Description

Disclaimer: Copyright infringement not intended.

Context

- The issue of circular trading could be taken up by the Goods and Services Tax (GST) Council in its upcoming meeting.

What is Circular Trading?

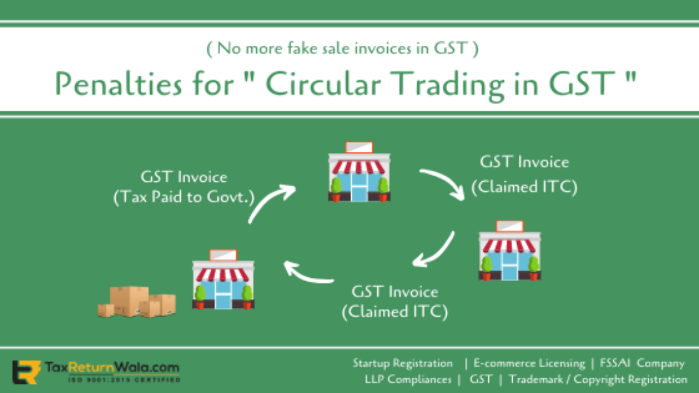

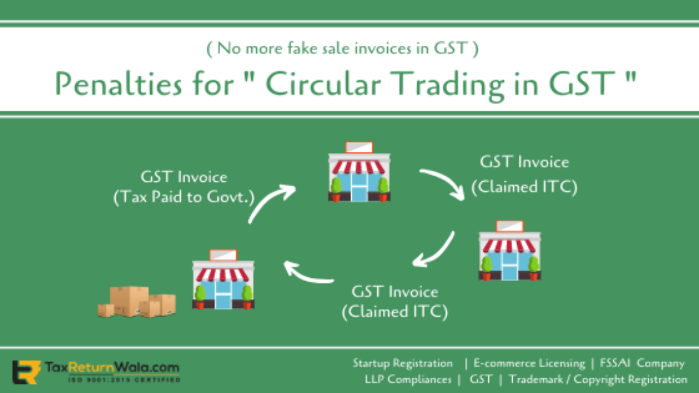

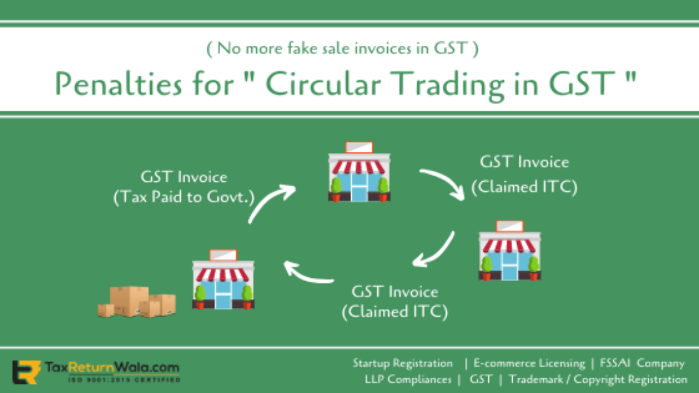

- Circular trading refers to fraudulently availing input tax credit by traders by issuing of invoices without availing any real goods or service.

Example of circular trading

- Suppose M/s. A, M/s. B and M/s. C is close group companies being engaged in circular trading. M/s. A issues sales invoice to M/s. B amounting to INR 2,00,000, wherein, GST tax amounts to INR 20,000. Please note, here only sales invoice is raised, and there is actually no movement of goods.

- M/s. B issues sales invoice (of the same goods) to M/s. C amounting to INR 1,50,000, wherein, GST tax amounts to INR 15,000. Here also only sales invoice is raised, without actual movement of goods. In this transaction, M/s. B has availed Input tax credit of INR 20,000 and paid only INR 15,000, meaning thereby that M/s. B will carry forward Input tax credit of INR 5,000.

- M/s. C issues sales invoice (of the same goods) to M/s. A amounting to INR 1,25,000, wherein, GST amounts to INR 12,500. Here also the only invoice is raised, without actual movement of goods. In this transaction, M/s. C has availed Input tax credit of INR 15,000 and paid only INR 12,500, meaning thereby that M/s. C will carry forward Input tax credit of INR 2,500.

.jpg)

The objective of circular trading

- After understanding the circular trading, it is more important to understand the objective, i.e. purpose of circular trading. The main objective of circular trading is inflating turnover of the business. However, through circular trading, companies may also aim to:

- To increase the valuation of the company/business;

- To benefit higher loans from the Banks or Non-Banking Financial Corporation (NBFC);

- To bring black money into the system;

- To avail fake input tax credit.

Circular Trading: It’s ill- effects

- This type of cycle basically creates a huge financial impact on companies’ accounts. This approach of fraud helps companies to inflate their turnover, gain larger loans from financial institutions or banks and also avail GST credits on every lap of transactions done, ultimately raising the black money.

Issue

- The issue has been a bone of contention and while the Central Board of Indirect Taxes and Customs had earlier this year issued a clarification, there continue to be pending court cases.

- Recently, the Bombay High Court had also issued a show cause notice to the Maharashtra GST department for arresting a person for alleged circular trading.

Tax Experts on Circular trading

- Tax experts believe that there is need to provide clarity on the issue of arrests for circular trading.“The CBIC has already issued a circular that circular trading is not a case of tax evasion and so arrests should not be made. However, detention in these cases continue.

Consequence of Circular Trading in India

- Since the provision of GST for circular trading are very harsh and are covered under serious offense as non-bailable and cognizable offense, where a police department has the authority to arrest without a warrant and can begin an investigation without any permission of a court if the amount surpasses beyond INR 5 Crs.

.jpg)

Conclusion

- In the absences of the clear-cut definition of circular trading there is lot of confusion in the trade and industry.

- The government (GST Council) should come out with the clear policy, FAQs and DO and DON’T as when the transactions are to be treated as Circular Trading.

- When there are no clear guidelines on Circular Trading , the harsh provisions of imprisonment cannot be left at the discretionary of the GST officers, which has a very big and direct impact on the reputation of the businessman in particular and the business community at large, and such provisions should be either diluted or deleted from the act.

https://www.financialexpress.com/economy/gst-council-to-discuss-circular-trading-de-criminalisation/2904937/

.jpg)