AIR Discussions (August 1st Week)

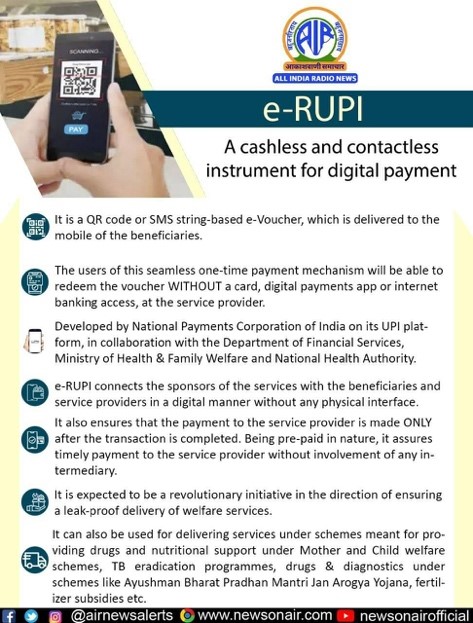

AIR SPOTLIGHT: EASING OF DIGITAL FACILITIES USING e-RUPI

CONTEXT: Taking the first step towards having a digital currency in the country, PM launched an electronic voucher based digital payment system “e-RUPI”.

WHAT IS e-RUPI?

- The platform, which has been developed by the National Payments Corporation of India (NPCI), Department of Financial Services, Ministry of Health and Family Welfare and the National Health Authority, will be a person-specific and purpose-specific payments system.

- The users of this seamless one-time payment mechanism will be able to redeem the voucher without a card, digital payments app or internet banking access, at the merchants accepting e-RUPI.

- e-RUPI would be shared with the beneficiaries for a specific purpose or activity by organizations or Government via SMS or QR code.

- This contactless e-RUPI is easy, safe and secure as it keeps the details of the beneficiaries completely confidential.

- The entire transaction process through this voucher is relatively faster and at the same time reliable, as the required amount is already stored in the voucher.

HOW WILL e-RUPI WORK?

- e-RUPI is a cashless and contactless digital payments medium.

- This will essentially be like a prepaid gift-voucher that will be redeemable at specific accepting centres without any credit or debit card, a mobile app or internet banking.

- e-RUPI will connect the sponsors of the services with the beneficiaries and service providers in a digital manner without any physical interface.

HOW WILL THESE VOUCHERS BE ISSUED?

- The system has been built by NPCI on its UPI platform, and has onboarded banks that will be the issuing entities.

- Any corporate or government agency will have to approach the partner banks, which are both private and public-sector lenders, with the details of specific persons and the purpose for which payments have to be made.

- The beneficiaries will be identified using their mobile number and a voucher allocated by a bank to the service provider in the name of a given person would only be delivered to that person.

GLOBAL EXAMPLES OF A VOUCHER-BASED WELFARE SYSTEM:

- In the US, there is the system of education vouchers or school vouchers, which is a certificate of government funding for students selected for state-funded education to create a targeted delivery system.

- These are essentially subsidies given directly to parents of students for the specific purpose of educating their children.

- In addition to the US, the school voucher system has been used in several other countries such as Colombia, Chile, Sweden, Hong Kong, etc.

WHAT ARE THE USE CASES OF e-RUPI?

- e-RUPI is expected to ensure a leak-proof delivery of welfare services.

- It can also be used for delivering services under schemes meant for providing drugs and nutritional support under Mother and Child welfare schemes, TB eradication programmes, drugs & diagnostics under schemes like Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, fertiliser subsidies etc.

- The government also said that even the private sector can leverage these digital vouchers as part of their employee welfare and corporate social responsibility programmes.

Benefit for MSMEs:

- This may allow MSMEs to send money to beneficiaries including employees and non-employees to ensure it is used for the required purpose, for instance, skill development courses and social welfare measures as well.

- It will see higher adoption rate in rural and distant areas effectively that are currently a hub of small businesses.

- e-RUPI has a significant potential to support small businesses in taking direct benefit from a multitude of governments schemes as well. For Example, under the Make in India initiative, financial assistance to MSMEs in ZED Certification (Zero Defect and Zero Effect practices) is being offered that can be passed on to them using this platform.

- The digital voucher can potentially be utilized to manage the working capital gap of the MSMEs such as enabling them to make GST or Provident Fund or Employee State Insurance payments utilizing e-RUPI and hence, shortening the working capital cycle significantly.

- Quicker receipt of financial subsidies and benefits under various schemes will result in improved working capital management & better financial liquidity for the small enterprises.

Benefits for Corporates:

- Corporates can enable well-being of their employees

- End to end digital transaction and doesn’t require any physical issuance hence leading to cost reduction

- Voucher redemption can be tracked by the issuer

- Quick, safe & contactless voucher distribution

Benefits for Hospitals:

- Easy & Secure - Voucher is authorized via a verification code

- Hassle free & Contactless payment collection - Handling of cash or cards is not required

- Quick redemption process - The voucher can be redeemed in a few steps and lesser decline due to pre-blocked amount

Benefits to the Consumer:

- Contactless - Beneficiary should not carry a print out of the voucher

- Easy redemption - 2 step redemption process

- Safe and Secure - Beneficiary doesn’t need to share personal details while redemption hence privacy is maintained

- No digital or bank presence required - Consumer redeeming the voucher need not have a digital payment app or a bank account

Capturing the unbanked and helping underprivileged: This initiative seems like one of the ways the government is trying to digitalize, while at the same time provide opportunities and resources for the underprivileged.

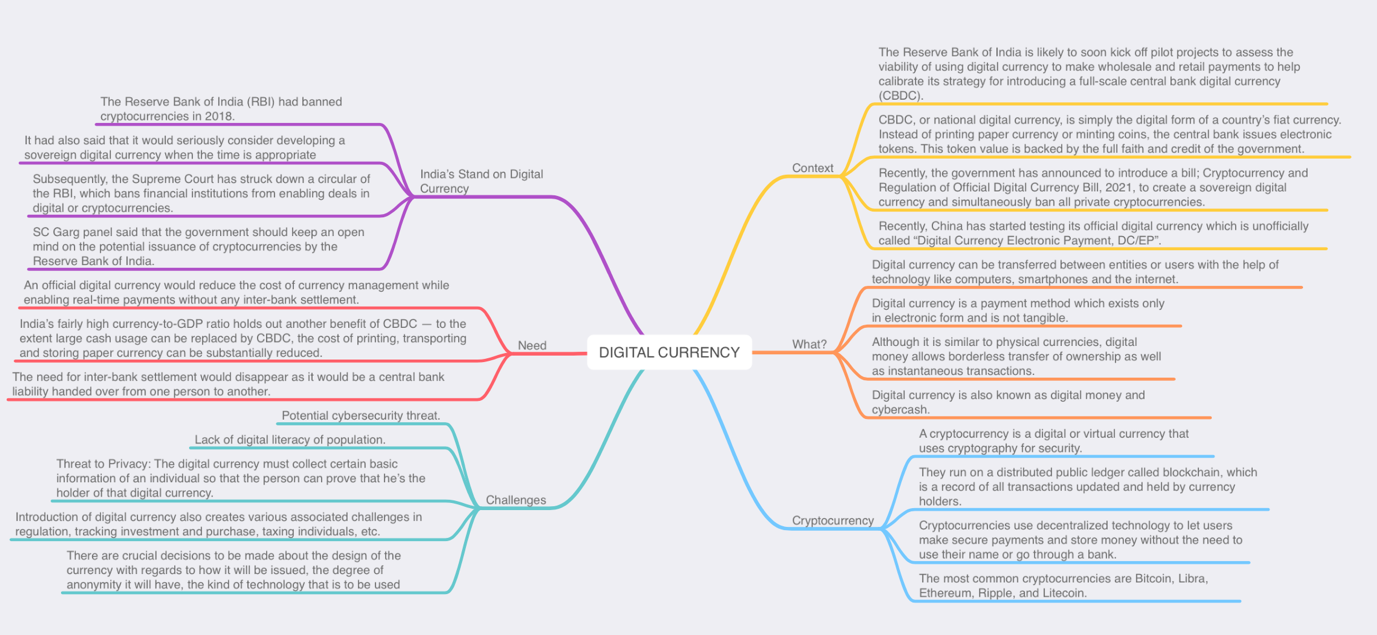

MOVE TOWARDS A DIGITAL CURRENCY?

- The government is already working on developing a central bank digital currency and the launch of e-RUPI could potentially highlight the gaps in digital payments infrastructure that will be necessary for the success of the future digital currency.

- In effect, e-RUPI is still backed by the existing Indian rupee as the underlying asset and specificity of its purpose makes it different to a virtual currency and puts it closer to a voucher-based payment system.

https://indianexpress.com/article/explained/what-is-e-rupi-digital-currency-india-pm-modi-7433637/

https://www.npci.org.in/what-we-do/upi/upi-erupi

NEWS IN BRIEF: PRELIMS SPECIAL

Essential Defence Services Bill 2021

- The Bill was recently passed by the Lok Sabha.

- The Bill aims to prevent the staff of the government-owned ordnance factories from going on a strike.

- It is meant to provide for the maintenance of essential defence services.

- Essential Defence Services include any service in any establishment or undertaking dealing with production of goods or equipment required for defence related purposes or any establishment of the armed forces or connected with them or defence.

- The Bill also empowers the government to declare services mentioned in it as essential defence services.

- The Bill amends the Industrial Disputes Act, 1947 to include essential defence services under public utility services.

- Besides, the bill has also defined strikes and punishments for violations.

Tribunals Reforms (Rationalisation and Conditions of Service) Bill, 2021

- The Bill was recently passed in Lok Sabha.

- The Bill replaces a similar Ordinance promulgated in April 2021.

- The Bill seeks to provide for uniform terms and conditions of the various members of the Tribunal and abolish certain tribunals, as a part of its bid to rationalize the tribunals.

- It seeks to dissolve certain existing appellate bodies and transfer their functions to other existing judicial bodies.

- It seeks to empower the Central Government to make rules for qualifications, appointment, term of office, salaries and allowances, resignation, removal and other terms and conditions of service of Members of Tribunals.

- It provides that the Chairperson and Members of the Tribunals will be appointed by the Central Government on the recommendation of a Search-cum-Selection Committee.

- It also provides the composition of the Committee, to be headed by the Chief Justice of India or a Judge of Supreme Court nominated by him.

- For state tribunals, there will be a separate search committee.

- The Union government has to ‘preferably’ decide on the recommendations of the search-cum selection committee within 3 months of the date of the recommendation.

- Tenure: Chairperson of a Tribunal shall hold office for a term of 4 years or till he attains the age of 70 years, whichever is earlier. Other Members of a Tribunal shall hold office for a term of 4 years or till he attains the age of 67 years, whichever is earlier.

https://newsonair.com/2021/08/02/both-houses-of-parliament-adjourned-for-the-day-2/

Insolvency and Bankruptcy Code (Amendment Bill), 2021

- The Bill is set to replace the Insolvency and Bankruptcy Code Amendment Ordinance 2021 promulgated in April 2021.

- It introduced an alternate insolvency resolution process for Micro, Small and Medium Enterprises (MSMEs) with defaults up to Rs 1 crore called the Pre-packaged Insolvency Resolution Process (PIRP).

- In March 2021 a sub-committee of the Insolvency Law Committee (ILC) recommended a pre-pack framework within the basic structure of the Insolvency and Bankruptcy Code (IBC), 2016.

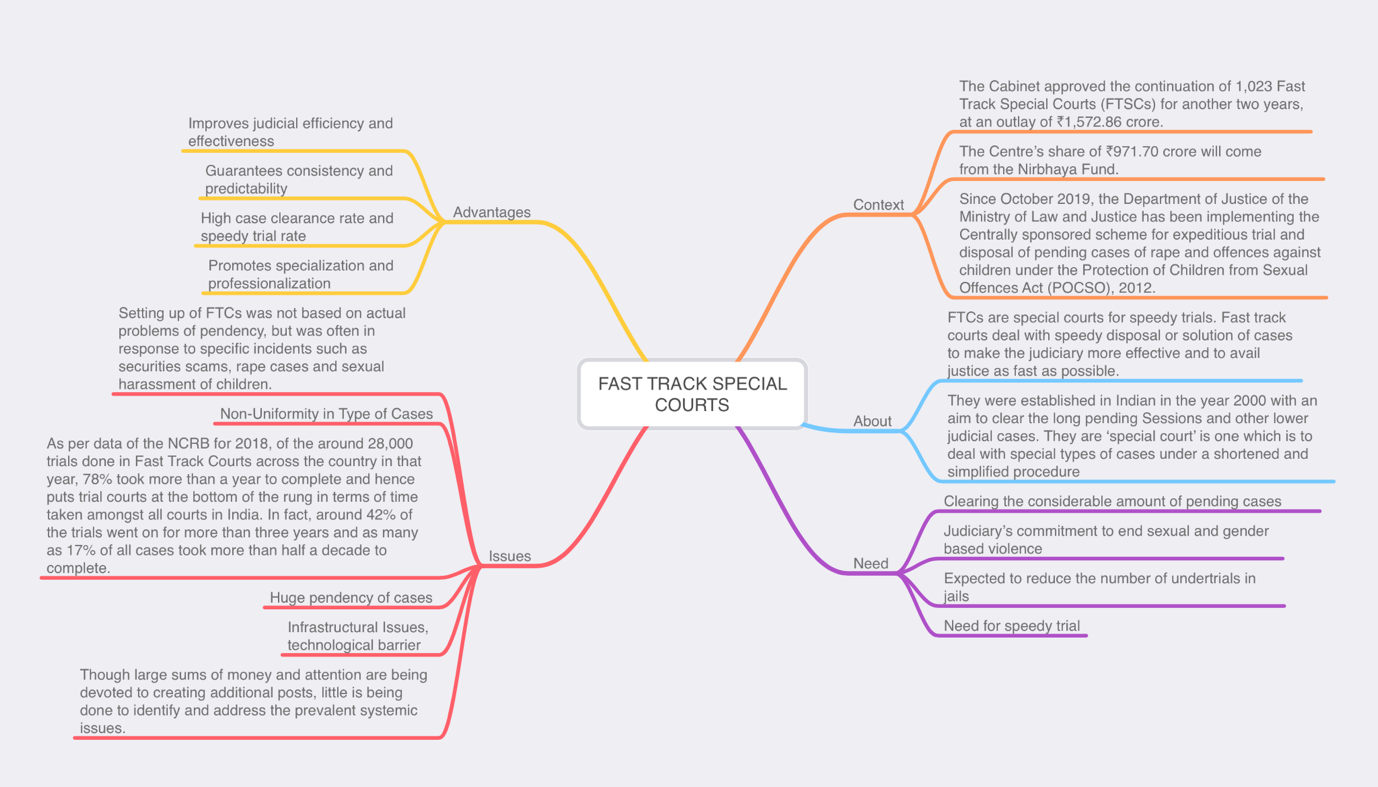

FAST TRACK SPECIAL COURTS:

1.png)