, Siddharth emphasized the significance of cleaning up the banking system to prepare it to meet the country's credit requirements.

- Initiatives like Jan Dhan, Mudra, PM Awas, and street vendor schemes have enabled greater formalization of the economy and improved access to credit for the unbanked population. The government's guarantee scheme has further provided comfort to banks in lending to these segments.

About banking reforms: An Introduction

- The performance of the Indian banking sector is intimately correlated with the overall health of the economy, perhaps more so than any other sector.

- The sector is tasked with supporting other economic sectors like agriculture, small-scale businesses, exports, and banking activities in developed commercial areas and remote rural areas.

- The improvement of asset quality, application of rational risk management procedures, and capital adequacy are some of the main functions of the Indian banking system.

- Banking sector reforms are implemented to improve the condition of the banking system. Multiple banking sector reforms have been introduced in India in the context of economic liberalisation and the growing trend toward globalisation.

- The main objective is to improve operational efficiency and promote banks' health and financial reliability so that Indian banks can meet internationally recognized standards of performance.

Disclaimer: Copyright infringement is not intended

Current scenario

- In 2021, the world suffered through multiple waves of the Covid-19 pandemic, bringing supply chain and logistics disruptions. In order to restore and sustain growth on a long-term basis while ensuring that inflation stays within the target range, India's monetary policy committee (MPC) decided to maintain the status quo on the policy repo rate.

- Additionally, the Reserve Bank of India (RBI) kept up its targeted efforts to address industry credit needs by:

- Providing unique refinancing facilities for all-India financial institutions (AIFIs)

- A term liquidity facility to finance the infrastructure and services for Covid-related healthcare

- Providing special long-term repo operations (SLTRO) for small finance banks (SFBs).

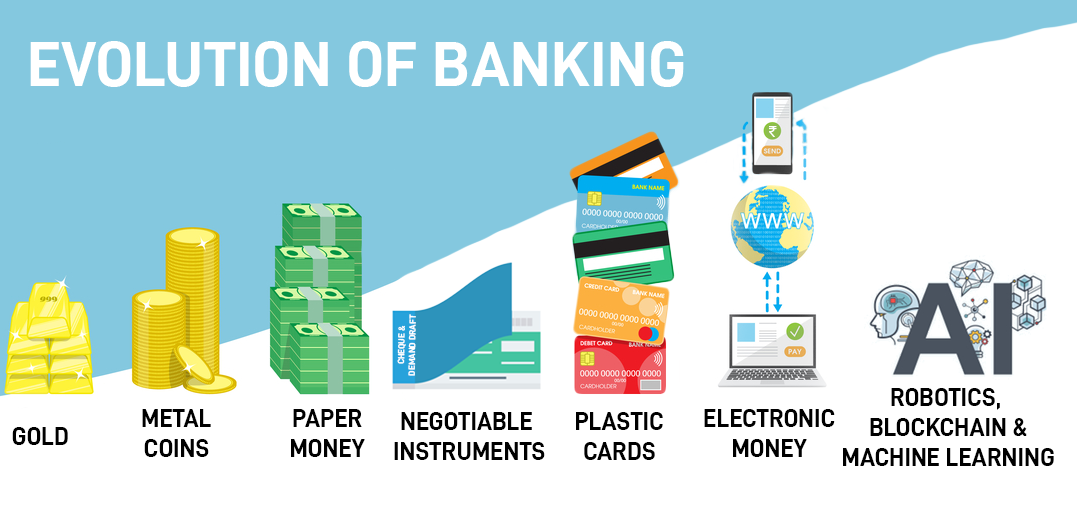

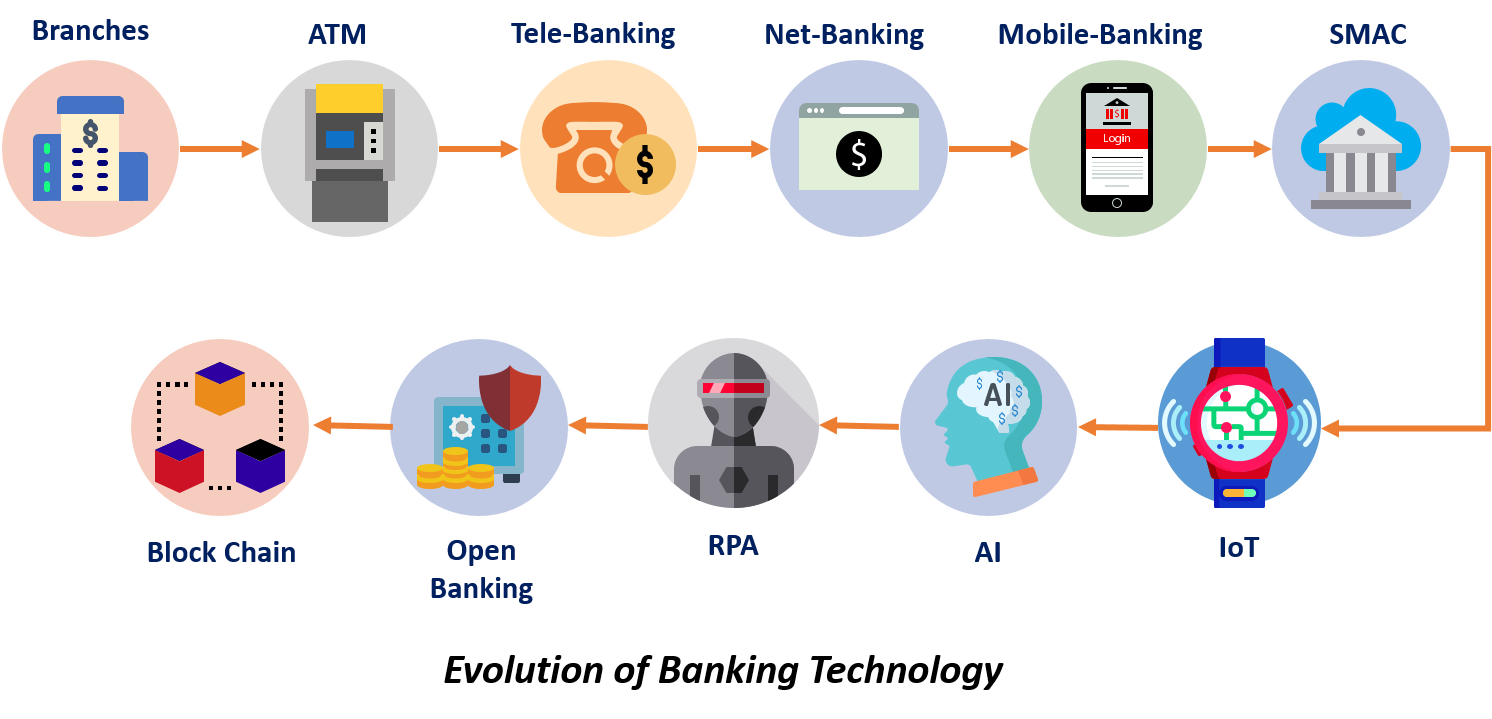

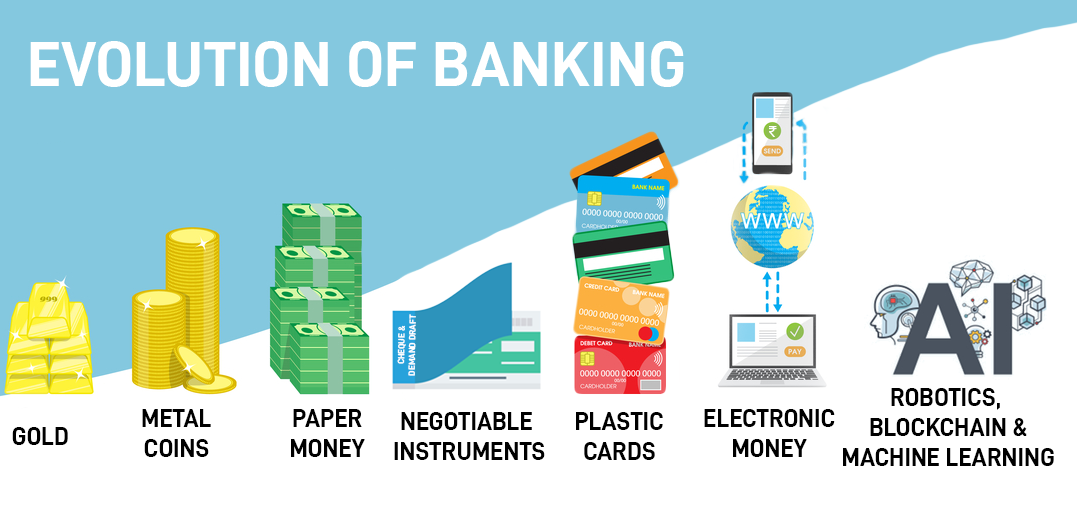

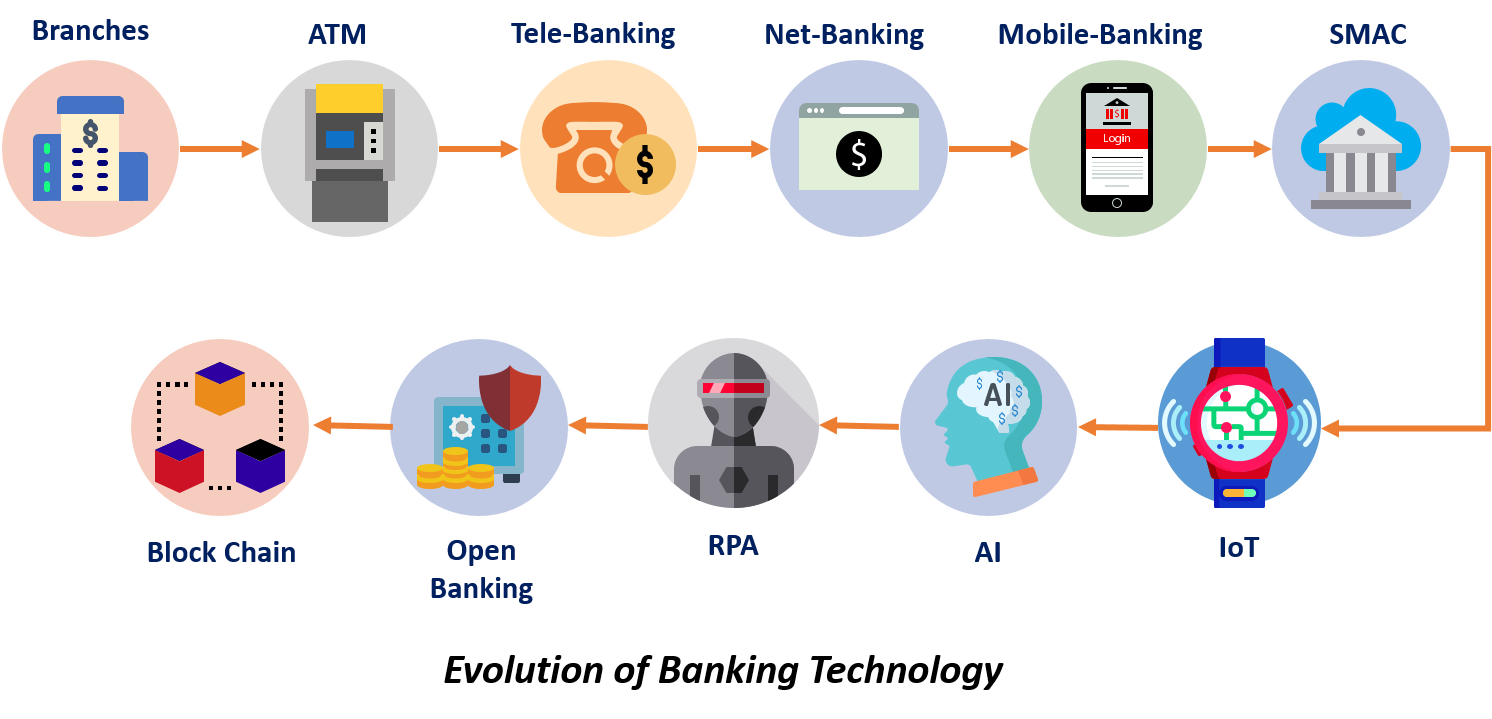

- The overall banking sector in India has evolved significantly over the last decade, from being a major lender to the industry to being the majority provider of personal loans, vehicle loans, credit cards, and housing loans.

- Private banks are gradually taking over from public sector banks as the main lenders in the country.

- Between the end of 2016-2021, the outstanding loans of public sector banks have gone up by Rs. 14.4 trillion (US$ 180.26 billion), whereas the outstanding loans of private banks have gone up by Rs. 22.8 trillion (US$ 285.41 billion), which is a difference of almost 60%.

- Another recent change in the banking sector is the emergence of e-banking, which is crucial in offering better services to clients. Internet banking, e-wallets, and mobile banking are some of the new methods that have replaced traditional methods of conducting transactions.

Banking Reforms

National Asset Reconstruction Company Limited (NARCL)

- The setting up of the NARCL was announced in the Union Budget 2021-22. The objective was to construct a 'bad bank' which would house bad loans of Rs. 500 crore (US$ 62.63 million) and above.

- There are already 28 existing asset reconstruction companies (ARCs) on the market. However, due to the sizeable and fragmented nature of the bad loan book held by different lenders, significant amounts of NPAs continue to appear on bank balance sheets. Thus, more choices and alternatives like the NARCL are required.

- NARCL will have a dual structure:

- it will consist of an asset management company (AMC) and an asset reconstruction company (ARC) to recover and manage stressed assets.

- It is a collaboration between private and public sector banks (PSBs), but PSBs will maintain 51% ownership in NARCL.

- NARCL will be capitalised through equity from banks and non-banking financial companies (NBFCs). If necessary, it will also issue new debt. The guarantee provided by the Government of India will lower the need for up-front capital. The NARCL will be assisted by the India Debt Resolution Company Ltd (IDRCL).

- In August 2022, the NARCL offered to buy the distressed loan accounts of five companies, including Future Retail.

India Debt Resolution Company Ltd. (IDRCL)

- The IDRCL is a service company/operational entity whose purpose is to manage the assets of the NARCL with the help of turnaround experts and market professionals.

- The NARCL will buy assets by presenting an offer to the lead bank; IDRCL will be included for management and value addition after NARCL's offer is accepted.

- Public FIs and PSBs will hold a 49% stake in IDRCL, and the rest will be with private banks.

Digital Rupee

- The central bank's digital currency (CBDC), the RBI's digital rupee, was announced in the Union Budget 2022-23 and is expected to be launched by the end of this financial year. India's digital economy is predicted to benefit greatly from the introduction of the digital rupee.

National Bank for Financing Infrastructure and Development (NaBFID)

- The NaBFID has been set up as a Development Financial Institution (DFI) to aid India in developing long-term infrastructure financing.

- The NaBFID has both developmental and financial objectives.

- Unlike banks, DFIs do not take deposits from the general public. Instead, they raise funds from the government, the market, and multilateral institutions, and are often backed by the government's guarantee.

- The government initially holds 100% of the shares in the bank, which may subsequently be reduced to 26%.

- The NaBFID was set up as a corporate body with an authorized share capital of Rs. 1 lakh crore (US$ 12.53 billion).

- The NaBFID plans to finance multiple projects that are a part of India's Rs. 6 trillion (US$ 75.18 billion) National Monetisation Pipeline.

Achievements in the Banking sector in India

- The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks.

- In recent years India has also focused on increasing its banking sector reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks.

- Schemes like these coupled with major banking sector reforms like digital payments, neo-banking, a rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

- In 2020-2022, bank assets across sectors increased. Total assets across the banking sector (including public and private sector banks) increased to US$ 2.67 trillion in 2022.

- In 2022, total assets in the public and private banking sectors were US$ 1,594.51 billion and US$ 925.05 billion, respectively.

- During FY16-FY22, bank credit increased at a CAGR of 0.62%. As of FY22, total credit extended surged to US$ 1,532.31 billion. During FY16-FY22, deposits grew at a CAGR of 10.92% and reached US$ 2.12 trillion by FY22. Bank deposits stood at Rs. 173.70 trillion (US$ 2.12 trillion) as of November 4, 2022.

- According to India Ratings & Research (Ind-Ra), credit growth is expected to hit 10% in 2022-23 which will be a double-digit growth in eight years. As of November 4, 2022 bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion).

- Non-food bank credit registered a growth of 17.6 per cent in November 2022 as compared with 7.1 per cent a year ago on the back of robust credit demand from the segments such as services, industry, personal, and agriculture and allied activities, according to RBI's statement on Sectoral Deployment of Bank Credit.

Challenges in banking reforms

Disclaimer: Copyright infringement is not intended

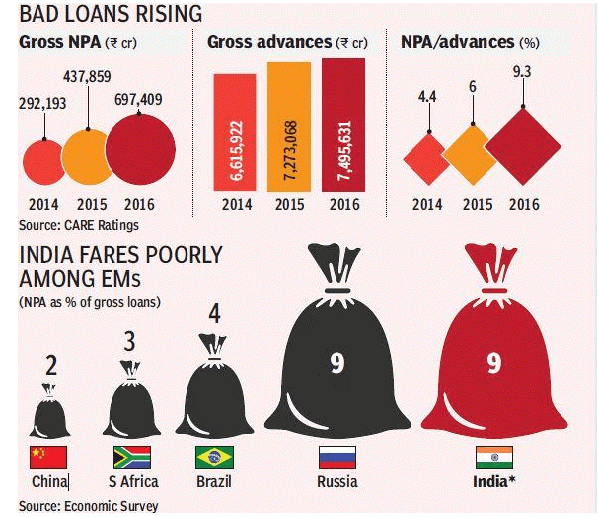

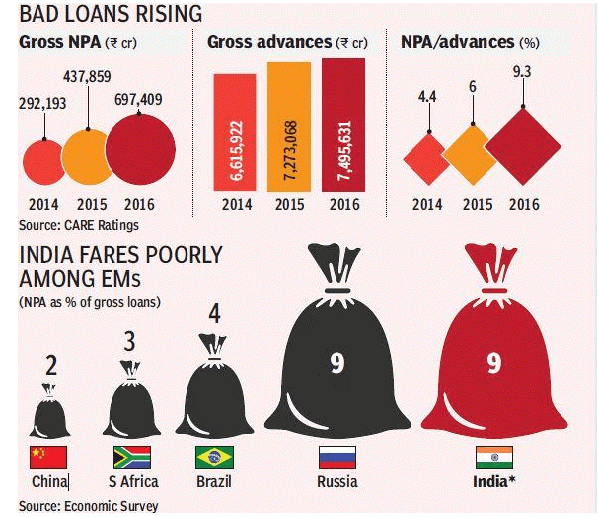

- The rise of Non-Performing Assets (NPAs), including bad loans or problems in the agricultural and corporate sectors. Currently, the country's NPAs have crossed ₹10 lakh crores, with more than 70% being from the corporate sector.

- The increasing number of frauds, including accounting fraud, demand draft fraud, uninsured deposits, fraudulent loans, and others. The RBI in 2022 reported total fraud cases of around 9103, the biggest being the PNB scam of ₹11,000 crores, Vijay Mallya defaulting lenders for Rs. 9000 crores, and several others that we have witnessed recently.

- Lack of banking for the underserved and rural population, which is approximately 69% of India's total population. Around 1.4 billion Indians do not have access to formal banking, as per the World Bank report.

- Lack of reach in rural areas, where technical enablement and use of financial services remain a big challenge.

Important initiatives undertaken by the central government

Financial Inclusion

- 300 million individuals opened a bank account for the first time since the government initiative to provide accessible and affordable financial services to the masses, called the Pradhan Mantri Jan Dhan Yojana, in 2014.

- Since 2011, the unbanked population has been cut down to half. In addition, 55% of Jan Dhan account holders are women, and 67% of the account holders reside in rural and semi-urban areas.

Digital Payments

- In 2016, the Government of India launched the UPI (Unified Payment Interface) System and BHIM, along with the National Payments Corporation of India (NPCI).

- This has improved mobile banking and online payments, creating a digital revolution.

Rise of Neo Banking

- In 2021, the Niti Ayog proposed to set up 'digital banks,' which rely on the Internet to offer their services instead of physical branches.

- This will revolutionize how banking as a service is provided to customers and create new opportunities for rural and urban sectors.

Way forward

- The transformation will help to cope with new economic and financial policies of the banks. It is playing a crucial role to create drastic changes in the banking industry particularly in the new private sector and foreign banks.

- The private banks take a big share of the cake; our public sector banks are still lagging behind regarding the various financial parameters.

- Immense opportunities are also available for the public sector banks if they change/modify and adopt new policies to combat the different recent challenges.

- It can be concluded that the mere introduction of IT alone will not be sufficient to bring necessary performance improvement and to get the competitive edge.

- Intelligent people are required to use such intelligent tools. Thus, even though IT management is a challenging flow in future banking scenarios, marketing not technology is going to be the challenge.

Closing thoughts

- To conclude focused attention on the new challenges may be imperative in the largest interest of securing economic growth with equity. Once these issues are addressed, the Indian banking sector has the potential to become further deeper and stronger. Greater attention to these issues would facilitate the financial structure of the economy and in the medium to long-term lead to broad-based economic growth.

- With positive steps being taken, including the rise of fintech and microfinancing options, the inclusion of the unbanked population, and initiatives for digitizing finance, the banking system in India will be the third-largest in the world by 2025, with the chances of becoming a $5 trillion economy by FY 2029.

https://newsonair.gov.in/News?title=Indian-Banking-Sector%3A-A-Journey-of-Reforms-and-Achievements&id=464899

https://www.ibef.org/blogs/india-s-banking-sector-reforms

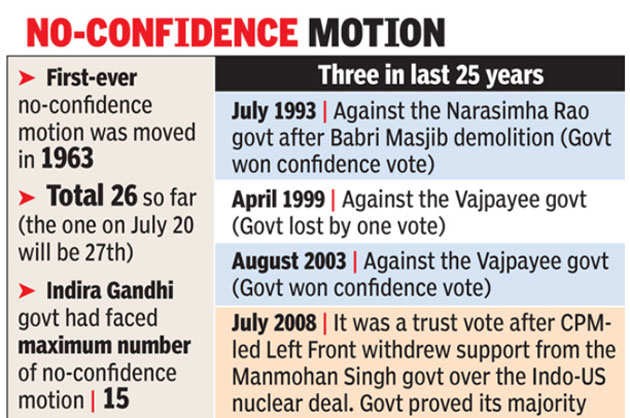

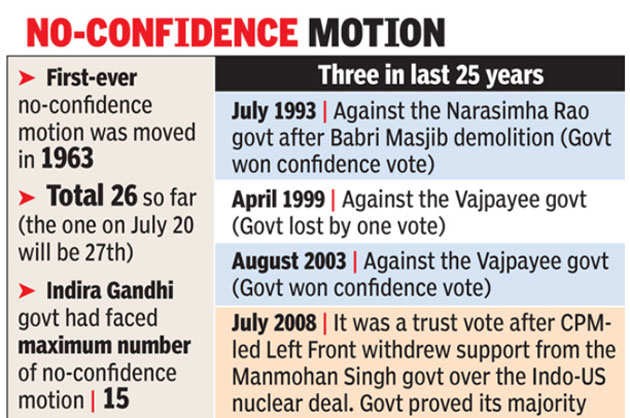

No-Confidence Motion

Context

- Amid a stalemate in Parliament over the Manipur violence issue, Congress today, July 26 moved a no-confidence motion against the government in the Lok Sabha.

Details

- Speaker Om Birla admitted the motion saying that he will discuss it with the leaders of all political parties and inform them about the appropriate time to take up the discussion on the motion.

- Earlier, Parliamentary Affairs Minister Pralhad Joshi asserted that people have confidence in Prime Minister Narendra Modi and the BJP.

- Talking to the reporters outside Parliament, he said, the opposition had brought a no-confidence motion in the last term as well and people had taught them a lesson.

Disclaimer: Copyright infringement is not intended

About No Confidence Motion

- A Council of Ministers is collectively responsible to the Lok Sabha and it remains in office till it enjoys the confidence of the majority of the members in Lok Sabha. Thus, a motion of no-confidence is moved to remove the council of ministers and thus oust the government from office.

- While Article 75 of the Indian Constitution specifies that the council of ministers shall be collectively responsible to the House of the People – there is no mention of a no-confidence motion.

- All it indicates is that the majority of Lok Sabha members must be with the Prime Minister and his Cabinet.

- Article 118 of the Constitution permits each house of Parliament to make its own rules for the conduct of business. Rule 198 of the Lok Sabha specifies the procedure for a motion of no-confidence.

- Any member may give written notice before 10 am; the Speaker will read the motion of no-confidence in the House and ask all those favoring the motion to rise.

- If there are 50 MPs in favor, the Speaker could allot a date for discussing the motion – but this has to be within 10 days. However, this cannot be done in conditions of din or confusion in the House.

Conditions of a no-confidence motion

- A no-confidence motion can be moved only in the Lok Sabha (or state assembly as the case may be). It cannot be moved in the Rajya Sabha (or state legislative council);

- It is moved against the entire Council of Ministers including the Prime Minister and not individual ministers or private members; and,

- It needs the support of at least 50 members when introduced in the Lok Sabha.

https://newsonair.gov.in/News?title=Congress-moves-No-Confidence-Motion-against-NDA-govt-in-Lok-Sabha%3b-Speaker-admits-Motion&id=464934

Environment and Climate Sustainability Working Group (ECSWG)

Context

- The 4th Environment and Climate Sustainability Working Group (ECSWG) and Environment and Climate Ministers meeting began in Chennai

Details:

- The three-day meeting brings together around 300 delegates from G20 member countries, invitee countries, and several International Organisations, with a focus on finalising the Ministerial Outcome and the Presidency Documents.

- The 4th ECSWG & Minister's Meeting will focus on three key areas - land restoration, circular economy, and blue economy. These topics will take center stage during the meeting to address environmental and sustainability challenges.

About the key details

- On the first day of the event, there will be two parallel sessions -: the Environment Track and the Climate Track. These sessions will delve into different aspects related to environmental and climate issues, with a focus on in-depth discussions about land degradation, biodiversity, and climate change.

- The principles which will be finalised over the next two days are important to make the ocean-based economy compliant with the concerns of climate change mitigation, adaption to climate change impacts, and interventions needed in ocean-based industries such as aquaculture and mining, etc.

- In the 4th ECSWG (Environmental Conservation and Sustainable Working Group), there will be participation from 19 member countries, including the European Union (EU).

- Additionally, nine guest countries will also be attending the event, making it a gathering of diverse nations with a shared interest in environmental conservation and sustainability.

Highlights

- The highlight of the 4th ECSWG and Environment and Climate Ministers meeting will be the launch of the Resource Efficiency Circular Economy Industry Coalition on day 2 of the event.

- The coalition's objective is to unite nations, industries, and experts in their endeavor to propel the global circularity agenda forward.

- This initiative is poised to become a momentous achievement during the G20 India Presidency, representing a collective stride towards fostering on-the-ground efforts in resource efficiency and advancing circular economy principles.

https://newsonair.gov.in/News?title=4th-ECSWG-%26-Environment-%26-Climate-Ministers%26%2339%3b-meeting-begins-in-Chennai&id=464925

Amrit Bharat Station Scheme

Context

- The Railways will take up the upgradation and modernisation of thousand three hundred nine Railway stations under the Amrit Bharat Station Scheme.

Details

- In a written reply in the Lok Sabha, Railway Minister Ashwini Vaishnaw said that the scheme has recently been launched for the development of Railway stations in the country.

- The scheme envisages improvement of the building, integrating the station with both sides of the city, multimodal integration and amenities for Divyangjans, and sustainable and environment-friendly solutions.

- It also provisions ballastless tracks, Roof Plazas as per necessity, phasing, and feasibility, and the creation of city centers at the station in the long term.

- Vaishnaw said that Indian Railways has implemented the One Station One Product scheme on 754 stations with 824 operational outlets.

About the scheme

- Amrit Bharat Station scheme envisages the development of stations on a continuous basis with a long-term vision.

- It is based on Master Planning for the long term and implementation of the elements of the Master Plan as per the needs and patronage of the station.

Aim

- The scheme aims at the preparation of Master Plans of the Railway stations and implementation of the Master Plan in phases to enhance the facilities including and beyond the Minimum Essential Amenities (MEA) and aiming for the creation of Roof Plazas and city centers at the station in long run.

- The scheme shall aim to meet the needs of the stakeholders, and station usage studies as far as possible based on availability of funds and inter-se priority.

- The scheme shall cater to the introduction of new amenities as well as the upgradation and replacement of existing amenities.

- This scheme will also cover the stations where detailed techno-economic feasibility studies have been conducted or are being conducted but the work for construction of Roof Plazas has not been taken up yet, ensuring the phasing of the Master Plan being suitably implemented and relocation of structures and utilities being given more emphasis in the phasing plans.

https://newsonair.gov.in/News?title=Railways-to-take-up-upgradation-%26-modernisation-of-one-thousand-three-hundred-nine-Railway-stations-under-Amrit-Bharat-Station-Scheme&id=464940

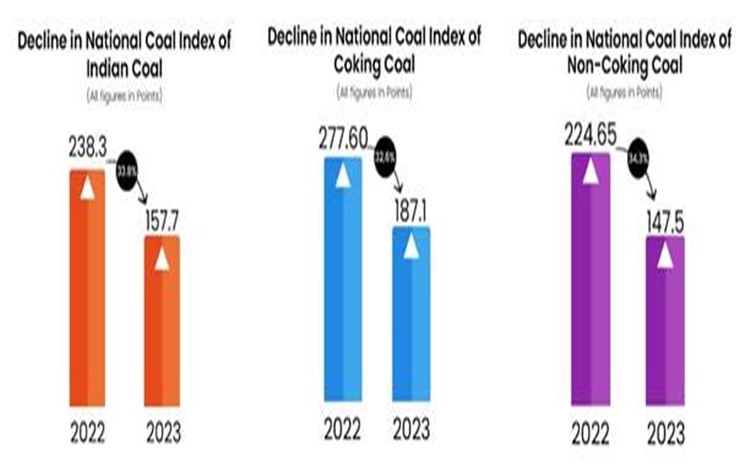

National Coal Index

Context

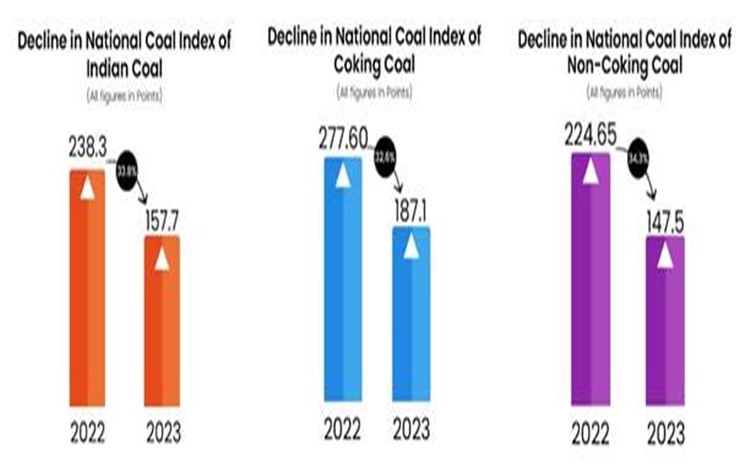

- The National Coal Index (NCI) has shown a significant decline of 33.8 percent in May this year at 157.7 points compared to May last when it was at 238.3 points.

Disclaimer: Copyright infringement is not intended

Details

- It indicates a strong supply of coal in the market, with sufficient availability to meet the growing demands.

- The NCI for non-coking coal stands at 147.5 points in May 2023, reflecting a decline of 34.3 percent compared to May 2022, while the coking coal index stands at 187.1 points in May 2023, with a decline of 32.6%.

- The peak of NCI was observed in June 2022 when the index reached 238.8 points. However, subsequent months have experienced a decline, indicative of abundant coal availability in the Indian market.

About Nation Coal Index

- The National Coal Index NCI is a price index that combines coal prices from all sales channels, including notified prices, auction prices, and import prices.

- Established with the base year as fiscal year 2017-18, it serves as a reliable indicator of market dynamics, providing valuable insights into coal price fluctuations.

- Additionally, the premium on coal auctions indicates the pulse of the industry and the sharp decline in coal auction premiums confirms sufficient coal availability in the market.

- India's coal industry affirms a substantial stockpile, with coal companies holding impressive stock. This availability ensures a stable supply for various sectors dependent on coal, significantly contributing to the overall energy security of the nation.

- The downward trend in the NCI signifies a more balanced market, aligning supply and demand. With sufficient coal availability, the nation can not only meet the growing demand but also support its long-term energy requirements, thus building a more resilient and sustainable coal industry.

https://newsonair.gov.in/News?title=National-Coal-Index-shows-decline-of-33.8-%25-in-May-this-year&id=464937