Central Bank Digital Currency

Figure 3: No Copyright Infringement Intended

Context:

- RBI Chairman has issued concern with respect to central bank digital currency (CBDC).

About CBDC:

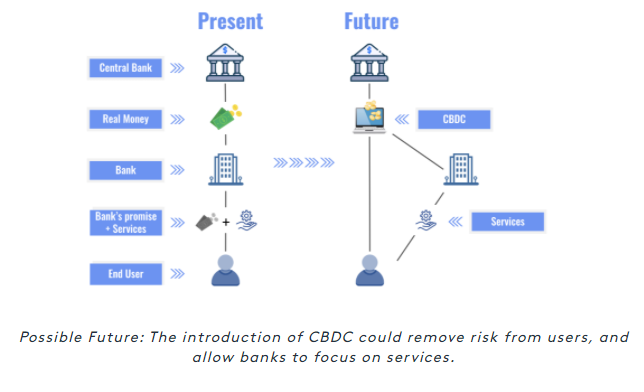

- The term central bank digital currency (CBDC) refers to the virtual form of a fiat currency.

- A CBDC is an electronic record or digital token of a country's official

- As such, it is issued and regulated by the nation's monetary authority or central bank.

- As such, they are backed by the full faith and credit of the issuing government.

Need for it:

- An official digital currency would reduce the cost of currency management while enabling real-time payments without any inter-bank settlement.

- India’s fairly high currency-to-GDP ratio holds out another benefit of CBDC — to the extent large cash usage can be replaced by CBDC, the cost of printing, transporting and storing paper currency can be substantially reduced.

- The need for inter-bank settlement would disappear as it would be a central bank liability handed over from one person to another.

Significance of CBDC over cryptocurrency:

- overeign guarantee: Cryptocurrencies pose risks to consumers. They do not have any sovereign guarantee and hence are not legal tender.

- Market volatility: Their speculative nature also makes them highly volatile. For instance, the value of Bitcoin fell from USD 20,000 in December 2017 to USD 3,800 in November 2018.

- Risk in security: A user loses access to their cryptocurrency if they lose their private key (unlike traditional digital banking accounts, this password cannot be reset).

- Malware threats: In some cases, these private keys are stored by technical service providers (cryptocurrency exchanges or wallets), which are prone to malware or hacking.

- Money laundering: Cryptocurrencies are more vulnerable to criminal activity and money laundering. They provide greater anonymity than other payment methods since the public keys engaging in a transaction cannot be directly linked to an individual.

- Regulatory bypass: A central bank cannot regulate the supply of cryptocurrencies in the economy. This could pose a risk to the financial stability of the country if their use becomes widespread.

- Power consumption: Since validating transactions is energy-intensive, it may have adverse consequences for the country’s energy security (the total electricity use of bitcoin mining, in 2018, was equivalent to that of mid-sized economies such as Switzerland).

SC Garg Committee recommendations (2019):

- Ban anybody who mines, hold, transact or deal with cryptocurrencies in any form.

- It recommend a jail term of one to 10 years for exchange or trading in digital currency.

- It proposed a monetary penalty of up to three times the loss caused to the exchequer or gains made by the cryptocurrency user whichever is higher.

- However, the panel said that the government should keep an open mind on the potential issuance of cryptocurrencies by the Reserve Bank of India.

Challenges with CBDC:

- Some key issues under RBI's examination include, the scope of CBDCs, the underlying technology, the validation mechanism and distribution architecture.

- Also, legal changes would be necessary as the current provisions have been made keeping in mind currency in a physical form under the Reserve Bank of India Ac

- Consequential amendments would also be required in the Coinage Act, Foreign Exchange Management Act (FEMA) and Information Technology Act.

- Sudden flight of money from a bank under stress is another point of concern.

Way forward:

- The launch of CBDCs may not be a smooth affair and still requires more clarity in India. There are still a lot of misconceptions about the concept of digital currency in the country.

- The effectiveness of CBDCs will depend on aspects such as privacy design and programmability.

- There is a huge opportunity for India to take a lead globally via a large-scale rollout and adoption of digital currencies.

1.png)