900% increase in rejection of crop insurance claims

Context: The number of farmers’ crop insurance claims that were rejected by insurance companies under the Centre’s flagship Pradhan Mantri Fasal Bima Yojana (PMFBY) multiplied 10 times in just two years.

Details:

- In 2017-18, the number of rejected claims was 92,869. In the next year, 2018-19, the figure more than doubled to 2.04 lakh. By 2019-20, it was 9.28 lakh, a whopping 900% increase.

About the scheme:

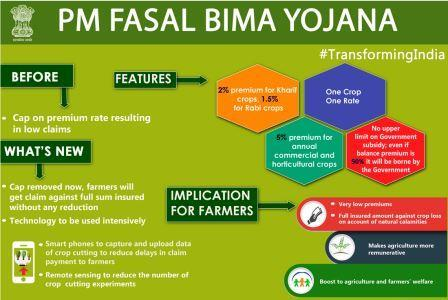

- The PMFBY will replace the existing two schemes National Agricultural Insurance Scheme as well as the Modified NAIS.

- Features:

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 5% for all Rabi crops.

- In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%.

- There is no upper limit on Government subsidy.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers.

- Smartphones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

- PMFBY is a replacement scheme of NAIS / MNAIS, there will be exemption from Service Tax liability of all the services involved in the implementation of the scheme.

- It is estimated that the new scheme will ensure about 75-80 per cent of subsidy for the farmers in insurance premium.

https://www.thehindu.com/todays-paper/tp-national/whopping-900-increase-in-rejection-of-crop-insurance-claims/article33764458.ece

1.png)