AIR Discussions (November 4th Week)

INDIA’S EXPANDING MANUFACTURING PMI

News

- India’s manufacturing PMI expands at a robust pace in November; Employment rises solidly for the ninth month in a row.

Details

- Posting PMI at 55.7 in November, up from 55.3 in October, the seasonally adjusted PMI signalled the strongest improvement in operating conditions for three months.

- The headline figure was also above its long-run average of 53.7. The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared to the previous month, and below 50 an overall decrease.

The index is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 400 manufacturers.

Status of Indian manufacturing industry:

|

A brief look back: India stands out as one such country: a potential manufacturing powerhouse that has yet to realize its promise. From fiscal year 2006 to fiscal year 2012, India’s manufacturing-sector GDP grew by an average of 9.5 percent per year. Then, over the next six years, growth declined to 7.4 percent. In fiscal year 2020, manufacturing generated 17.4 percent of India’s GDP, little more than the 15.3 percent it had contributed in 2000. (By comparison, Vietnam’s manufacturing sector more than doubled its share of GDP during the same interval.) And in the past 13 years, India’s manufacturing-sector share of employment increased by just one percentage point, compared with a five-point increase for the services sector. |

- The manufacturing sector currently accounts for nearly 17 per cent of India’s GDP. It employed over 5 crore Indians in 2016-17 and has declined by 46 per cent to reach 2.73 crore in 2020-21. This indicates that the sector has been gradually losing momentum over the years.

- In the last few years earlier small manufacturers have now just become traders.

- Tough labour laws, expensive credit, costly or inadequate power supply make import from China and selling in India more profitable than producing these goods domestically.

- MSMEs sector accounts for around 6% of the manufacturing GDP and around 25% of the service sector GDP ; and contributes to around 33% to India’s manufacturing output.

- Indian manufacturers lost space to imports that were cheaper, better looking and fast rolling mainly because of lack of market feedback, lack of modification and dearth of novel technology.

|

Bottlenecks in manufacturing Sector Poor logistics causes delays and raises inventory costs; High prices for power and credit inflate operating expenses. The small, fragmented companies that make up some value chains cannot operate productively and with efficiency; cannot innovate quickly enough to keep up with competitors; and cannot command price premiums because they lack strong brands.

Prospects in Manufacturing Sector India’s natural resources (for example, iron ore, bauxite, high solar insolation, and cotton) and low-cost labor are a boon to makers of basic metals, textiles and apparel, renewable energy, and chemical products. The country’s large numbers of well-trained workers lend strength to skill-intensive value chains such as pharmaceutical formulations, capital goods, and automotive components. And many manufacturing value chains in India operate in close proximity to strong domestic markets. The makers of fast-selling technology products, for example, enjoy ready access to millions of Indian consumers. |

Progress of India in manufacturing:

- Assembly in electronics in the mobile sector has taken a quantum jump. India has emerged as the second largest manufacturer of mobile handsets in the world in terms of volume.

- India became the second largest steel producer in the world.

- India ranks second largest cement producer in the world.

- India is also among the top three aluminium producing countries in the world.

- India has won the largest number of Deming Awards outside of Japan. [Deming Prizes Recognize businesses worldwide for excellence in applying the principles of Total Quality Management].

- India is the largest manufacturer of two wheelers in the world.

- Great affordability rate is creating a huge market within the country.

- Leaders in manufacturing sector have been innovative in maintaining the entire supply chain right, from procuring steel to product designing.

- The small cars sector in India successfully built a huge supply chain owing to factors such as locational advantage, ease of doing business, intensive and support given such as allotting land in Southern India, near the ports. Example: Hyundai and Maruti.

How can India become a global manufacturing hub?

Learning from success stories of other countries

- Vietnam, the country of 100 million people, began manufacturing only ten to twelve years ago at a low base in a variety of sectors like garments, electronics and assembly. It has now had a sustained growth of 12-14%.

Five critical steps India needs to take:

- Labor-intensive sectors: We need to recognize that our strength lies in labor, cost and productivity skills so we need to make mega industrial clusters preferably near its ports, which leverage on laborintensive sectors.

- Ease of doing business: We must aggressively work on policy matters related to logistics costs, loading-unloading time, moving stock by road or rail etc.

- Boosting export: Manufacturing is closely related to export. We cannot be successful in manufacturing unless we are also successful in exports.

- Correcting the exchange rate: One of the handicaps in manufacturing is our exchange policy because the exchange rate is somewhat overvalued. This causes disadvantage to Indian exporters and also Indian industry, as Industry has to reckon with cheap imports. If the exchange rate is strong then imports look cheaper than domestic goods.

- Increasing market access: In the present time, trade blocs are more popular than multilateral policies under the WTO. India should sign an FTA with the European Union and US that will help in the long run in promoting market access and huge opportunities.

How to ensure that Indian products are competitive against foreign goods?

- Research & Development (R&D): R&D is not merely the responsibility of the Government and public sector units but also that of private sector companies.

- India’s R&D spend is only 0.7% of the GDP which is less than then our peer countries such as Vietnam (2%) – it needs to be double and triple. R&D in our educational institution must be encouraged. More academia and industry partnership is required to boost R&D.

- To promote exports, a three way partnership is needed

- Diplomatic missions abroad must reach out to investors in those countries who are interested in setting up R&D facilities in India.

- The Ministry of Commerce & Industry should take the lead towards promoting R&D.

- Industry associations and chambers like FICCI and CII, should connect small -medium enterprises an companies to this initiative.

Do we need major labor reforms to become a global manufacturing hub?

- Restrictive labor laws have prevented companies in India from reaping the full benefits in output, productivity and employment and export.

Reforms needed:

- Fixed employment policy: It gives flexibility to industries to hire and fire the workers or upscale or downscale workforce as per need, without significantly compromising on labor interest.

- Simple labor laws: labor laws must be made less complex to give more decision making autonomy to manufacturing units.

- Amend Factories Act 1948: many provisions are obsolete which must be removed.

- Self-certification: To develop a culture of trust and transparency, monthly and quarterly inspections by the Government authorities should be replaced by a self-certification norm and defaulters should be strictly penalized.

Way forward:

- Boost spending on research and development to at least 2% of the GDP.

- Eliminate exemptions on countervailing duties on imports as the duty exemptions are favoring foreign producers over domestically made goods

- Monetize the land owned by public sector companies which could be used to develop eco-systems to nurture start-ups and develop sites for industrial clusters.

- Allow industries to buy electricity directly from the markets.

- Rationalizing labor laws to promote big industries rather than small and dwarf industries.

- Government should refrain from frequent policy twisting as it deter investment due to policy uncertainty.

- Improving infrastructure from transport systems to the power sector to reduce logistic cost and power outage.

- Improve access to finance for MSMEs sectors as most are facing financial crunch.

- Overhauling school and college curriculum to impart market relevant skills to youth.

- MSMEs should be included in the industrial clusters and given more Government support such as market facilitation, technology support, simplification of compliance norms etc.

- There must be mission mode in a targeted manner to achieve the goal of manufacturing hub.

- ‘Atma Nirbhar Bharat’ initiative must be given more focus for developing self-reliance across various sectors. For instance, despite having rich coal reserves, India is dependent on coal imports- this should be given proper attention.

- By adopting Industry 4.0 and automation technologies and investing in analytics, reskilling, and upskilling, Indian manufacturers could accelerate.

- Policy reforms that help create better infrastructure and logistics.

- By providing incentives to suppliers that operate within port-proximate export-processing (or coastal economic) zones, policy makers can make a tremendous difference in favor of Indian manufacturers.

- Boost productivity by offering more value-added goods, with higher product quality, better packaging, and stronger brands. Such enhancements would allow them to command higher prices, leading to one and a half to three times higher GVA (for example, in food processing, capital goods, steel, and steel products).

|

VGF Additional support for high-technology and low-carbon value chains might come from viability-gap funding (VGF), in which the government provides some capital to make projects financially viable. For example, India imports nearly all of the LCD panels that go into electronic devices made in the country. The country lacks the technology to set up an LCD-panel factory, and the investment case for such a plant does not hold up in the current tariff regime. Combined with time-bound tariffs or incentives, VGF could help improve the returns from investments in such a factory to 10 to 12 percent of the invested capital. |

- Accessing Capital: With an incremental capital-to-output ratio between 4.5 to 6.0, India’s manufacturing sector would need investments totalling $1.0 trillion to $1.5 trillion over the next seven years to double its GDP in the same timeframe, provided that India also raises its GVA capture in these value chains by 25 percent.

- Financial reforms would help stable, cash-generating manufacturers attract low-cost domestic capital from long-term savings pools, such as pension funds and insurance.

PMI:

- Started in 1948 by the US-based Institute of Supply Management, the Purchasing Managers’ Index, or PMI, has now become one of the most closely watched indicators of business activity across the world.

What is a PMI?

- PMI or a Purchasing Managers’ Index (PMI) is an indicator of business activity-- both in the manufacturing and services sectors.

- It is a survey-based measurethat asks the respondents about changes in their perception of some key business variables from the month before.

- It is calculated separately for the manufacturing and services sectors and then a composite index is constructed.

How is the PMI derived?

- The PMI is derived from a series of qualitative questions.

- Executives from a reasonably big sample, running into hundreds of firms, are asked whether key indicators such as output, new orders, business expectations and employment were stronger than the month before and are asked to rate them.

How does one read the PMI?

- A figure above 50 denotes expansion in business activity.

- Anything below 50 denotes contraction.

- Higher the difference from this mid-point greater the expansion or contraction.

- The rate of expansion can also be judged by comparing the PMI with that of the previous month data.

- If the figure is higher than the previous month’s then the econ-omy is expanding at a faster rate. If it is lower than the previous month then it is growing at a lower rate.

What are its implications for the economy?

- The PMI is usually released at the start of the month, much before most of the official data on industrial output, manufacturing and GDP growth becomes available.

- It is, therefore, considered a good leading indicator of economic activity. Economists consider the manufacturing growth measured by the PMI as a good indicator of industrial output, for which official statistics are released later.

- Central banks of many countries also use the index to help make decisions on interest rates.

What does it mean for financial markets?

- The PMI also gives an indication of corporate earningsand is closely watched by investors as well as the bond markets.

- A good reading enhances the attractiveness of an economy vis-a- vis another competing economy.

- For instance, India’s manufacturing activity as measured by the PMI expanded, while for China/XYZ country it dipped.

INDIA’S PHARMA EXPORTS

News

- India's export of pharma products has registered a tremendous growth of 138 per cent from April to October 2022 over the same period in 2013.

Overview

- India plays an important role in the global pharmaceuticals and vaccine industry. It is the largest provider of generic medicines globally. The country has a share of 20% in the global supply volume and contributes to around 60% of the global vaccines. India ranks third in the world in terms of volume and is the fourteenth largest in terms of value. Key segments of the Indian pharmaceutical industry are OTC medicines, Generics, APIs, Vaccines, Biosimilars, and Custom Research Manufacturing (CRM).

- India is the world leader in supplying vaccines like DPT, BCG, and Measles. It also has the highest number of US FDA approved plants outside of USA. The key USP of the Indian Pharmaceutical Industry is affordable price and high quality and because of this, India is also sometimes called the “Pharmacy of the World”. The total annual turnover of the industry was US$ 36.7 billion in 2019-20. One of the major achievements of the Indian Pharma Industry is the access to affordable HIV drugs. Additionally, India is one of the largest suppliers of low-cost vaccines to the world.

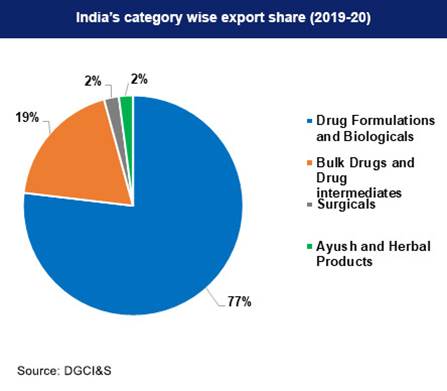

- India majorly exports drug formulations & biologicals, and these products contribute to about 75% of the total pharmaceuticals exports out of India.

Export Trend

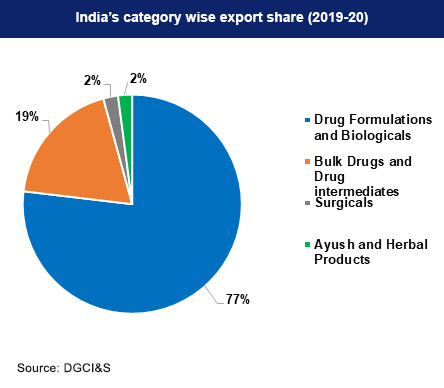

- India’s share of pharmaceuticals and drugs in the global market is 5.92%. Formulations and Biologics constituted the major portion of India’s exports with a share of 73.31% followed by drug intermediates and bulk drugs. During 2021-22, the country exported pharma products worth US$ 24.62 billion, flat over the previous year. In 2020-21, the exports grew at 18% YoY to US$ 24.4 billion.

- This robust performance was achieved despite the global supply chain disruptions, lockdowns, and subdued manufacturing. In March 2022, India exported US$ 2.4 billion worth of drugs and pharmaceuticals, a 23% increase from US$ 1.97 billion in February 2022. USA, UK, South Africa, Russia, and Nigeria are India’s top five export destinations. India played a key role during the Covid-19 pandemic and demonstrated its ability to be a consistent and reliable pharma supplier to the world even during the time of crisis.

- India has the highest number of United States Food and Drug Administration (USFDA) compliant companies with plants outside of USA. About 8 out of 20 global generic companies are from India and over 55% of the exports from the country are to the highly regulated markets. As the country is the biggest vaccine exporter, about 65-70% of the World Health Organization (WHO) vaccine requirements are sourced from India. From April 2022-September 2022, exports of Drugs & Pharmaceuticals stood at US$ 12,724.06 million and exports of Medicinal and Pharmaceutical products stood at US$ 4066.86 million.

Export Destinations

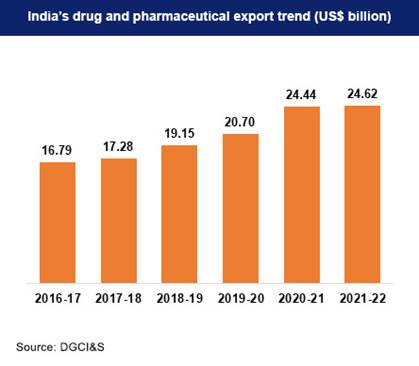

- India exports pharmaceutical products to North America, Africa, the EU, ASEAN, Latin America & Caribbean (LAC), Middle East, Asia, CIS and other European regions. Nearly two-thirds of India’s exports goes to NAFTA, Europe, and Africa. The top five export destinations for Indian Pharma Industry in 2021-22 were USA, the UK, South Africa, Russia, and Nigeri

- USA, the UK and Russia are among the largest importers from India at a share of 29%, 3% and 2.4%, respectively during 2021-22. India’s exports of pharma products to these countries in FY21-22 were: USA with US$ 7,101.6 million, the UK with US$ 704.5 million, South Africa with US$ 612.3 million, Russia with US$ 597.8 million, and Nigeria with US$ 588.6 million. India’s pharma exports to USA in value grew at a CAGR of 6.9% over last three years. Additionally, for UK and Russia, it grew at a CAGR of 3.8%, and 7.2%, respectively over the same period.

- As of August 2021, the number of USFDA approved facilities stood at 741. Additionally, the number of ANDAs won by the Indian firms till December 2020 stood at 4,346. USFDA inspections were not conducted during the last couple of years due to the Covid pandemic, however, the inspections have started happening now and are expected to further increase Indian exports to USA.

GOVERNMENT INITIATIVES

- The Government of India has set up several schemes to further strengthen the pharmaceutical industry. The Strengthening of Pharmaceutical Industry (SPI) scheme focuses on bolstering the existing infrastructure facility, with a total financial outlay of Rs. 500 crore (US$ 64.5 million).

- Production Linked Incentive (PLI) schemes for pharmaceuticals, critical key starting materials (KSMs), medical devices, bulk drug parks, etc. are introduced to encourage manufacturers. Through the PLI scheme, the Government of India hopes to increase investment and production in the Indian pharmaceutical sector. The scheme is expected to generate an incremental sale of Rs. 2,94,000 crore (US$ 37.09 billion) in six years, starting from 2022-23 to 2027-28.

- For the promotion of the Indian pharmaceutical industry, the Pharmaceutical Promotion and Development Scheme (PPDS) was introduced in 2017 with financial support for conducting seminars, conferences, exhibitions and delegations.

- Pharmaceutical Technology Upgradation Assistance Scheme (PTUAS) was implemented to facilitate small and medium sized enterprises (SMEs) to attain WHO-GMP norms. This will enable them to compete at a global scale.

- The Pradhan Mantri Bhartiya Janaushadhi Pariyojana’ (PMBJP), was originally launched in 2008 as “Jan Aushadhi Scheme”. This scheme aims to make quality affordable generic medicines available to all.

GOVERNING BODY

Pharmaceutical Export Promotion Council of India (Pharmexcil)

- Pharmexcil is a promotion body set up by the Government of India to promote the Indian pharmaceutical industry. The roles of the council are to advise the government, organize seminars and meetings on export-related issues, organize business meetings in India and abroad and also organize trade delegations. The council also assists its members in getting Market Access Incentive (MAI) claims from the Government of India.

Department of Pharmaceuticals

- The Department of Pharmaceuticals was formed in 2008 to focus on the development of the pharmaceutical sector in the country. The key functions of the department are to ensure availability of drugs at reasonable prices, proper functioning of Central Pharma Undertakings, support projects and revival of schemes, ensure proper management, develop human resources and infrastructure, formulate schemes & projects and formulate an annual plan, budget and monitoring of budget expenditure.

Must Read: https://www.iasgyan.in/daily-current-affairs/indias-health-diplomacy-and-indias-pharma-sector

IPPB

Context

- India Post Payments Bank has cautioned its customers of cyber frauds.

IPPB

- India Post Payments Bank, abbreviated as IPPB, is a division of India Post which is under the ownership of the Department of Post, a department under Ministry of Communications.

- Opened in 2018 India Post Payments Bank is a 100% central government-owned entity.

- The Payment bank was started with the vision to build the most accessible, affordable and trusted bank for the common man in India.

- The main objective is to promote financial inclusion in a simple and secure manner at the customers' doorstep.

- It aims to utilize nearly 1,60,000 post offices as access points and 3 lakh postmen and Grameen Dak Sewaks to provide doorstep banking services.

- It delivers simple and affordable banking solutions through innovative interfaces available in 13 languages.

Services offered by the Bank

- It offers savings accounts, money transfers and insurances through the 3d parties, bill and utility payments.

- The Bank offers savings and current accounts up to a balance of ₹2 Lakh.

- Customers can use QR code payments eliminating the need to remember account numbers, PINs and Passwords.

- Unified Payments Interface (UPI)

- Immediate Payment Service

- National Electronic Funds Transfer

- Real-time gross settlement

- Bharat BillPay

- Direct Benefit Transfer

- RuPay Debit Card

- AEPS (Adhaar Enabled Payment Service)

According to the data released in January 2022, the India Post Payment Bank had crossed the landmark of 5 crore customers.

NON-CONVERTIBLE DEBENTURES

News

- Union Minister for Road Transport and Highways, Mr. Nitin Gadkari rang the opening bell at Bombay Stock Exchange, BSE on Friday morning to mark the listing of Non-Convertible Debentures of National Highways Authority of India Infrastructure Investment Trust- NHAI InvIT.

What are NCDs?

- Non‐Convertible Debenture is a financial instrument issued by Corporates for specified tenure to raise resources / funds through public issue or private placement.

- This debt instrument cannot be converted into equity. It is a fixed income instrument same as bank fixed deposit and can be traded on stock exchanges. Interest can be earned monthly / quarterly / annually / cumulative and on maturity principal amount is paid to the debenture holder.

Benefits of investing in NCDs

If one is looking for an investment that generates fixed income periodically, NCDs may be an ideal investment as it offers.

- Higher rate of interest as compared to fixed deposits, postal savings or similar investments.

- If the bonds are listed, liquidity as one can sell it in the secondary market before its maturity

- If listed bond possibility of capital appreciation i.e. one can sell your bond at a price higher than your cost price in the market

Features of Non‐Convertible Debentures

- Higher rate of returns: NCDs in the past have offered interest rates which were quite attractive as compared to interest on other fixed-income options.

- Flexible tenure: The tenure of NCDs can be anywhere between 2 years and 20 years, thereby providing better maturity opportunities.

- Lower credit risk: An NCD loses value when interest rate in the system goes up and gains when the interest rate declines. However, when the NCD is held until maturity, one is likely to realize the promised return and the risk due to movement in interest rates is eliminated or minimized.

- Professionally rated: NCDs are rated by certified and professional credit rating agencies.

- Easy liquidity: NCDs are generally listed securities hence one can sell them in the secondary market before maturity.

- Capital appreciation: As NCDs are listed securities, it can benefit from the fluctuations in stock market and may have capital appreciation.

- No Tax deduction at source: There is no tax deduction at source (TDS) on NCDs offered in DEMAT mode and listed on a stock exchange as per section 193 of the IT Act.

- Interest Payout Options: One could look at different interest payout options offered by NCDs such as monthly, quarterly, half‐yearly or annual interest payments.

Taxation on NCD

- As per section 193 of the Income Tax Act, 1961, there is no tax deduction at source (TDS) from any securities issued by a company, in a dematerialized form and listed on a recognized stock exchange in India. However, NCDs allotted to non‐resident Indians (NRIs) will be subject to TDS as per section 195 of the Income Tax Act, 1961.

- For individual investors, if the NCDs are sold before a year, the profits will be added to the income of the investor and he will have to pay taxes at the same rate as per the income tax slab. For any profit made by selling NCDs after a year, tax will be paid at 10%, if indexation is not done or 20% if the indexation is done.

Minimum investment

- Amount invested by a single investor is as decided by the company and varies with the issuances. Usually investors can start investing with amounts as low as Rs 10000/‐.

Basis of NCD allotment

- Allotment is based on “First come first serve” basis.

Where are NCDs bought from and sold to

- Debentures can be bought and sold through secondary market. They are traded like shares

Is NCD a Share or a fixed deposit?

- NCD is neither a share nor fixed deposit. It is similar to fixed deposit in the sense that at time of redemption, the return is fixed.

Are NCDs taxable?

- Dematerialized forms of NCDs are not taxable.

.jpg)

.jpg)

1.png)