Description

Copyright infringement not intended

In News:

- The Union Government is set to discuss a new pension model, which has been proposed by the Chief Minister of Andhra Pradesh in the state.

- Andhra Pradesh Pension scheme is a unique pension model that combines the elements of both the Old Pension Scheme (defined benefit) and the New Pension Scheme (defined contribution).

- The scheme is also known as the ‘Guaranteed Pension Scheme’ (GPS).

- Officials in the Union Finance Ministry said that the model “is interesting”, but it needs to be studied in detail.

Andhra Pradesh's new Pension Scheme:

- It ‘defined contribution’ from employees every month and offers two options of ‘defined benefit’;

- Option 1: Employees can get a guaranteed pension of 33% of their last drawn salary if they contribute 10% of their basic salary every month which is matched by a 10 % contribution by the state government.

- Option 2: Employees can get a guaranteed pension of 40% of their last drawn salary if they contribute 14% of their salary every month, which will be matched by a 14% government contribution.

.jpeg)

Old Pension Scheme (OPS):

- Earlier the Pension of the Centre and states government employees was fixed at 50% of the last drawn basic pay.

- For example: If a government employee’s basic monthly salary at the time of retirement was Rs 20,000, he/she would be assured of a pension of Rs 10,000.

- The monthly payouts of pensioners also increased with hikes in dearness allowance (DA) announced by the government for serving employees.

- DA is calculated as a percentage of the basic salary, it is a kind of adjustment the government provides to its employees and pensioners to make up for the steady increase in the cost of living.

- DA hikes are announced twice a year, generally in January and July.

- Currently, the minimum pension paid by the government is Rs 9,000 a month, and the maximum is Rs 62,500 (50% of the highest pay in the Central government, which is Rs 1, 25,000 a month).

- The Old Pension System was replaced by a New Payment System (NPS), which came into effect for employees joining government service from 1st January 2004,

- The New Pension System promises an assured or ‘defined’ benefit to the retiree. It is therefore described as a ‘Defined Benefit Scheme’.

Concerns related to the OPS:

- Under OPS, the main problem was that the pension liability remained unfunded, there was no corpus specifically for pension, which rise continuously.

- The government budget provided for pensions every year; there was no clear plan on how to manage growing expenditures in future. It also created inter-generational equity issues; the present generation had to bear the continuously rising burden of pensioners.

- Over the last three decades, pension liabilities for the Centre and states have increased manifold.

- In 1990-91, the Centre’s pension bill was Rs 3,272 crore, and the outgo for all states put together was Rs 3,131 crore.

- By 2020-21, the Centre’s bill had jumped 58 times to Rs 1,90,886 crore; for states, it had shot up 125 times to Rs 3,86,001 crore.

- Overall, pension payments by states take away a quarter of their tax revenues. For some states, it is much higher such as;

- For Himachal, it is almost 80 % (pensions as a percentage of the state’s tax revenues), and for Punjab, it is almost 35%.

- If wages and salaries of state government employees are added to the pension bills, states are left with hardly anything from their tax receipts.

Steps taken to reform the Pension System:

- In 1998, the Union Ministry of Social Justice and Empowerment released a report for an Old Age Social and Income Security (OASIS) project.

- The OASIS project was not meant to reform the government pension system — its primary objective was targeted at unorganised sector workers who had no old age income security.

- The committee formed under the project noted that less than 11% of the estimated total working population had some post-retirement income security like a government pension, Employees’ Provident Fund (EPF), or the Employee Pension Scheme (EPS). The rest of the workforce had no means of post-retirement economic security.

- The OASIS report recommended that individuals could invest in three types of funds;

- Safe (allowing up to 10% investment in equity).

- Balanced (up to 30% in equity).

- Growth (up to 50% in equity)

- The balance would be invested in corporate bonds or government securities.

- The Union Ministry of Personnel, Public Grievances and Pensions set up a high-level expert group (HLEG) under B K Bhattacharya to look into the situation for government employees.

- The HLEG suggested 2 types of hybrid defined benefit/ defined contribution schemes for government employees.

- Type 1: It recommended a 10% contribution by the employer and the employee. The accumulated funds would be used to pay pension in annuity form.

- Type 2: No limit was specified for the employee, but the employer’s contribution would be matching but limited to 5%. Accumulated funds could be withdrawn in lumpsum or converted into an annuity. These incomes would be tax-exempt.

- The report was submitted in 2002, but not accepted by the government.

Origin of the New Pension Scheme (NPS):

- The Project OASIS report became the basis of the New Pension System.

- NPS was originally designed for unorganised sector workers and was adopted by the government for its employees.

- NPS for Central government employees was notified on December 22, 2003, and it was made mandatory for all recruits joining government service from January 1, 2004.

- The defined contribution comprised 10% of the basic salary and dearness allowance by the employee and a matching contribution by the government, In January 2019, the government increased its contribution to 14% of the basic salary and dearness allowance.

Significance of NPS:

- Simple – Opening an account with NPS provides a Permanent Retirement Account Number (PRAN), which is a unique number it remains with the subscriber throughout his lifetime.

- Flexible - NPS offers a range of investment options and choices of Pension Funds (PFs) for planning the growth of the investments reasonably and monitoring the growth of the pension corpus.

- Subscribers can switch over from one investment option to another or from one fund manager to another.

- Portable- NPS provides seamless portability across jobs and locations. It would provide a hassle-free arrangement for the individual subscribers while he/she shifts to the new job/location, without leaving behind the corpus build, as happens in many pension schemes in India.

- Well Regulated- NPS is regulated by Pension Fund Regulatory and Development Authority (PFRDA), with transparent investment norms, regular monitoring and performance review of fund managers by NPS Trust.

- The dual benefit of Low Cost and Power of compounding: Till retirement, pension wealth accumulation grows over the period with a compounding effect.

- Ease of Access: The NPS account is manageable online. An NPS account can be opened through the e-NPS portal. Further contributions can also be made online through the following eNPS portals.

Pension Bill in India:

- CAG report titled ‘Union and State Finances at A Glance’ for 2019-20 highlighted that the Committed Expenditure in respect of the Union Government consists of 67% on Interest Payment and Servicing of Debt. The remaining 19% and 14% of expenditure constituted the expenditure on Pensions and Salary and Wages respectively.

- The Centre’s total Committed Expenditure accounted for 37% of its total revenue expenditure of Rs 26.15 lakh crore in 2019-20.

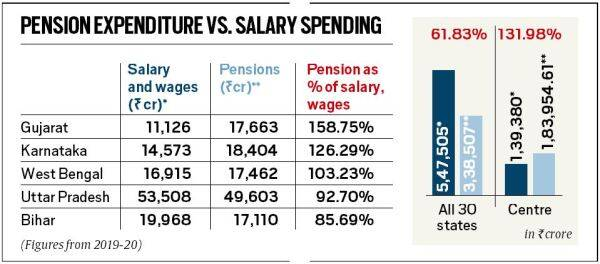

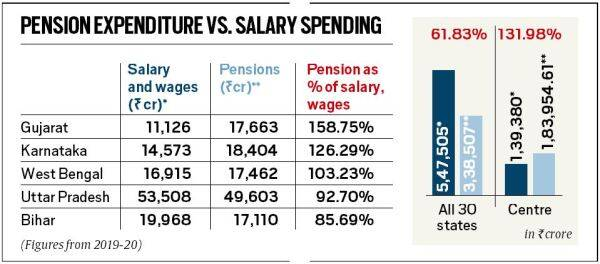

- Expenditure on pension has emerged as one of the major components of the Committed Expenditure of the Centre and states in recent years. It was higher than the ‘salary and wages’ expenditure of the Centre and three states – including Gujarat – during 2019-20, according to official data of the Comptroller and Auditor General of India.

- According to data available from the Comptroller and Auditor General of India (CAG), the Centre’s total Committed Expenditure was Rs 9.78 lakh crore during 2019-20, which included an expenditure of Rs 1.39 lakh crore on ‘salary and wages’, Rs 1.83 lakh crore on pensions and Rs 6.55 lakh crore on ‘interest payments and servicing of debts’.

- Higher committed expenditure means that the government has lesser flexibility to determine the purpose for which revenue expenditure is to be incurred.

Must Read: https://www.iasgyan.in/daily-current-affairs/employee-pension-scheme

Consider the following Statements;

- Under the Old Pension Scheme, the Pension of the Centre and states government employees was fixed at 50% of the last drawn basic pay.

- The Old Pension System was replaced by the New Payment System (NPS) in 2014.

Which of the following statement is/are correct?

(A) 1 only

(B) 2 only

(C) Both 1 and 2

(D) Neither 1 nor 2

Answer: A

Explanation:

Statement 1 is correct: Under the Old Pension Scheme (OPS), the Pension of the Centre and state government employees was fixed at 50% of the last drawn basic pay.

For example: If a government employee’s basic monthly salary at the time of retirement was Rs 20,000, he/she would be assured of a pension of Rs 10,000.

Statement 2 is incorrect: The Old Pension System was replaced by a New Payment System (NPS), NPS for Central government employees was notified on December 22, 2003, and it was made mandatory for all recruits joining government service from January 1, 2004.

https://indianexpress.com/article/india/andhras-guaranteed-pension-scheme-model-catches-the-attention-of-centre-8426007/#:~:text=It%20is%20attractively%20called%20the,contribution%20by%20the%20state%20government.