DAILY NEWS ANALYSIS 21 FEBRUARY

SOCIETY

SC passes interim order on Mahadayi tribunal’s award

Court order:

- Allowed an application by the State of Karnataka to notify the Mahadayi Water Dispute Tribunal’s award.

Mahadayi water dispute tribunal:

- Mahadayi Water Tribunal under Interstate River Water Disputes Act has been constituted to decide the sharing of the Mandovi river waters by the riparian states.

- In August 2018, Mahadayi Water Tribunal verdict permitted Goa to use 24 tmcft (excluding the 9.395 tmcft prevailing uses), Karnataka to use 5.4 tmcft (including 3.9 tmcft for export outside the basin) and Maharashtra to use 1.33 tmcft for consumptive purposes.

- Karnataka approached the Supreme Court alleging injustice is done in allocation of water to the state.

About Mandovi river:

- The Mandovi and the Zuari are the two primary rivers in the state of Goa.

- The river has a length of 77 kilometres (48 miles), 29 kilometres (18 miles) in Karnataka and 52 kilometres (32 miles) in Goa.

- It originates from a cluster of 30 springs at Bhimgad in the Western Ghats in the Belagavi district of Karnataka.

- The river has total 2,032 km2 catchment area of which 1,580 km2, 375 km2 and 77 km2 catchment area are in Goa, Karnataka and Maharashtra respectively.

Constitutional Approach for Inter-state River water dispute:

- Entry 17 of State List deals with water i.e. water supply, irrigation, canal, drainage, embankments, and water storage and water power.

- Entry 56 of Union List empowers the Union Government for the regulation and development of inter-state rivers and river valleys to the extent declared by Parliament to be expedient in the public interest.

According to Article 262, in case of disputes relating to waters:

- Parliament may by law provide for the adjudication of any dispute or complaint with respect to the use, distribution or control of the waters of, or in, any inter-State river or river valley.

- Parliament may, by law provide that neither the Supreme Court nor any other court shall exercise jurisdiction in respect of any such dispute or complaint as mentioned above.

Parliament has enacted two laws according to Article 262:

- River Board Act, 1956: The objective of Boards is to advise on the inter-state basin to prepare development scheme and to prevent the emergence of conflicts. Till date, no river board as per above Act has been created.

- Inter-State Water Dispute Act, 1956:

- In case, if a particular state or states approach to Union Government for the constitution of the tribunal:

- Central Government should try to resolve the matter by consultation among the aggrieved states.

- In case, if it does not work, then it may constitute the tribunal.

Need to amend 1956 act:

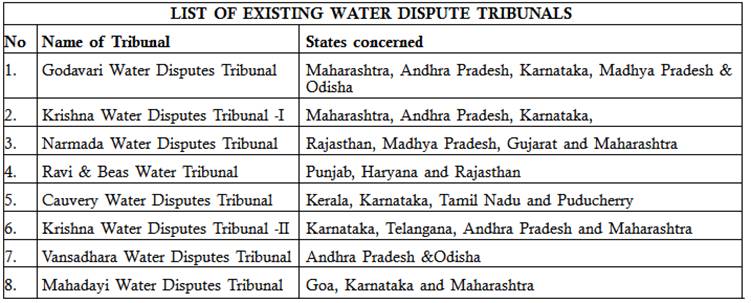

- There are dozens of tribunals for interstate water dispute resolution. It makes the process unwieldy and delayed.

- There are time delays from 6 years to 20 years in awarding the verdict.

- Low acceptance of the awards by the state: Only three out of eight awards have been accepted.

- There are tribunals for last 30 years like Cauvery tribunal, Ravi tribunal and hasn’t given any verdict.

- There has been delay in constituting the tribunals. It took nine years to constitute the Narmada tribunal.

- The River Boards Act 1956, which is supposed to facilitate inter-state collaboration over water resource development, remained a ‘dead letter’ since its enactment.

- There was no clarity in the tenure of tribunal members.

- Generally tribunal’s members were not specialist in areas.

- Tribunals didn’t go forward in water management and focus on developing a water database.

- Tribunals were created when State approached the centre and centre approved creation of tribunals.

Provisions of the Inter-State River Dispute (Amendment) act: 2019

- A dispute between two states will first go to a dispute resolution committee. In case of its failure, dispute will go to the permanent tribunal.

- A single Tribunal with different benches for all the river disputes.

- Maximum duration for a tribunal award is 6 years. 1.5 years are for dispute resolution committee and 4.5 years are for tribunals hearing and verdict.

- Tribunal’s member tenure will be of 5 years or 70 years of age.

- Tribunal will consist domain experts.

- Tribunal decisions are binding and has authority of Supreme Court order.

- It will require maintenance of basin database.

POLITY

A.R. Rahman Foundation among more than 20 NGOs that get Union Home Ministry nod

The Union government has granted Foreign Contribution Regulation Act (FCRA) licence to more than 20 NGOs this year and it includes the A.R. Rahman Foundation.

FCRA (Foreign contributing regulating act):

- Government of India started regulating NGO by FCRA in 1976.

FCRA and NGO:

- According to the FCRA, any ngo that accepts foreign contribution has to register with the home ministry. And such contribution can only be accepted through designated banks.

- The ngo has to report to the central govt any foreign contribution within 30 days of receipt.

- They need to file annual reports with the home ministry. It must also report the amount of foreign contribution, its source, how it was received, the purpose for which it was intended, and the manner in which it was utilised.

- In case of non-compliance with provision of FCRA, government can penalise NGO. Eg: if these NGOs don’t file annual returns, the government can issue a showcase notice and subsequently suspend or cancel their licenses.

- In the last two years, licenses of around 20000 NGOs have been cancelled by the central government after they were found violating various provisions of FCRA act.

FCRA amendment act 2010:

- Registration is mandatory and after every 5 years renewable is done, else the license will expire.

- Only 50 % of foreign funds can be used for administrative expenses. Therefore, allowing the government to control how a civil society spends its money.

- It changes the term political parties to “org of political nature “to include NGO, student and trade unions.

Amendment in FCRA rules 2019:

- All the members and office bearers of an NGO will have to file an affidavit making it mandatory for it to report “any violation” of the FCRA provisions by the applicant organisation.

Issues in FCRA:

- Arbitrary use. Unnecessary harassment is being faced by NGOS due to arbitrary use of this act.

- License are not renewed many time citing vague reasons.

- NGOs like Ford foundation, Greenpeace also have been harassed in the past.

- FCRA is often used to curb political dissent.

- 50 % funding clause curbs the administrative freedom of NGOs.

- Non conformity with international regulations. India is a signatory to international covenant on civil and political rights. Which mandates us to provide freedom of association.

- In 2015, UN special rapporteur on rights to freedom of peaceful assembly and association submitted its report on the working of FCRA act 2010. It criticises the act and held that provisions are not in conformity with international conventions and the arbitrary in nature.

ECONOMY

World’s second-biggest control centre for goods trains set to roll

The world’s second-biggest Operation Control Centre for goods trains, built in India by the Dedicated Freight Corridor Corporation of India (DFCCIL) is ready to begin operations.

About the Control Centre:

- It will be the ‘nerve-centre’ of the over 1,800 km-long eastern dedicated freight corridor.

- The control centre has a theatre which measures 1560 sq. m, with a video wall of more than 90 m.

- It will be used as a one-stop shop for controlling and monitoring rail systems, including train operations and the power supply system.

About Eastern Dedicated freight corridor:

- Eastern Dedicated Freight Corridor or Eastern DFC is a freight specific railway under construction in northern to eastern India by Indian Railways.

- The railway will run between Ludhiana in Punjab and Dankuni (near Kolkata) in West Bengal.

- This freight corridor will cover a total distance of 1839 km.

- This corridor will also pass through Dadri, which is the origin point of the Western Dedicated Freight Corridor and which will serve as a junction.

- Eastern DFC through States of Punjab, Haryana, Uttar Pradesh, Bihar, Jharkhand and West Bengal.

- It is designed for a maximum speed of 100 Kmph.

- The funding of the project is through World Bank loan (US $ 2.725 billion) for the Eastern DFC.

Vacant SEZ land to be used for affordable housing: Maharashtra minister

Provision of the Policy:

- In case of no industrial activity in more than 50% area, the land stands vested with the government.

- Land speculation cannot be permitted and therefore the government will put to notice all SEZ developers to start industrial production/ permitted activity within the SEZ within a period of 24 months.

- The activity must cover more than 50% of the SEZ land acquired and in case the developer fails to do so, the entire balance land will stand vested with the government and the government will reimburse the cost of such land to the developer at the same rate at which it was originally acquired by the SEZ developer by using Government machinery and thereafter use it for providing affordable housing.

Special Economic Zones (SEZ):

- Government of India first introduced the concept of SEZ in the export import policy 2000 with a view to provide an internationally competitive and hassle free environment for exports.

- SEZ refers to a specially demarcated territory usually known as ‘deemed foreign territory’ with tax holidays, exemption from duties for export and import, world level economic and social infrastructure for production and augmentation of export activities within the territory.

- The Special Economic Zones Act, 2005 provided statutory status to SEZ.

Features of SEZ Scheme:

- A designated duty free enclave to be treated as a territory outside the customs territory of India for the purpose of authorised operations in the SEZ.

- No licence required for import.

- Manufacturing or service activities allowed.

- The Unit shall achieve Positive Net Foreign Exchange to be calculated cumulatively for a period of five years from the commencement of production.

- Domestic sales subject to full customs duty and import policy in force.

- Full freedom for sub-contracting.

- No routine examination by customs authorities of export or import cargo.

- SEZ developers, co-developers and units enjoy direct tax and indirect tax benefits as prescribed in the SEZs Act.

Facts related to SEZ:

- SEZs being set up under the SEZ Act, 2005 and SEZs Rules, 2006 are primarily private investment driven.

- No funds are sanctioned by the Central Government for setting up of SEZ.

- Fiscal concessions and duty benefits have been allowed to developers and units as per the SEZ Act and Rules thereunder.

- The provision of SEZs Act, 2005 are applicable on manufacturing and services sectors.

Centre releases Rs 19950 cr GST compensation to states, total at Rs 1.2 trillion

The finance ministry said Rs 19,950 crore was released to states and union territories on last Monday.

- With this release of GST compensation, the central government has released a total of Rs 1, 20,498 crore towards GST compensation to the states/UTs during current fiscal.

- The money released compares to only Rs 78,874 crore having been collected as compensation cess in the current FY.

Provisions in the GST act:

- States were guaranteed to be compensated for any loss of revenue in the first five years of GST implementation.

- This compensation was to come out of a pool that is to be created by levy of cess on certain sin and luxury goods over and above the GST tax rate.

- The shortfall is calculated assuming a 14 per cent annual growth in GST collections by states over the base year of 2015-16.

- It is released at the end of every two months.

1.png)