DAILY NEWS ANALYSIS 19 MAY

EDITORIALS

A jolt to national energy security

Issues with amendment of electricity act 2003:

- Erosion of concurrent status of electricity in constitution. Weaken the control of states over electricity ,which has become human necessity.

- Choke the distribution utilities/companies (DISCOM) and jeopardise the country’s energy security.

DISCOM troubles

- Centralisation of control over the sector has driven up the cost of power purchase to 80% of the total costs of State DISCOMs.

Issue of two part tariff policy:

- DISCOMs were required to sign long-term power purchase agreements (PPA) with private players , committing to pay a fixed cost to the power generator, irrespective of whether the State draws the power or not, and a variable charge for fuel when it does.

- The PPAs signed by DISCOMs were based on over-optimistic projection of power demand estimated by the Central Electricity Authority (CEA), a central agency.

- The 18th Electric Power Survey (EPS) overestimated peak electricity demand for 2019-2020 by 70 GW.

- NTPC Limited’s Kudgi, in Karnataka, alone received Rs. 4,800 crore as idle fixed costs during 2018-19, operating at a plant load factor of only 22%.

- Due to the CEA’s overestimates, the all-India plant load factor of coal power plants is at an abysmal 56% even before COVID-19.

Factor of renewable energy

- Must run status of renewable energy required DISCOMs to absorb all renewable power in excess of mandatory renewable purchase obligations.

- This means backing down thermal generation to accommodate all available green power, entailing further idle fixed costs payable on account of two-part tariff PPAs.

Second factor:

- Power demand peaks after sunset.

- In the absence of viable storage, every megawatt of renewable power requires twice as much spinning reserves to keep lights on after sunset.

- Third, in 2015 the Centre announced an ambitious target of 175 gigawatts of renewable power by 2022, offering a slew of concessions to renewable energy developers, and aggravating the burden of DISCOMs.

- Incidentally, China benefited by as much as $13 billion in the last five years from India’s solar panel imports.

About Electricity Act 2020

1. The amendment proposes sub-franchisees, presumably private, in an attempt to usher in markets through the back door. Private sub-franchisees are likely to cherry-pick the more profitable segments of the DISCOM’s jurisdiction.

2. Proposes even greater concessions to renewable power developers, with its cascading impact on idling fixed charges, impacting the viability of DISCOMs even more.

3. Seeks to eliminate in one stroke, the cross-subsidies in retail power tariff.

4. State regulators will henceforth be appointed by a central selection committee, the composition of which inspires little confidence in its objectivity.

5. Establishment of a centralised Electricity Contract Enforcement Authority whose members and chairperson will again be selected by the central selection committee.

6. The power to adjudicate upon disputes relating to contracts will be taken away from State Electricity Regulatory Commissions and vested in this new authority, ostensibly to protect and foster the sanctity of contracts.

Criticism of bill:

1. Amendments are silent on whether a private sub-franchisee would be required to buy the expensive power (averaging out the idle fixed costs) from the DISCOM or procure cheaper power directly from power exchanges.

Affect of elimination of cross subsidy

2. Elimination of cross subsidy would make that each consumer category would be charged what it costs to service that category.

- Rural consumers requiring long lines and numerous step-down transformers and the attendant higher line losses will pay the steepest tariffs.

- Proposed amendments envisage that State governments will directly subsidise whichever category they want to, through direct benefit transfers.

- Eliminating cross subsidies in one stroke when State governments are already struggling with direct power subsidies is bound to be ruinous to their finances.

3. Appointment by central committee jeopardises not only regulatory autonomy and independence but also the concurrent status of the electricity sector.

4. Will ensure that States saddled with high-priced PPAs and idling fixed costs, yet forced to keep increasing the share of renewables in their basket, have no room for manoeuvre.

Public sector assets must be monetised to fund physical, social infrastructure

Debates on monetary policy and fiscal policy:

- Monetary policy has moved swiftly and aggressively in many economies but questions remain on its incremental efficacy.

- Concerns abound that highly risk-averse financial systems will thwart the efficacy of lower rates and higher liquidity.

- Fiscal policy can have much efficacy. But how much space does it have? There in lies the debate.

Fiscal Space in India:

-“Fiscal space” debate in India has centred exclusively on this year’s deficit and how it will be financed.

- How much will the deficit go up? How much can it go up? Who will absorb the extra issuance?

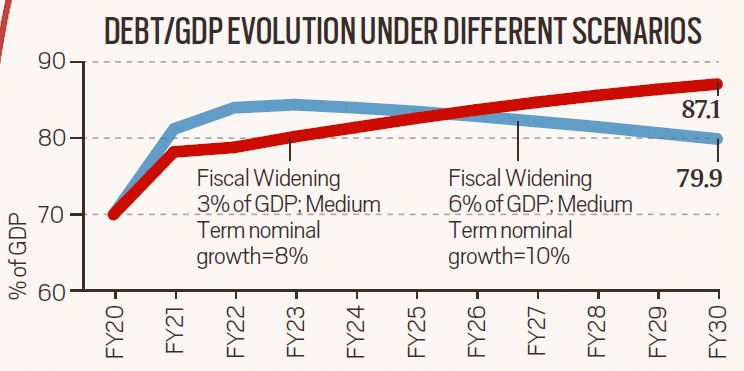

- Rating agencies concern is the government’s inter-temporal budget constraint and how India’s debt/GDP evolves in the coming years.

- How much will India’s debt/GDP jump up this year?

- Will debt/GDP keep rising year after year? Or will it start declining?

- As research has found, it’s typically the trajectory of debt/GDP — more than the level — that impacts future growth.

Evolution of debt:

The evolution of debt is essentially a function of three variables:

1. The primary deficit (fiscal deficit net of interest payments)

2. The relationship between nominal GDP growth and the government is cost of borrowing.

- The higher is the difference between growth and cost of borrowing, the greater is the depreciation of the existing debt stock.

Indian calculation:

- India comes into COVID-19 with a debt/GDP of about 70 per cent,

- A primary deficit across the Centre and states of about 2.5 per cent of GDP (including the Centre’s extra-budgetary resources) — based on the Revised Estimates for 2019-20

- A weighted average sovereign borrowing cost of about 7.5 per cent (on the stock of debt)

- An estimated pre-COVID nominal GDP growth of 7.5 per cent in 2019-20.

- In other words, the favourable gap between growth and borrowing costs had closed.

Calculations for the Current year

- Under relatively benign scenarios (nominal GDP growth of 4 per cent and a fiscal expansion of 3 per cent of GDP this year) India’s debt/GDP will balloon towards 80 per cent by the end of the year.

- But India will not be alone. Public debt is expected to balloon all over the world.

- Instead, what will matter for sustainability is the trajectory of debt thereafter. Does debt/GDP come down or keep going up in subsequent years?

Calculations for the future

- In turn, the subsequent trajectory depends overwhelmingly on medium-term growth. Consider this:

- Even if this year’s combined fiscal deficit widens by 6 per cent of GDP (but the primary deficit is then consolidated back to 2 per cent of GDP in 3 years) as long as nominal GDP is 10 per cent in the medium term (which corresponds to real GDP growth of 7 per cent), debt/GDP gets on to a constantly declining path after the third year.

- This suggests a bigger fiscal intervention is sustainable but only if medium-term growth prospects are lifted in tandem.

Alternative scenario

- If this year’s deficit widens by “just” 3 per cent of GDP but if medium-term nominal GDP growth settles at 8 per cent (that is, real GDP growth of 5 per cent), debt/GDP rises relentlessly for the next decade towards 90 per cent of GDP.

- It suggests that Small changes in medium-term growth have large implications for fiscal sustainability.

Main conclusion:

- The main takeaway: How much fiscal space India has to respond in the crisis year will depend crucially on what potential growth is likely to be in the coming years.

- The more that India’s policy response can preserve, protect and boost medium-term growth — both through the nature of the policy intervention this year and the accompanying reforms — the larger the fiscal response India can mount.

- The fiscal debate between “need” and “affordability” is endogenous.

- The medium-term sustainability of any fiscal package this year will depend on the nature of growth-enhancing interventions and reforms that accompany it.

Possible Interventions:

1. Policy must ensure that all viable enterprises can survive the pandemic. The government’s credit-guarantee scheme is, therefore, very important.

2. Higher potential growth is only feasible if the financial sector is able to fund it.

3. The government’s announcement on unshackling agriculture if carried through to its logical conclusion is potentially game-changing for farmers and will be a landmark reform for the sector. But reforms are a process, not an event.

4. As COVID-19 hastens the reorganisation of supply-chains within Asia, India must seize the moment to integrate into the Asian supply chain.

5. Revisit a Special Export Zone (SEZ) model (with the appropriate regulatory environment to avoid the pitfalls of the past) to help create discrete ecosystems within the country that enable globally-competitive export production?

6. India will not be able to fundamentally alter its growth potential without crucial investments in health and education. The government’s announcement to boost health spending is, therefore, very welcome.

7. Existing assets on the public sector balance sheet must be aggressively monetised to fund growth-enhancing investments in physical and social infrastructure. This will simultaneously take the pressure off the fiscal and financial sectors, and deliver a productivity-enhancing swap on the public sector balance sheet.

POLITY

‘Unknown sources funding parties’

Finding of the Association for democratic reforms report (ADR):

1. More than half of the income of 23 regional parties whose annual audit and contribution reports were analysed came from unknown sources in 2018-19.

2. A total of Rs. 481.27 crore or 54.32% of the parties’ income came from unknown sources.

3. Ninety per cent of the income from unknown sources was through electoral bonds.

J&K notifies rules for domicile certificates

Domicile rules:

1. Eligible non-locals can also apply for the certificate.

2. These rules provide a simple time-bound and transparent procedure for issuance of domicile certificates in such a manner that no category of person is put to any inconvenience.

3. There is a timeline of 15 days for issuance of certificates.

4. Domicile certificates have now been made a basic eligibility condition for appointment to any post under the Union Territory of J&K following the amendments in the previous Act.

5. All Permanent Resident Certificate holders and their children living outside J&K can apply for the certificates.

6. Kashmiri migrants living in or outside J&K can get domicile certificates by simply producing their Permanent Residence Certificate (PRC), ration card copy, voter card or any other valid document.

7. Bonafide migrants can apply with the Relief and Rehabilitation department by providing documents like electoral rolls of 1988, proof of registration as a migrant in any State in the country or any other valid document.

INTERNATIONAL NEWS

Call for WHO probe into virus origin

About WHO Probe:

- It aims to evaluate possible food and animal-related sources that could have led to the spread of the deadly pandemic.

- Informed sources said that given the growing number of co-sponsors, the likelihood of a vote on the motion was lessened.

- The language of the motion seeks to delve deep into the origin of the virus.

- It requests the Director General to identify the zoonotic source of the virus and the route of introduction to the human population, including the possible role of intermediate hosts.

- Calls for “impartial, independent and comprehensive” evaluation into the “WHO-coordinated international health response” to the COVID-19 pandemic.

Prelims Bits

Forest advisory committee:

1. It is an apex body tasked with adjudicating requests by the industry to raze forest land for commercial use.

2. It was set up under Forest conservation act 1980, hence is a statutory body.

3. FAC advises the ministry on any activity that requires the diversion of forestland for non-forest use.

4. It is just an advising body.

5. The FAC, with seven members — three of them independent — is headed by the director general of forest.

Etalin Hydro Electric Project

1. Hydro power project in Dibang valley district of Arunachal Pradesh.

Electoral Bonds:

1. Interest-free bearer bonds (like Promissory Notes) that can be purchased from specified branches of the State Bank of India in a designated 10-day window in every quarter of the financial year.

2. Allows individuals and domestic companies to present these bonds — issued in multiples of Rs 1,000, 10,000, 1 lakh, 10 lakh, and 1 crore — to political parties of their choice.

3. Buyers of the bonds have to submit full KYC details at the time of buying.

4. However, the beneficiary political party is not required to reveal the identity of the entity that has given it the bond(s).

Pinanga andamanensis

1. Rare Palm tree of Andaman

2. It is a critically endangered species.

3. Found in Mount Harriet National Park (endemic).

1.png)