Fuel prices

Copyright infringement not intended.

Context

- In the last 17 days, the retail petrol prices were revised upwards 14 times. Latest data show that the incremental rise in petrol prices may continue for some more time.

India’s crude oil imports

- India imports 85% of its oil from more than 40 countries.

- The bulk of supplies come from the Middle East and the US. (India imports only 2% of its supplies from Russia.)

- Imports include oil which it converts to petroleum products after refining.

- India exports petroleum products – accounting for more than 13% of its total exports – to more than 100 countries.

Role of Ukraine crisis in fuel price rise in India

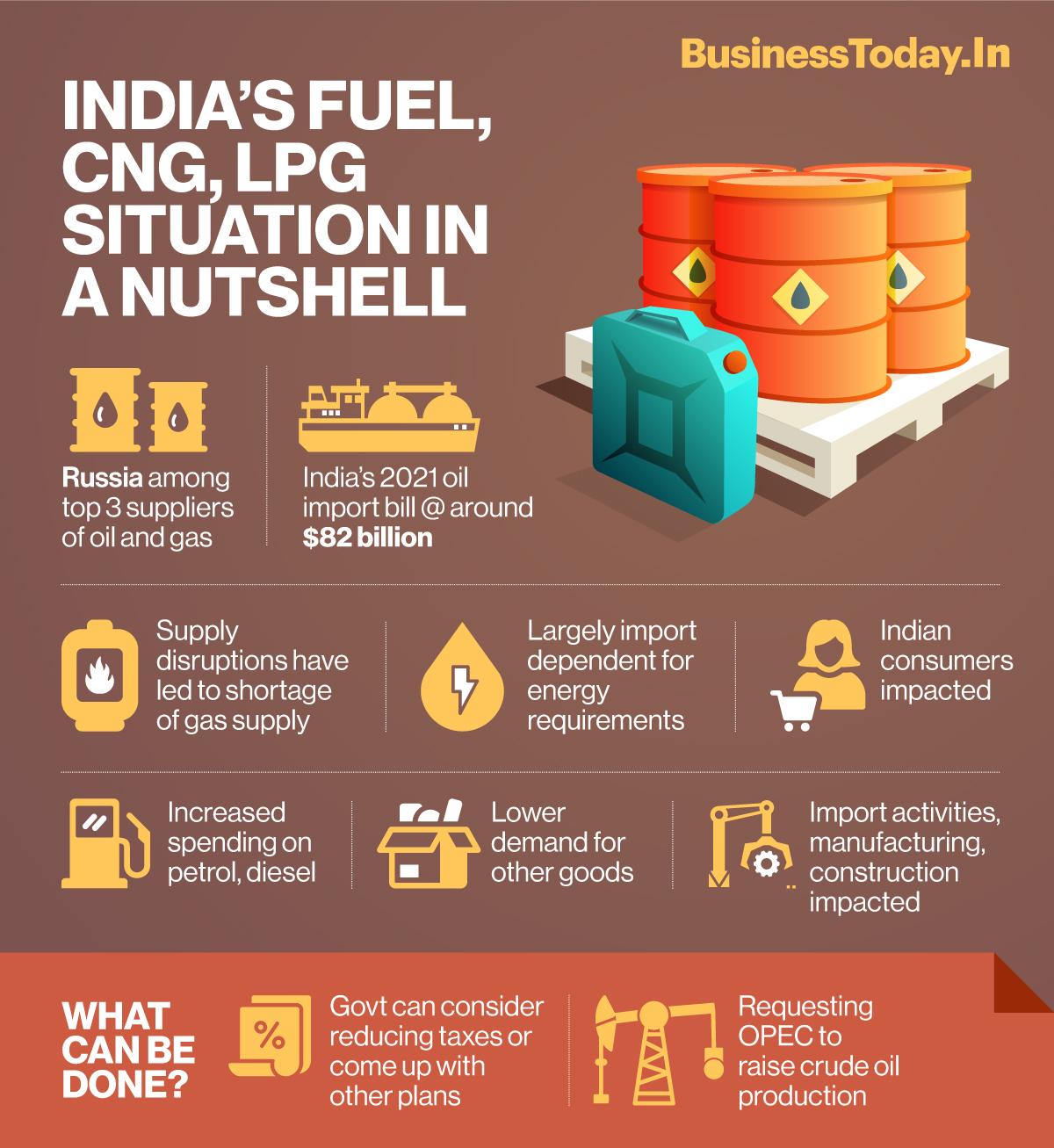

- Russia is one of the top three suppliers of fuels – oil and gas. India buys about $1 billion of oil from Russia, though its oil import bill is over $82 billion (for 2021) - a 108 per cent rise from 2020 and imports a major chunk of its natural gas from Qatar.

- Crisis between the two countries has led to shortage of gas supply, leading to a rise in gas prices.

- The supply disruptions and sanctions on Russia have created a major hike in the global energy prices. India is dependent on international energy supply and international prices impact Indian consumers.

- But sanctions on Russia are not the only reason behind the rise in gas prices in India.

- There are six main factors that the rise in gas prices in India can be attributed to —

- Ban on Russia after Ukraine invasion,

- Crude supply from US reserves and other countries,

- Lockdown in China,

- OPEC not seemingly increasing output and

- US not increasing its crude output.

Government’s view

- Fuel prices hiked in India are 1/10th of prices hiked in other countries.

- Comparing gasoline (petrol) prices between April 2021 and March 2022, the prices in the USA have increased by 51 per cent, Canada by 52 per cent, Germany by 55 per cent, the UK by 55 per cent, France by 50 per cent, Spain 58 per cent but in India only 5 per cent.

Copyright infringement not intended.

How are Fuel Prices Determined in India?

- Fuel rates are revised everyday at 06:00 AM in India, and this is called dynamic fuel price method.

- This makes sure that variations of global oil prices throughout the day are transmitted and reflected to fuel users and dealers.

India imports 80 percent of crude oil. We process this crude oil in our domestic refineries to generate petroleum products. A large share of our petrol comes via this process. In fact, we barely import any petrol or diesel. This crude oil goes through three stages of the transaction before it comes to your automobiles in the form of petrol and diesel.

How can Government controls Prices of Fuels?

- Central government’s tool to control prices of fuel is Excise Duty.

- State government’s tool to control prices of fuel is VAT.

Who is the official regulator of Fuel prices in India?

- Apart from taxes, Central government regulates the prices of fuels through base prices and cap prices at which dealers and OMCs deal with each other, decided by PPAC (Petroleum Planning and Analysis Cell) under Ministry of Petroleum and Natural Gas.

- Apart from this there are many licenses, regulations, laws applicable to refineries, OMCs, dealers, etc. and after passing through all this processes we get our tank filled with the fuel.

How Retail Price Of Petrol & Diesel Calculated?

- Fuel rates are decided by oil marketing companies. State-owned oil marketing companies (OMCs). Since they aren't government regulated anymore, it's the responsibility of the oil companies to adjust prices according to global rates.

- The retail price of fuel is decided according to the rolling average of international benchmark prices over the previous 15 days; new prices come into effect at 6 am every day.

- However, the state and central governments takes taxes on the retail price of petrol and diesel.

Fuel prices in India are one of the highest taxed in the world. The amount we pay for 1 Liter fuel consists of average 70% taxes.

|

Important terms related to Fuel Pricing Oil Refineries: These refineries buy or extract crude like WTI (West Texas Intermediate) Crude, Brent Crude, OPEC Basket crude, etc. and convert these crudes into petrol, diesel, Aviation turbine fuel, Biofuels, etc. Examples of such refineries are Reliance Industries, Nayara Energy, Bharat Petroleum, Indian Oil, Shell, ONGC, Saudi Aramco, etc. OMC (Oil Marketing Companies): These are the companies who market the converted crudes (petrol, diesel, etc.) to dealers and ultimately to users. Examples of such refineries are Indian Oil, Bharat Petroleum, Shell, Essar, etc. Dealers: Dealers are the People who are engaged into business of buying fuels from OMCs and distributing them to users. They are distributors of fuel. Example: Arvind Patel and Pravin Patel are distributors of cars of Maruti Suzuki Co., they are called dealers of the company and runs the business known as ‘Patel Motors’. Users: We are the users of fuel for our vehicles, also the airplane transport companies who buys the aviation turbine fuels from OMCs directly to keep their planes flying through the skies. |

Impact of Global Crude Oil Price rise on India

- Current Account Deficit: The increase in oil prices will increase the country's import bill, and further disturb its current account deficit (excess of imports of goods and services over exports).

- Inflation: The increase in crude prices could also further increase inflationary pressures.

- Fiscal Health: If oil prices continue to increase, the government shall be forced to cut taxes on petroleum and diesel which may cause loss of revenue and deteriorate its fiscal balance. The revenue lost will erode the government's ability to spend or meet its fiscal commitments in the form of budgetary transfers to states.

- Economic Recovery: Any increase in global prices can affect its import bill, stoke inflation and increase its trade deficit, which in turn will slow its economic recovery.

- Natural Gas Price: The increase in gas prices has put upward pressure on the price of both Compressed Natural Gas (CNG) used as a transport fuel and Piped Natural Gas (PNG) used as a cooking fuel.

- Subsidies: The rise in crude oil prices is also expected to increase the subsidy on LPG and kerosene, pushing up the subsidy bill.

A Recent Example

- In India Investor sentiment has been hurt over the last few days in line with rising crude prices. Foreign portfolio investors have pulled out a net of Rs 51,703 crore from Indian equities leading to decline and volatility in equity markets. The rupee has fallen over 1.7% against the dollar from $73.8 per barrel on Jan 12 to hit $75.09.

Final Thoughts and way ahead

- Given that the crude prices are still high, any meaningful decrease in the retail prices can be achieved only if another round of excise duty and VAT cuts is implemented.

- The whole world including India needs to rethink its reliance on imported fuels.

- There needs to be a renaissance of nuclear and locally mined coal along with further accelerated renewable investments in an effort to substitute gas and coal imported.

- The key to the energy transition is in our hands. The huge change required needs to be led by policymakers, consumers, individuals and industry.

- High oil prices improve the economics of alternatives like electric or hydrogen vehicles.

- Need of the hour: Combined with the need to decrease import dependence a serious policy push followed by a strong consumer response to deploy electric vehicles and other solutions quicker and at a greater scale.

- Achieving a substantial change however would take years if not decades. For example, in Norway, where 65% of all vehicles sold in 2021 were electric, oil demand has fallen less than 10% since 2013.

- Transitioning to alternatives quickly would not only improve energy security, it will significantly cut CO2 emissions and eliminate our dependencies in such war like situations.

Read: https://www.iasgyan.in/daily-current-affairs/crude-oil-price

1.png)