DAILY NEWS ANALYSIS 15 MAY

EDITORIALS

States cannot be left to the Centre’s mercy

- The Maharashtra government too decided to permit liquor shops to open but was quickly forced to reverse its decision in some parts of the State following protests.

- Similar protests against the sale of alcohol were seen in various States.

- This may be largely due to fears of crowding and the consequent spread of COVID-19 rather than about alcoholism and its potentially deleterious societal impact. Then, why are state governments opening up the liquor shops?

A triple blow

- Financially broke State governments are forced to adopt desperate and reviled measures such as opening liquor shops to mobilise money for their fight against COVID-19

- All the States have come together like “pearls on a string” in the “spirit of cooperative federalism” for the economic integration of India in GST. What was not mentioned was that the States on that “pearl string” were now stuck to the Centre’s neck forever.

- GST forced the States to surrender their powers to raise resources independently through local State taxes and place them entirely at the mercy of the Centre for most of their financial needs.

- For richer States such as Maharashtra, Tamil Nadu, Gujarat, Delhi, Karnataka, Punjab, Haryana and Kerala, 70% or more of their revenue comes from taxes generated within their State boundaries.

- Nearly half of these were from the sale of goods and services within the State and the remaining half, from a combination of excise duties on petrol, electricity, alcohol, land registration fees, etc.

- Before GST, States were free to charge sales taxes as legislated by their State legislatures. If a State had a natural disaster, they could raise additional resources for rehabilitation by raising sales tax rates on goods and services.

- For the sake of GST, States sacrificed their fiscal powers in the promise of ‘economic efficiency’ and ‘tax buoyancy’, which never materialised.

- Under GST, States are legally entitled to their share of tax revenues collected in their State.

- But they are now reliant on the Centre to release these funds to them periodically.

- When the GST was enacted, States were also guaranteed a minimum tax revenue every year for a period of five years. In the midst of the current pandemic, the Centre has reneged on both these promises.

Acting as triple blow:

States are not being paid what they are owed,

- They are not being helped with additional resources,

- They are bearing the brunt of the pandemic’s impact.

- They have also lost the powers to raise their own sales tax revenues. So, how are they supposed to fight this health calamity with no money?

Other Options:

- The other available options for States to raise funds are through taxes on sale of petroleum products, alcohol, lottery tickets, electricity, and land or vehicle registration.

- During this extreme lockdown, demand for petroleum products, electricity, land and vehicles has dwindled substantially.

- So, the only option left for most States is to raise funds through the sale of alcohol.

- For the large, richer States, alcohol sales account for more than one-third of their State tax revenues.

Borrowing for States:

- In order to borrow money, states need the Centre’s approval to raise their borrowing limit or to stand as guarantors.

- Since, States do not have clear revenue visibility, the rates at which they can borrow are very high and their ability to borrow is severely undermined.

- They are once again dependent on the Centre to borrow funds from the market and then release them to the States.

Working in Pre-GST era:

- States would have had the funds raised through sales taxes to themselves and not be at the Centre’s mercy to release funds.

- States would have raised taxes on select essential goods sold in their States (say, mangoes or coconut oil) in accordance with their norms.

- As it is clear that COVID-19 has to be fought in a decentralised manner at the local level and not through a Delhi diktat, the resources needed to fight this disease should also be raised locally and not be dependent on Delhi’s whimsical magnanimity.

Conclusion:

- Former Finance Minister Arun Jaitley’s catchphrase “cooperative federalism” has proved to be neither cooperative nor federalist in times of this crisis.

- The idea of ‘one nation, one tax’ is deeply flawed in an economically and politically divergent India.

- Ruling parties and alliances in States can change every five years.

- The efficient functioning of a GST regime cannot be beholden to political party affiliations at the Centre and the States.

- Democratically elected State governments cannot be expected to govern with no fiscal powers.

- Five States account for half of all GST collections in the country. It is time these bigger States challenge the very idea of GST.

Reference: https://www.thehindu.com/opinion/lead/states-cannot-be-left-to-the-centres-mercy/article31585516.ece

Are India’s labour laws too restrictive?

Context:

Some State governments including Uttar Pradesh (U.P.) and Madhya Pradesh (M.P.) have proposed ordinances to exempt manufacturing establishments from the purview of most labour laws.

Justification of Ordinance:

- The Constitution provides a number of basic rights, and, under the directive principles of state policy, a number of assurances. Changes potentially will hurt, will dis-enable the realisation of the constitutional objectives.

- The facility of the concurrent subject has been abused.

- States have exploited the weakened conditions of the trade unions in this pandemic.

Rigidity in our laws:

- The World Bank survey, 2014, asked employers... and the employers did not rate labour law regulations as [among] the top five or seven or 10 irritants.

- For employers, the availability of skilled workforce and cooperative labour-management relations were far more important than flexible labour laws.

- Employers will not benefit from these laws because these provisions will hurt labour welfare and thereby labour efficiency.

- India is a labor surplus country and majority of them are at the bottom of the rung. It is the responsibility of state government to protect their interest.

- Dilution of labor laws will make working conditions worse, and life worse for workers.

- Macro policies, industrial policies, trade policies govern the climate of job creation, in addition to the overall health of the economy. If none of that is in place, a simple tweaking of the labour laws basically worsens working conditions and doesn’t achieve much else.

Issue of lack of flexibility in labor laws:

- At the lower end of the manufacturing spectrum, the labour laws have been arbitrarily and extortionately imposed.

- Bribes can be extracted in the name of labour laws not being covered, making life difficult for employers, which creates incentives for them to double book, keep workers off the books.

- We cannot extend it to the entire manufacturing sector, to vastly productive industries, to large-scale manufacturing, where we know that the labour share of income has been precipitously declining, productivity has been rising.

Issue of Industry asking Centre to mandate the labor to return or face penal actions:

- The state and the employers could ask the employees to report for work, only if three conditions are met.

- There must be enabling conditions like resumption of public transportation or private provision of transportation by the employers.

- COVID SOPs [must be] effectively implemented at the workplace because the workers could withdraw from a potentially hazardous workplace.

- Third, there must be work.

- If these three conditions are satisfied and still the workers do not report, action can be taken against them, as per the company rules or agreements or the standing orders under the Industrial Employment Standing Orders Act, 1946.

About making a more attractive destination than China:

- It is ironic in a way in the globalisation period, that countries compete on low wages, and primarily on that sort of labour element, particularly the labour-surplus countries.

- Almost always, the overall business climate, the reliability of the state and its policies, the infrastructural situation, electricity supply, logistics and transport, the quality of labour and the skill of labour, human capital issues.

Future for labor force:

- The responsibility actually lies squarely on the government to restore some health to the labour market.

- In the immediate term, there is a necessity for the government to come out with a fairly strong fiscal package that creates optimistic conditions by providing employment to people, something that tightens the labour market a little bit, puts money in people’s pockets, and creates demand in the economy.

- The private investment then will follow as it usually does.

About Different labor laws:

- The Factories Act lays down eight-hour work shifts, with overtime wages, weekly offs, leave with wages and measures for health, hygiene and safety.

- The Industrial Disputes Act provides for workers participation to resolve wage and other disputes through negotiations so that strikes/lockouts, unjust retrenchments and dismissals are avoided.

- The Minimum Wages Act ensures wages below which it is not possible to subsist.

- These enactments further the Directive Principles of State Policy and protect the right to life and the right against exploitation under Articles 21 and 23.

- Section 5 of the Factories Act empowers the State governments to exempt only in case of a “public emergency”, which is explained as a “grave emergency whereby the security of India or any part of the territory thereof is threatened, whether by war or external aggression or internal disturbance”. There is no such threat to the security of India now.

Reference: https://www.thehindu.com/opinion/op-ed/are-indias-labour-laws-too-restrictive/article31585617.ece

One for the poor: On Centre’s corona package

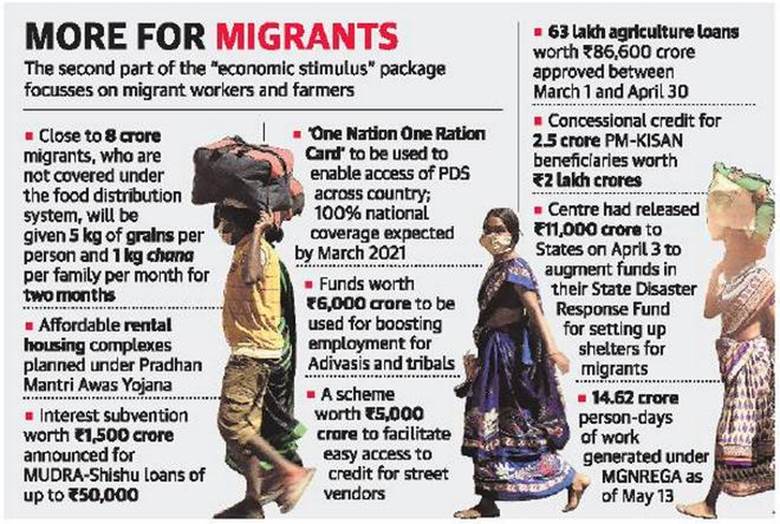

- In the second of a series of measures that are part of a ₹20 lakh crores economic package, Union Finance Minister Nirmala Sitharaman has tried to address the needs of these sections, apart from small farmers.

- She has recognised that migrant workers have taken to the Mahatma Gandhi National Rural Employment Guarantee Scheme in a major way after the Centre gave explicit instructions to reopen the scheme.

- This remains a lifesaver for people dependent on fragile livelihoods, and the decision to extend it to the monsoon season is welcome.

- The government should also ensure that wages are paid without delays, a major problem with the scheme’s implementation lately.

- A waiver or at least an extension of the 100-day limit per household too would have helped.

- It is now up to the States to ensure the scheme is implemented properly.

- For migrants who are still stationed in their places of work and who are not beneficiaries of the National Food Security Act or State schemes, the Finance Minister has promised 5 kg of food grains per person and 1 kg of channa per family per month for two months.

- This will bring the number of people receiving subsidised foodgrains close to the legal requirement of the National Food Security Act (67% of the population).

- But the government could have extended the Public Distribution System coverage to include more people who are suffering from loss of jobs and livelihoods, besides migrant workers.

- Ms. Sitharaman also announced that the ‘one nation, one ration card’ scheme to allow migrants access any fair price shop across the country will be implemented by March 2021

- Many of the announcements, including one for small farmers, are a combination of liquidity and credit-easing measures or the extension of existing schemes.

- As things stand, they fall short of the substantive fiscal measures that could stimulate demand in the economy.

SOCIETY

Migrants to get free food grains

- Provide free food grains for the next two months to migrant workers who do not have ration cards.

- The Centre will spend Rs. 3,500 crores for this purpose.

- There were an estimated eight crores migrant workers who had been housed in government- and privately run relief camps across the country since the lockdown.

-An extension of credit facilities for urban housing, street vendors and farmers and an interest subvention scheme for small businesses.

- The move to provide free food grain for migrant workers is an extension of the Pradhan Mantri Garib Kalyan Yojana, announced on March 27, which provided an additional monthly free rice or wheat allocation of 5 kg per person, and 1 kg of pulse per household from April to June to the 80 crores people with ration cards covered by the National Food Security Act (NFSA).

- By August 2020, the ration card portability scheme will allow 67 crores NFSA beneficiaries in 23 connected States to use their cards at any ration shop anywhere in the country, allowing migrant workers to access subsidised food away from their home villages.

- The scheme would cover all beneficiaries by March 2021.

Reference: https://www.thehindu.com/todays-paper/migrants-to-get-free-foodgrains/article31587382.ece

India reminds China of claims over Gilgit-Baltistan

Indian Statement:

- The recent incidents of face-off between the troops of India and China are neither correlated nor have any connection with other global or local activities.

- Reminded China about India’s claims over Gilgit-Baltistan where China has teamed up with Pakistan to build the Diamer-Bhasha dam.

About Diamer-Bhasha dam:

- Diamer-Bhasha Dam is a concreted-filled gravity dam, in the preliminary stages of construction, on the River Indus between Kohistan district in Khyber Pakhtunkhwa and Diamer district in Gilgit-Baltistan, Pakistan.

- Its foundation stone was laid by the then Prime Minister of Pakistan on 1998.

- The eight Million Acre Feet (MAF) reservoir with 272-metre height will be the tallest roller compact concrete (RCC) dam in the world.

About Gilgit-Baltistan:

- Gilgit-Baltistan (GB) is spread over 72,871 sq km, and is five-and-a-half times the size of PoK.

- GB is divided into three administrative divisions and 10 districts. Gilgit, Hunza, Ghizer and Nagar are in the Gilgit administrative division.

ECONOMY

₹90,000-crore ‘power backup’ will help ease liquidity pressure on discoms

-The Centre’s decision to provide ₹90,000 crores liquidity injection for the funds-starved electricity distribution companies (Discoms) is likely to ease the liquidity pressure in the Indian power sector.

- This will help generators to clear their bank dues, and purchase coal to supply power. This wound ensure continuity of uninterrupted power supply.

- The loan will be provided against the ₹94,000 crores receivables of the discoms and will be secured against receivables, and additionally guaranteed by the respective state governments.

- The loan tenure would be of 7-10 years with a moratorium of two years.

1.png)