AIR Discussions (December 1st Week)

AIR Spotlight: Fintech Innovations for Financial Inclusion and Good Governance

Context: Prime Minister while virtually inaugurating the InFinity Forum, urged the fintech industry in India to convert their Fintech initiatives into a Fintech revolution.

More on the news:

- As per PM, the revolution will help to achieve financial empowerment of every single citizen of the country, highlighting that the Fintech industry in India is already innovating to enhance access to finance and the formal credit system to every person in the country.

- As per him, the rise of Fintech is resting on four pillars - income, investments, insurance and institutional credit.

- When income grows, investment becomes possible; Insurance covers enable greater risk-taking ability and investments; and Institutional credit brings means for advancement

- Finance is the lifeblood of an economy, and technology is its carrier. Both are equally important for achieving “Antyodaya and Sarvodaya”.

InFinity Forum:

- It is a leadership forum on Financial Technology, jointly hosted by the Gift City regulator IFSCA and Bloomberg.

- It aims to unite the world’s leading minds in policy, business, and technology to explore and advance the biggest ideas in FinTech, and to develop those ideas into global solutions and opportunities.

- The two-day summit will see participation from more than 70 nations, while Indonesia, South Africa and the United Kingdom are partner countries.

- The agenda of the Forum will focus on the theme of 'Beyond'; with various sub themes including FinTech beyond boundaries, with governments and businesses focussing beyond the geographical boundaries in the development of global stack to promote financial inclusiveness; FinTech beyond Finance, by having convergence with emerging areas such as SpaceTech, GreenTech and AgriTech to drive sustainable development; and FinTech Beyond Next, with focus on how Quantum Computing could impact the nature of Fintech industry in the future and promote new opportunities.

- IFSC at Gift City was born out of the vision that finance combined with technology would be an important part of India’s future development. GIFT City is an emerging global financial and IT services hub, a first of its kind in India, designed to be at or above par with globally benchmarked business districts.

Fintech sector in India:

- As per KPMG, India's fintech sector attracted over $2 Billion in investments in the first half of 2021.

- Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services.

- At its core, fintech is utilized to help companies, business owners and consumers better manage their financial operations, processes, and lives by utilizing specialized software and algorithms that are used on computers and, increasingly, smartphones.

- Fintech also includes the development and use of crypto-currencies such as bitcoin.

- However, It needs to be underlined that fintech innovation will be incomplete without fintech security innovation.

How Fin-technology has catalyzed financial inclusion?

- From less than 50% of Indians having bank accounts in 2014, India has almost universalized it with 430 million Jan Dhan accounts in the last 7 years.

- At 87%, India has the highest FinTech adoption rate in the world against the global average of 64%.

- Other initiatives include:

- 690 million RuPay cards clocking 3 billion transactions last year;

- UPI processing around 4.2 billion transactions in just last month;

- Almost 300 million invoices are uploaded on the GST portal every month;

- Despite the pandemic, about 1.5 million railway tickets are getting booked online every day;

- FASTag processed 3 billion seamless transactions;

- PM Svanidhi enabled access to credit for small vendors across the country; e-RUPI enabled targeted delivery of specified services without leakages.

- India’s United Payments Interface (UPI) has seen participation of 224 banks & recorded 2.6 billion transactions worth over $68 Bn and the highest ever, more than 3.6 Bn transactions, in Aug’21

- Over 2 trillion transactions were processed using the AePS (Aadhar-enabled payment system) last year.

- India is today one of the fastest growing Fintech markets with more than 2,100 FinTechs.

- A lot of Indian Fintech markets are unicorns and India’s market is currently valued at $31 Bn, and expected to grow to $84 Bn by 2025.

- Recently, India has overtaken China as Asia’s top financial technology (FinTech) market. Having emerged as the world’s second-largest fin-tech hub (trailing only the US), India is experiencing the ‘FinTech Boom’.

Active Areas of FinTech Innovation:

- Cryptocurrency and digital cash.

- Blockchain technology, that maintains records on a network of computers, but has no central ledger.

- Smart contracts, which utilize computer programs (often utilizing the blockchain) to automatically execute contracts between buyers and sellers.

- Open banking, a concept that leans on the blockchain and posits that third-parties should have access to bank data to build applications that create a connected network of financial institutions and third-party providers.

- Insurtech, which seeks to use technology to simplify and streamline the insurance industry.

- Regtech, which seeks to help financial service firms meet industry compliance rules, especially those covering Anti-Money Laundering and Know Your Customer protocols which fight fraud.

- Cybersecurity, given the proliferation of cybercrime and the decentralized storage of data, cybersecurity and fintech are intertwined.

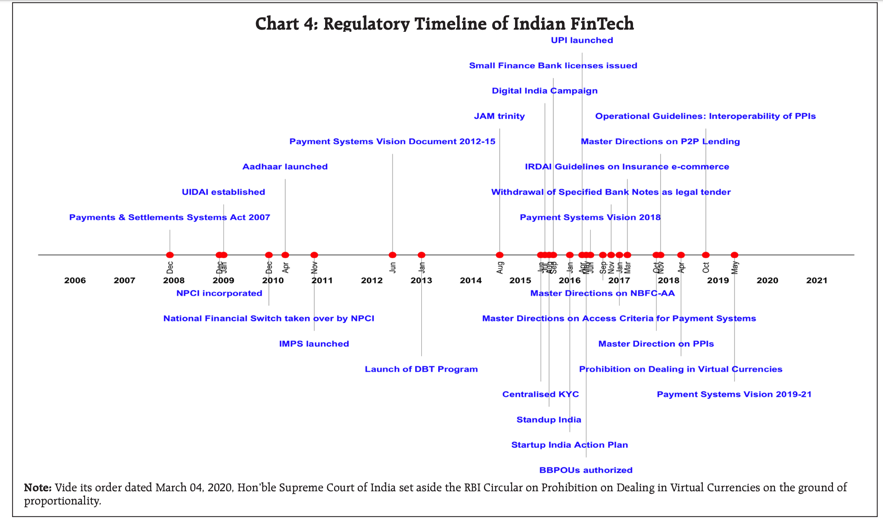

Key Growth Drivers of FinTech in India:

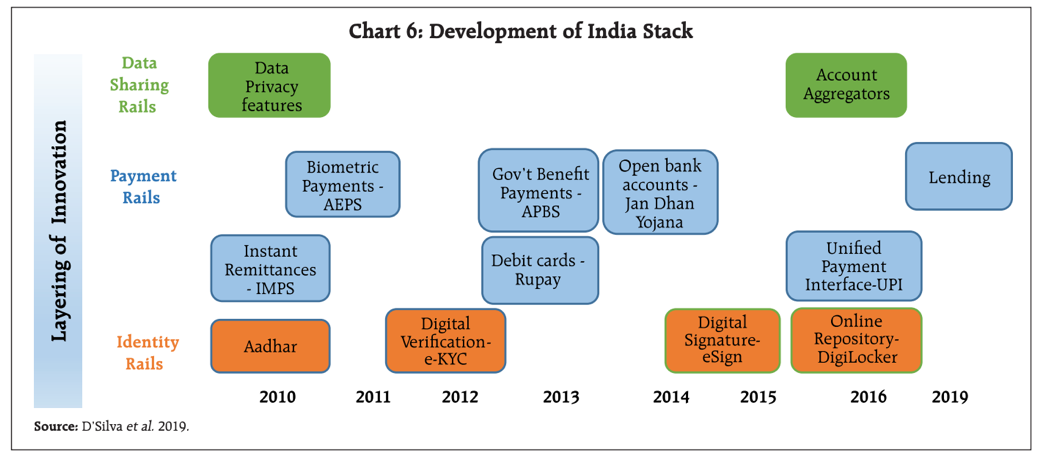

- Widespread identity formalisation (Aadhar): 2 bn enrolments.

- High level of banking penetration through the Jan Dhan Yojana: 1+ bn bank accounts.

- High smartphone penetration: 2 bn mobile subscribers.

- India Stack: Set of APIs for businesses and startups.

- Growing disposable income of Indians.

- Key government initiatives such as UPI and Digital India.

- Wide middle-class expansion: By 2030, India will add 140 mn middle-income and 21 mn high-income households which will drive the demand and growth in the Indian FinTech space.

Opportunities Related to FinTech:

- Driving Financial Inclusion in India: A significant number of people in India remain outside the purview of the formal financial system. Use of financial technologies can help address the gaps in financial inclusion left by the traditional models of banking and finance.

- Providing Financial Assistance to the MSMEs: Lack of capital is one of the biggest threats to their existence. According to the IFC Report, the total addressable credit gap in the MSME segment is estimated to USD 397.5 billion. This is where FinTech comes into the picture, and has the potential to solve the credit availability issues.

- With several FinTech start-ups offering easier and quicker access to loans, MSMEs are no longer required to go through the tedious process of documentation, paperwork and multiple visits to a bank.

- Enhancing Customer Experience and Transparency: FinTech start-ups offer convenience, personalisation, transparency, accessibility and ease of use – factors that empower customers to a great extent.

- The FinTech industry will develop unique and innovative models for assessing risks.

- Leveraging big data, machine learning, and alternative data to underwrite credit and develop credit scores for customers with a limited credit history will improve the penetration of financial services in India.

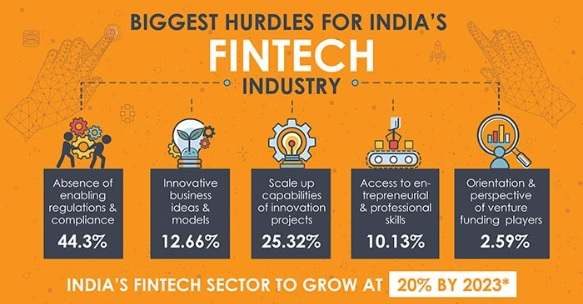

Associated Challenges:

- Cyber-Attacks: Automation of processes and digitization of data makes fintech systems vulnerable to attacks from hackers. Recent instances of hacks at debit card companies and banks are illustrations of the ease with which hackers can gain access to systems and cause irreparable damage.

- Data Privacy Issue: The most important questions for consumers pertain to the responsibility for cyber attacks as well as misuse of personal information and important financial data.

- First, despite immense scope for innovation, cross-border payments are still unchartered territory for FinTechs.

- Second, the increasing popularity of FinTechs could exacerbate data use, protection and privacy concerns if the statutory rights and obligations of service providers are not clearly delineated.

- Third, there is a need to ascertain the impact of FinTech on financial stability, due to higher potential for system-wide risk with its expansion.

- Fourth, there is inequality of access to FinTech services.

- Fifth is the issue of consumer protection and digital education.

- Finally, regulators need to conduct themselves neutrally.

Way Forward:

- Currently, India majorly relies on import of offensive as well as defensive cybersecurity capabilities. Given the growing scale of adoption of technology, it is imperative for India to attain Atma-Nirbharta in this domain

- Apart from establishing technological safeguards, educating and training customers to spread awareness about the benefits of fintech and guard against cyberattacks will also help in democratisation of FinTech.

- Established fintech sandboxes by RBI to evaluate the implications of technology in the sector is a step in the right direction. However, there is a requirement for a strong data protection framework in India. In this context, the personal data protection bill, 2019, must be passed after thorough debate and deliberation.

- FinTechs need to prioritise regulatory compliance and the management of cyber risks.

- Ensuring a high degree of interoperability among startups is key to ensure a coordinated response to market demand and changing attitudes.

- For a healthy and sustainable business ecosystem, FinTechs need to bridge the digital divide and promote equitable, broad-based customer participation across urban and rural areas and the various producing and consuming sectors.

https://pib.gov.in/PressReleasePage.aspx?PRID=1776353

https://pib.gov.in/PressReleasePage.aspx?PRID=1759602

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1777520

https://web-assets.bcg.com/9e/bb/11de3305496dbef780031efeb6b0/bcg-ficci-report-india-fintech.pdf

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/7FINTECHEED4C43FC31D43C9B9D7F8F31D01B08E.PDF

News in Brief: Prelims Special

Omicron Variant

- The new omicron variant has been declared as a variant of concern by the WHO and was detected first in South Africa.

- It is a globally dominant delta plus and the most troubling COVID-19 variant.

- Consists of high mutation capacity and rate.

- The name omicron has been derived from the Greek alphabet to prevent the stigma attached to the country that detected it. This was decided by the World Health Organisation.

- The new variant is alleged to reduce the efficiency of vaccines and other treatments along with diagnostic detection failure.

https://newsonair.com/2021/12/03/knowing-the-omicron-variant/

World AIDS Day

- World AIDS Day celebration was organised on the 1st of December 2021 by the National AIDS Control Organization (NACO) which emphasized important aspects of the global theme for 2021 which is “End inequalities. End AIDS”.

- Day is celebrated to tackle the deadly HIV (Human Immunodeficiency Virus) and spread awareness and prevent discrimination against those who suffer from this detrimental disease.

- This day, in history, was celebrated as the first health day in the year 1988.

https://newsonair.gov.in/News?title=World-AIDS-Day-is-being-observed-today&id=430608

Cyclone Jawad

- The cyclone is named Jawad by Saudi Arabia and it means generous or merciful.

- India, Bangladesh, Myanmar, Pakistan, Maldives, Oman, Sri Lanka and Thailand decide the names of cyclones in the region.

- The countries submit a list of cyclone names from time to time to choose the names from the pool.

- While selecting names for cyclones, countries first analyse them to see if the word is easily understood by people in the region, hence the names are generally familiar words.

https://newsonair.com/2021/12/04/cyclone-jawad-likely-to-hit-andhra-pradesh-and-odisha-coast-today/

Dam Safety Bill

- Rajya Sabha passed the landmark dam safety bill which was ratified by Lok Sabha in 2019.

- Within the ambit of the Dam Safety Bill, a National Committee on Dam Safety will be created to facilitate the dam safety policies, protocols and procedures.

- A regulatory body, National Dam Safety Authority, will be constituted for the holistic implementation and monitoring of dam safety protocols and standards.

- At the state level, the regulatory functions would be operated by State Committees on Dam Safety and State Dam Safety Organisation.

- The interrelationship between dam safety and climate change has been acknowledged by the bill and it provides for regular inspection and hazard classification of dams.

- Emergency action plans and comprehensive dam safety reviews will be carried out by expert intervention.

- It also provides for a flood warning system to protect the inhabitants from calamities.

- In order to follow compliance, there is a penalty imposed on the dam owners for poor maintenance of the dams.

https://newsonair.gov.in/News?title=Parliament-passes-Dam-Safety-Bill%2C-2019&id=430759

Hornbill Festival

- The Hornbill Festival is a reflection of the rich culture, lifestyle and food habits of Nagaland and it is the largest festival of the warrior tribes of Nagaland wherein the celebration continues for 10 days.

- The festival derives its name from the bird hornbill (also called Dhanesh bird) which occupies an important place in the culture and historic tales of Naga tribes.

- This festival is celebrated every December in Nagaland and North-East India.

International Day of Persons With Disabilities

- Every year since 1992, the International Day of Persons with Disabilities (IDPD) has been annually observed around the world on December 3.

- The theme for the year 2021 is – Leadership and participation of persons with disabilities toward an inclusive, accessible and sustainable post-COVID-19 world.

Navy Day

- In order to recognise the relentless commitment of the Indian Navy and extend warm greetings to the courageous personnel, every 4th day of December is celebrated as Navy Day.

- This day stands with enormous significance as it witnessed India’s victory during Operation Trident in 1971.

https://newsonair.com/2021/12/04/indian-navy-day-inside-the-world-of-nations-sea-guardian/

President’s Standard

- The 22nd Missile Vessel Squadron, also known as the Killer Squadron, will be awarded the President’s Standard.

- The President’s Standard is the highest honour bestowed by the Supreme Commander to a military unit in recognition of the service rendered to the nation.

- It is the same honour as the President’s Colours, awarded to a relatively smaller military unit.

1.png)