Lok Sabha Speaker and unruly MPs: What House rules say

The suspension of two Congress members by Lok Sabha Speaker Om Birla after unruly scenes in the House has brought back focus on the conduct of MPs, and related issues.

Rules 378: The Speaker shall preserve order and have all powers necessary for the purpose of enforcing own decisions.

Rules 373: The Speaker can ask any member to withdraw from the house in case of grossly disorder conduct. The member has to withdraw compulsorily and remain absent for the day is sitting of the house.

Rules 374: The Speaker may name a member who disregards the authority of the Chair or abuses the rules of the House through disorder conduct. Speaker can disqualify such members after a passed motion to be absent for remaining session. House can revoke such disqualification through a motion.

Rules 374(1): If a member abuses rules of house by coming into the well or shouting slogans, can be automatically suspended from the service of the House for five consecutive sittings or the remainder of the session through naming by Speaker.

- Speaker Sumitra Mahajan suspended 45 members of Lok Sabha belonging to the TDP and AIADMK after they continuously disrupted proceedings for days.

- Speaker Meira Kumar had suspended 18 MPs from (undivided) Andhra Pradesh following pandemonium in the House.

In December 2018, Lok Sabha’s Rules Committee recommended automatic suspension of members who entered the well of the House or wilfully obstructed business by shouting slogans despite being repeatedly warned by the Chair.

- The ruling party of the day invariably insists on the maintenance of discipline, and the opposition on its right to protest.

- Mps had created chaos for action against government like creation of states.

- Speaker has power to disqualify members on grounds of defection.

- He has the power to expunge unparliamentarily language from the proceedings of the house.

- In extreme disruption, he can adjourn the house or call for recess.

- He is the final interpreter of constitution, rule of procedure and conduct of lok Sabha that prevent chaos.

- The Speaker can suspend the member if he/she breaches privilege of the house.

- Making it compulsory for the speaker to resign from his party before taking the position of speaker. It will ensure neutrality of the post.

- Some of speaker’s decision like suspension of members may be subject to judicial review.

- A code of ethics for MPs must be formed to clearly define cases for suspension and dismissals.

- Power must be given to speaker to form a parliamentary committee to recommend removal of MPs regularly disrupting the house.

The Ministry of Coal asked the state-run coal miner Coal India Limited (CIL) to produce 2 MMSCB (million metric standard cubic metres) per day of coalbed methane (CBM) gas in the next 2 to 3 years.

- CBM, like shale gas, is extracted from unconventional gas reservoirs.

- The methane is held underground within the coal and is extracted by drilling into the coal seam and removing the groundwater. The resulting drop in pressure causes the methane to be released from the coal.

- India’s CBM resources are estimated at around 92 trillion cubic feet (TCF), or 2,600 billion cubic metres (BCM).

- It is found in 12 states of India, with the Gondwana sediments of eastern India holding the bulk.

- CBM production in March 2015 was around 0.77 MMSCMD from 5 CBM blocks.

- Can be used for power generation.

- Auto fuel

- Feedstock for fertilisers

- Industrial uses such as in cement production, rolling mills, steel plants, and for methanol production.

- It was developed by German scientists in late 1990s.

- It is able to fight Vitamin A deficiency, which is the leading cause of blindness among children and can also lead to death due to infectious diseases such as measles.

- Rice is naturally low in the pigment beta-carotene, which the body uses to make Vitamin A.

- Golden rice is rich in this pigment, which give its golden colour.

- Bangladesh could become the first country to approve plantation of this variety.

Reference: https://indianexpress.com/article/explained/explained-what-is-golden-rice-6135523/

- The Central GST collection this fiscal year stood at Rs. 3.26 lakh crores, about half of the government’s target for 2019-20.

- On direct taxes, between April-October, 2019, the net collection of direct taxes was Rs. 5, 18,084 crores.

- The Budget Estimates for Central Goods and Services Tax (GST) for 2019-20 have been fixed at Rs. 6, 63,343 crores.

- On direct taxes, the Budget Estimate was Rs. 13, 35,000 crores.

- Slowdown in the economy.

- Consumption is down affecting GST collection.

- Profitability of the corporate sector has also been hit; this has resulted in low or no increment in salary for employees affecting direct tax.

- Shortfall in tax collection could be more than Rs.2-lakh crores after taking into account the estimated Rs. 1.45-lakh crores foregone on account of corporate tax rate cut.

What is Goods and Services Tax?

- It is a tax that customers have to bear when they buy any goods or services, such as food, clothes, electronics, items of daily needs, transportation, travel, etc.

- The concept of GST is that it is an “Indirect Tax”, i.e. this tax is not directly paid by customers to the government, but is rather levied on the manufacturer or seller goods and the providers of services. The sellers usually add the tax expense into their costs, and the price the customers pay is inclusive of GST. Thus, in most cases, one ends up paying a tax even if they are not an income taxpayer.

How it was introduced in India?

- It required a Constitutional Amendment, and hence, a two-thirds majority approval in the Parliament, and a nod of more than at least half of the states.

What are the benefits of GST in India?

- GST was India’s biggest tax system overhaul since Independence. GST replaced a plethora of indirect taxes such as states’ sales tax, service tax, excise, etc., with a single central tax regime applied uniformly on all products and services

- Biggest benefit of GST was that it opened up entire India as a single unified market allowing free movement of goods across states’ borders, as opposed to the earlier scenario where state borders became barriers.

- GST allowed for faster movement of trucks and led to requirements for fewer warehouses across several states. However, GST has multiple tax rate slabs for different categories of products – a fact that still makes it more complicated than many expected.

What are the different types of GST?

Central GST (CGST): GST paid on each transaction is divided into two equal parts: the part for the Centre is termed as CGST.

State GST (SGST): The part of a state’s share of GST, when a transaction takes place within the state, is called SGST.

Union territory GST (UGST): When a transaction takes place within a union territory (UT) without a legislature, the part of GST that the UT gets is called UGST.

Integrated GST (IGST): When a transaction takes place between two states/UTs or between a state/UT and any foreign territory, IGST is levied without any bifurcation on the applicable GST rate.

What items are not taxed or covered under GST?

There are a few products, which were not under the purview of GST till long after its launch.

Alcohol for human consumption: On alcohol, the power to tax remains with the states.

Petroleum products: GST was not imposed on five petroleum products — crude oil, diesel, petrol, natural gas and ATF.

Tobacco: Along with GST, the Central Government has the power to levy additional excise duty on tobacco products.

Entertainment tax: The power to decide on entertainment tax levied by local bodies remains with the states.

Also, there are some exceptions on Indian Railways tickets, where instead of the destination, the origin of the journey is taken into consideration. For example, if Rajdhani Express is registered in Delhi, on the tickets from Delhi, CGST and SGST will be levied, while IGST will be charged when the journey originates at a place other than Delhi.

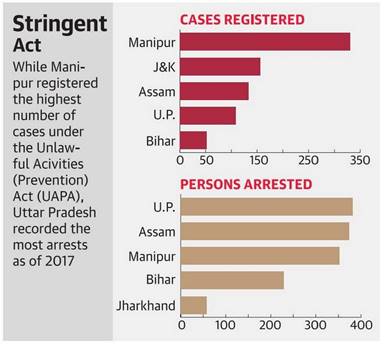

More than 35% cases registered under the stringent Unlawful Activities (Prevention) Act (UAPA) were recorded in Manipur, as per the National Crime Records Data (NCRB) provided by the Home Ministry in the Rajya Sabha last week.

About NCRB:

- The National Crime Records Bureau, abbreviated to NCRB, is an Indian government agency responsible for collecting and analysing crime data as defined by the Indian Penal Code (IPC) and Special and Local Laws (SLL)

- NCRB is headquartered in New Delhi and is part of the Ministry of Home Affairs (MHA), Government of India.

- NCRB was set-up in 1986 to function as a repository of information on crime and criminals so as to assist the investigators in linking crime to the perpetrators.

Objectives of NCRB:

- Create and maintain secure sharable National Databases on crimes and criminals for law enforcement agencies and promote their use for public service delivery.

- Collect and process crime statistics at the national level and clearing house of information on crime and criminals both at National and International levels.

- Lead and coordinate development of IT applications and create an enabling IT environment for Police organizations.

- National repository of fingerprints of all criminals.

- To evaluate, modernize and promote automation in State Crime Records Bureaux and State Finger Print Bureaux.

- Training and capacity building in Police Forces in Information Technology and Finger Print Science.

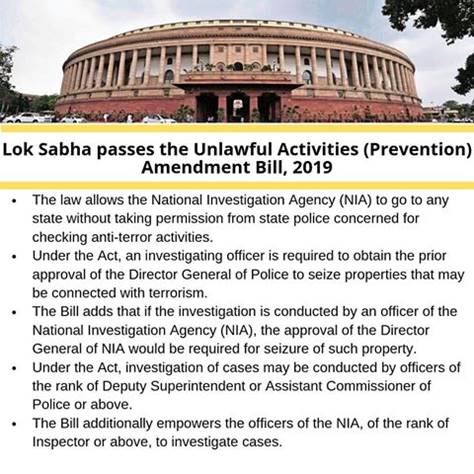

- Law empower the Centre to label individuals as terrorists (there used to be terrorist organisations so far and individuals were prosecuted for being part of or assisting them).

- The onus of proving that one is not a terrorist is on the individual.

- The law does not specify the process that Centre will follow to brand someone a terrorist.

- To be denotified as a ‘terrorist’, an individual can make an application to the Centre seeking a review. If his application is rejected, the individual can approach a review committee. If the committee rules in his favour, the terrorist tag is taken away.

- There is no specified time limit for appointing review committee or the time limit in which it is supposed to give its order.

© 2025 iasgyan. All right reserved