DAILY NEWS ANALYSIS 05 MAY

ECONOMY

COVID-19 and India’s fiscal conundrum

Projected Growth rate after Covid 19:

- Growth forecast for 2020 slashed by the International Monetary Fund (IMF) to 1.9% from the previously estimated 5.8%.

- In April, the World Bank estimated that India would grow 1.5% to 2.8% in 2020-2021.

Fiscal Stimulus efforts:

- RBI has granted regulatory forbearance relating to asset classification to support economic activity.

- Indian government has provided fiscal stimulus of 1.7 trillion rupees.

- The Asian Development Bank and the World Bank have committed to offering relief packages worth $1.5 billion and $1 billion, respectively, to India.

Relief Packages in Asia:

- Financing through Bonds: Most advanced economies can manage such financing by issuing bonds given their global demand.

- Loan from IMF: Over 50 struggling low-income countries with limited resources to tackle the crisis have turned to the IMF for help.

- Debt relief: The G7 countries have agreed to offer debt relief to low-income countries by suspending their debt service payments.

Challenges and Financing of Fiscal relief in India:

- Such assistance can at best only be supplementary to the larger underlying stimulus package that India may need to roll out.

- India has limited fiscal space to roll out the fiscal stimulus as government debt hovers around 72% of GDP, which is comparatively higher than all other emerging markets in the region.

- Aggressive stimulus will result into higher public debt. It will also negatively impact India’s credit ratings.

- There is a limited demand for Indian bonds.

- There is a heightened risk aversion among foreign investors and short-term capital outflows from India.

- India has the least state capacity to make tough decisions to return to a trajectory of fiscal credibility.

Way Forward:

- Country’s $476 billion of foreign exchange (FX) reserves be used towards this purpose.

- To monetize the deficits by allowing the RBI to print money to buy the government bonds as long as inflation remains under check.

- Start re-prioritising expenditures away from low-priority, unproductive areas towards greater spending on health and social safety nets for low-income households.

Reference: https://www.thehindu.com/opinion/op-ed/covid-19-and-indias-fiscal-conundrum/article31504085.ece

Explained: Why liquor matters to states

Context:

- There have been long queues outside the liquor store following the relaxations after lockdown 3.0

- The Delhi government has announced 70% Corona fee.

- Liquor contributes a considerable amount to the exchequers of all states and Union Territories except Gujarat and Bihar, both of which have enforced prohibition.

- Generally, states levy excise duty on manufacture and sale of liquor.

- States also charge special fees on imported foreign liquor; transport fee; and label & brand registration charges.

- A few states, such as Uttar Pradesh, have imposed a “special duty on liquor” to collect funds for special purposes, such as maintenance of stray cattle.

Collection of revenue:

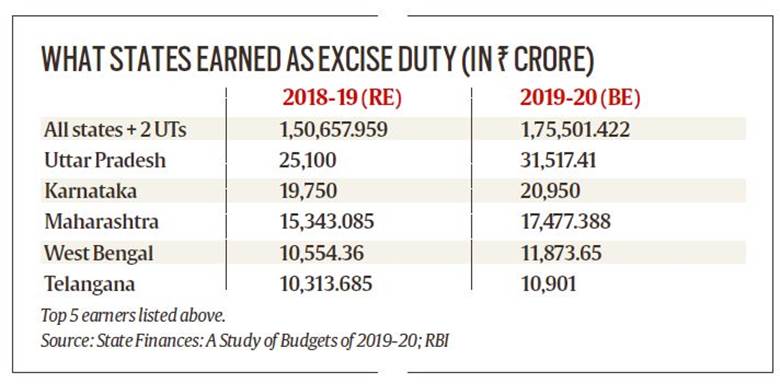

- The RBI report shows that during 2019-20, the 29 states and the UTs of Delhi and Puducherry had budgeted a combined Rs 1, 75,501.42 crores from state excise on liquor.

- On an average, the states collected about Rs 12,500 crores per month from excise on liquor in 2018-19, which rose to about Rs 15,000 crores per month in 2019-20.

Sources of Revenue for states:

- The states’ revenues comprise broadly two categories — Tax Revenue and Non-Tax Revenue.

- Tax revenue is divided into two further categories: State’s Own Tax Revenue and Share in Central Taxes.

Own Tax Revenue comprises three principal sources:

- Taxes on Income (agricultural income tax and taxes on professions, trades, callings and employment);

- Taxes on Property and Capital Transactions (land revenue, stamps and registration fees, urban immovable property tax);

- Taxes on Commodities and Services

RBI Report:

- Share of State GST: 43.5%

- Sales tax especially on Petroleum products: 23.5%

- State excise at 12.5%,

- Taxes on property and capital transactions at 11.3%.

SOCIETY

A grain stockiest with a role still relevant

About FCI:

- It was set up under the Food Corporations Act 1964.

- In its first decade, the FCI was at the forefront of India’s quest of self-sufficiency in rice and wheat.

- It helped in managing procurement and stocking grain that supported a vast Public Distribution System (PDS) after green revolution.

Challenges to FCI:

- Its operations were regarded as expensive and inefficient.

- Poor storage conditions meant a lot of grain was lost to pests, mainly rats;

- Diversion of grain was widespread.

- By the late 1990s, the FCI was often referred to as the “Food Corruption of India”.

- The FCI is overwhelmingly reliant on rail, which has several advantages over road transport.

- FCI is having massive debt closer to 2.25 trillion rupees in the form of national small saving fund loan.

- Extended food distribution of subsidized grain leads to depression of local prices thus negatively affecting farmers.

- Cost of food subsidy is continuously rising affecting long term survivability of FCI.

Role of FCI:

- The FCI has consistently maintained the PDS, a lifeline for vulnerable millions across the country.

- It holds the key to warding off a looming crisis of hunger and starvation especially after Covid 19 pandemic.

- As of April 13, 2020, the FCI had already moved 3 million tonnes (post-lockdown), to States, including Uttar Pradesh, Bihar, West Bengal and Karnataka and those in the Northeast, where demand outstrips within State procurement and/or stocks.

- The FCI has also enabled purchases by States and non-governmental organisations directly from FCI depots, doing away with e-auctions typically conducted for the Open Market Sale Scheme (OMSS).

- With passenger rail and road traffic suspended, grain can move quickly without bottlenecks.

- The FCI already has a decentralised network of godowns.

Way Forward:

- It would be useful for the State government and the FCI to maintain stocks at block headquarters or Panchayats in food insecure or remote areas, in small hermetic silos or containers.

- There is a strong case for the central government to look beyond the PDS and the Pradhan Mantri Garib Kalyan Yojana and release stocks over and above existing allocations, but at its own expenses rather than by transferring the fiscal burden to States.

- In many States, there is a vibrant network of self-help groups formed under the National Rural Livelihoods Mission (NRLM) which can be tasked with last mile distribution of food aid other than the PDS.

- Rather than undertaking FIFO strategy (First In, First Out), FCI must undertake strategy which has least cost and time.

- FCI and NAFED must together work with Farmers produce organization to provide direct marketing logistics for the farmers. It will ensure less economic burden on states and better income realization for farmers.

- FCI must move forward with other commodities like distributing seeds, fertilisers and packaging materials to ensure safety of grains.

- FCI should implement the Shanta Kumar Committee report and must become an agency for innovations in food management system.

SC to hear PIL on food security for all

About PIL:

- Seeking universal coverage under the Public Distribution System and food security for all amid an “acute food shortage” due to the ongoing nationwide lockdown.

- Sought relaxations in the requirement of ration cards for supply of rations under the Public Distribution System during the COVID-19 pandemic in order to help mitigate the food shortages and prevent deaths of the poor.

- There have been numerous deaths due to starvation since the commencement of the lockdown.

- There are many marginalised sections of people who are not covered under the National Food Security Act and in dire need of rations.

Earlier Court ruling:

- In the 2016 judgement, the SC had ruled that “it would be inappropriate for the State Governments to deprive any household in drought affected areas of the requisite food grains merely because they do not have a ration card”.

- The apex court had held that the ration card could be substituted by a valid identity card or any proof of residence.

POLITY.

MPLADS, its suspension, and why it must go

Context:

- Recently, government has suspended MPLAD scheme for next two years and will utilize its money to deal with the pandemic.

- Opposition has been vocal about criticism of it.

About MPLAD scheme:

- MPLAD is a central government scheme, under which MPs can recommend development programmes involving spending of Rs 5 crores every year in their respective constituencies.

- MPs from both Lok Sabha and Rajya Sabha, including nominated ones, can do so.

- States have their version of this scheme with varying amounts per MLA.

- Suspension of the MPLAD Scheme will make Rs 7,800 crores available to the government.

- Prime Minister P V Narasimha Rao announced the scheme on December 23, 1993 in Lok Sabha.

Working of the Scheme:

- MPs and MLAs do not receive any money under these schemes.

- The government transfers it directly to the respective local authorities.

- The legislators can only recommend works in their constituencies based on a set of guidelines.

- For the MPLAD Scheme, the guidelines focus on the creation of durable community assets like roads, school buildings etc. Recommendations for non-durable assets can be made only under limited circumstances.

Evaluation of the Scheme:

- The entire population across the country stands to benefit through the creation of durable assets of locally felt needs, namely drinking water, education, public health, sanitation and roads etc. under MPLAD Scheme.

- Until 2017, nearly 19 lakh projects worth Rs 45,000 crores had been sanctioned under the MPLAD Scheme.

- Third-party evaluators appointed by the government reported that the creation of good quality assets had a “positive impact on the local economy, social fabric and feasible environment”.

Criticism of the Scheme:

1. The scheme violates the principle of Separation of power, which is the foundation of democracy.

2. CAG Report Findings:

- CAG in its report mentioned that expenditure incurred has been less than the booked amount.

- Utilisation of funds between 49 to 90% of the booked amount.

- 549 of the 707 works test-checked (78%) of the works recommended were for improvement of existing assets;

- Use of lesser quantities of material than specified by contractors resulting in excess payments and sub-standard works;

- No accountability for the expenditure in terms of the quality and quantities executed against specifications”;

- Delays in issuing work orders ranging from 5 to 387 days in 57% of the works against the requirement of issuing the work order within 45 days of the receipt of recommendation by the MP;

- Extensions of time granted to contractors without following the correct procedure;

- Register of assets created, as required under the scheme, not maintained, therefore location and existence of assets could not be verified;

- Failure of internal control mechanisms in the department in terms of non-maintenance of records”.

3. Utilisation gap:

- There are wide variations in the utilisation of the MPLAD amount in various constituencies.

Indiaspend report:

- 508 MPs (93.55%) did not, or could not, utilise the entire MPLADS amount from May 4, 2014 till December 10, 2018, in 4 years and 7 months.

- Though ₹1,757 crores had been released for MPLADs, only ₹281 crores had been utilised by all the 543 MPs till May 15, 2015.

- Since the MPLADS began in 1993, ₹5,000 crores was lying unspent with various district authorities by May 15, 2015.

4. Money under MPLADS being used to appease or oblige two sets of people: opinion-makers or opinion-influencers, and favourite contractors.

Supreme Court verdict:

- Supreme Court had held it constitutional in 2010.

Conclusion:

- There has been varying gap in the implementation of MPLAD scheme.

- It has led to huge diversion of resources with clear biasness towards favoritism. Thus, the scheme should be disbanded altogether.

Reference: https://www.thehindu.com/opinion/lead/mplads-its-suspension-and-why-it-must-go/article31504548.ece

HEALTH

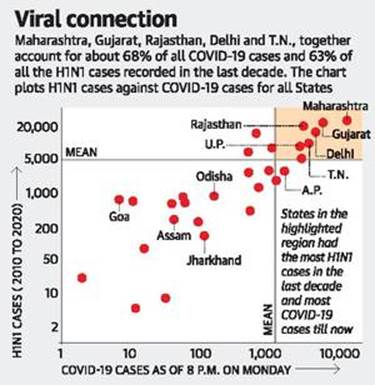

States with high swine flu rate record most COVID-19 cases

Data from the Health Ministry’s National Centre for Disease Control (NCDC): Five States — Maharashtra, Gujarat, Rajasthan, Delhi, Tamil Nadu — account for about 70% of India’s confirmed COVID-19 cases. Also, these States consistently accounted for the bulk of swine flu cases, or seasonal influenza (H1N1) since 2015.

About Swine Flu (H1N1):

- Swine flu is an infection caused by a virus.

- It's named for a virus that pigs can get.

- People do not normally get swine flu, but human infections can and do happen.

- In 2009 a strain of swine flu called H1N1 infected many people around the world.

About National Centre for Disease Control (NCDC):

- National Centre for Disease Control (NCDC; previously known as National Institute of Communicable Diseases) is an institute under the Indian Directorate General of Health Services, Ministry of Health and Family Welfare.

- It was established in July 1963 for research in epidemiology and control of communicable diseases and to reorganize the activities of the Malaria Institute of India (MII).

- The Institute was envisaged to act as a centre par excellence for providing multi disciplinary and integrated expertise in the control of communicable disease.

INTERNATIONAL

India flays nod for Gilgit-Baltistan polls

Context:

- Pakistan Supreme Court allowed Pakistan government to conduct polls in the region of Gilgit-Baltistan of Pakistan-occupied Kashmir (PoK).

- India has registered strong protest.

Indian Protest:

- It is Pakistan’s attempt to make “material changes” to the disputed area, by bringing federal authority to Gilgit-Baltistan (G-B), which has functioned as a “provincial autonomous region” since 2009.

- The Government of Pakistan or its judiciary has no locus standi on territories illegally and forcibly occupied by it.

- India completely rejects such actions and continued attempts to bring material changes in Pakistan-occupied areas of the Indian territory of Jammu & Kashmir.

- Instead, Pakistan should immediately vacate all areas under its illegal occupation.

- India’s reaction is consistent with its previous objections against elections in G-B and in other parts of PoK, which it refers to as “Azad Jammu Kashmir”.

About PoK and Gilgit Baltistan:

- Pakistan Occupied Kashmir is an area of 13,297 sq km, which was under the control of the Pakistani forces when the ceasefire line came into effect on January 1, 1949.

- PoK is divided into 10 districts: Neelum, Muzaffarabad, Hattian Bala, Bagh, and Haveli bordering areas in Kashmir, and Rawlakot, Kotli, Mirpur, and Bhimber bordering areas in Jammu.

- The capital of PoK is Muzaffarabad, a town located in the valley of the Jhelum River.

- In 1963, through an agreement, Pakistan ceded to China over 5,000 sq km of J&K land under its control, in the Shaksgam area.

- Gilgit Baltistan (GB) is spread over 72,871 sq km, and is five-and-a-half times the size of PoK.

- GB is divided into three administrative divisions and 10 districts. Gilgit, Hunza, Ghizer and Nagar are in the Gilgit administrative division.

PM slams Pakistan in virtual NAM meeting

Prime Minister Narendra Modi made an indirect reference to Pakistan during an online meeting of the Non-Aligned Movement (NAM) Contact Group.

PM comment:

- Some countries were fomenting terrorism in the midst of the global pandemic.

- He supported a more representative post-COVID-19 world order.

- He urged the World Health Organization (WHO) to focus on building health capacity in the developing countries.

- The comment also takes a dig at Pakistan’s alleged role in the ongoing social media spat between Indian and Gulf-based commentators.

About NAM:

- The Non-Aligned Movement (NAM) is an international organization (group of countries) who do not want to be officially aligned with or against any major power bloc (group of countries).

- In 2018, the movement had 125 members and 25 observer countries.

- The group was started in Belgrade in 1961. It was created by Yugoslavia's President, Josip Broz Tito, India's first Prime Minister, Jawaharlal Nehru, Egypt's second President, Gamal Abdel Nasser, Ghana's first president Kwame Nkrumah, and Indonesia's first President, Sukarno.

- All five leaders believed that developing countries should not help either the Western or Eastern blocs in the Cold War.

- They also believed that developing countries should not be capitalist or communist, but should try to find a different way to help their people.

- The Havana Declaration of 1979 said that the purpose of the organization is to help countries keep their "the national independence, sovereignty, territorial integrity and security of non-aligned countries.

1.png)