Description

Copyright infringement not intended

Context: Bharat Bill Pay was launched as a subsidiary of NPCI in the year 2021. It has witnessed a threefold business growth in just 2 years.

Details

- Bharat Bill Pay System (BBPS) was launched in 2021 as a subsidiary of the National Payment Corporation of India (NPCI). It was created to address the need for an integrated bill payment system in India that is accessible, interoperable, and convenient for customers.

- The Reserve Bank of India (RBI) mandated the establishment of BBPS to streamline bill payments and enhance the efficiency of the process.

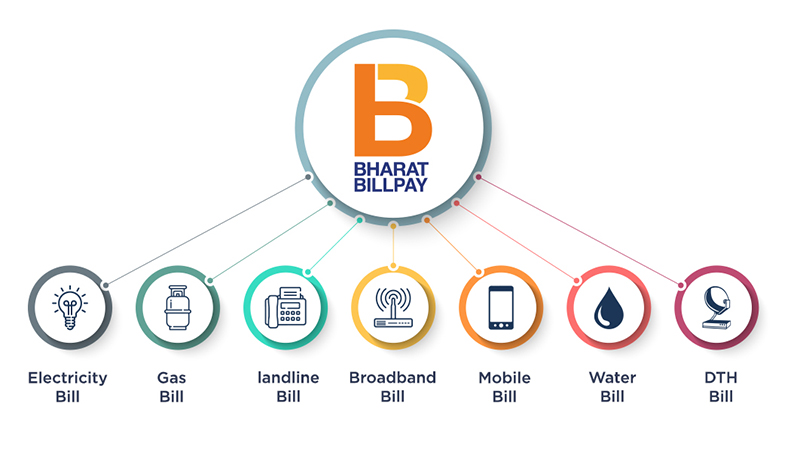

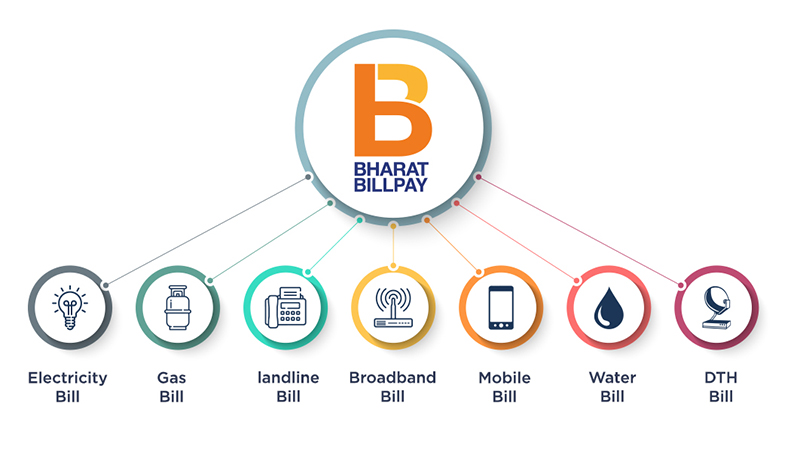

- It allows customers to pay for various recurring bills through multiple payment modes and channels.

Features

- Interoperability: BBPS allows customers to make bill payments for various services (utilities, telecom, DTH, etc.) across different billers and service providers through a single platform.

- Accessibility: The bill payment services offered by BBPS are easily accessible to customers through a wide network of agents, both online and offline.

- Multiple Payment Options: BBPS supports various payment methods, including credit/debit cards, net banking, UPI, mobile wallets, and cash payments through agents.

- Convenience: Customers can make bill payments anytime, anywhere, avoiding the need to visit multiple billers' websites or physical locations.

- Safety and Security: BBPS adheres to strict security standards to ensure the safety of customers' financial transactions and personal information.

Significance

- Streamlined Bill Payments: BBPS simplifies the bill payment process for consumers by providing a unified platform, reducing the need for dealing with multiple billers separately.

- Financial Inclusion: BBPS enables easier bill payments for people in remote areas who may not have access to digital payment methods, as they can utilize the services of BBPS agents.

- Boosting Digital Payments: The system encourages the adoption of digital payment methods, contributing to the government's efforts to move towards a cashless economy.

- Increased Transparency: BBPS offers transparency in bill payment services, allowing customers to track and monitor their payments easily.

Challenges

- Customer Awareness: One of the significant challenges for BBPS is creating awareness among the general population about its existence and benefits.

- Integration and Expansion: Expanding the BBPS network and integrating all billers and service providers onto the platform can be a complex and time-consuming task.

- Cybersecurity: As with any digital payment system, maintaining robust cybersecurity measures is crucial to protect customer data and prevent fraud.

Way Forward

- Continuous Innovation: To remain competitive and relevant, BBPS should continuously innovate its services and explore new payment technologies.

- Partner Collaboration: BBPS should work closely with billers, service providers, and other stakeholders to expand its network and enhance interoperability.

- Customer Education: Investing in awareness campaigns and educational programs will help customers understand the benefits and convenience of using BBPS.

- Integration with Digital Initiatives: BBPS should align itself with the government's various digital initiatives to foster financial inclusion and support the overall digitization efforts in the country.

Conclusion

- Bharat Bill Pay is a revolutionary initiative that aims to simplify and streamline the bill payment process for customers and billers in India. It has shown remarkable growth and potential in the last two years and has the scope to become the preferred choice for all recurring bill payments in the country. Overall, It has the potential to revolutionize bill payment services in India, making it more convenient and accessible for customers while contributing to the growth of digital payments in the country. However, addressing challenges and adapting to the dynamic payment landscape will be essential for its sustained success.

Must-Read Articles:

UPI: https://iasgyan.in/daily-current-affairs/upi-4

Digital Payments: https://www.iasgyan.in/daily-current-affairs/digital-payments

Digital Economy: https://www.iasgyan.in/daily-current-affairs/digital-economy

|

PRACTICE QUESTION

Q. How has the digital payment system significantly impacted society and the economy, what challenges does it face, and what strategies can be employed to ensure its continued growth and success?

|

https://www.businessworld.in/article/Bharat-Bill-Pay-s-Business-Grew-Threefold-In-Just-2-Years-CEO-Nupur-Chaturvedi-/19-07-2023-484690/