No plans to merge EPF, NPS: FinMin

Context: Finance Minister Nirmala Sitharaman has said there is no intent to discourage higher income earners from saving with the Employees Provident Fund (EPF) and that she was open to reviewing the contribution limit of Rs. 2.5 lakh a year for tax-free interest.

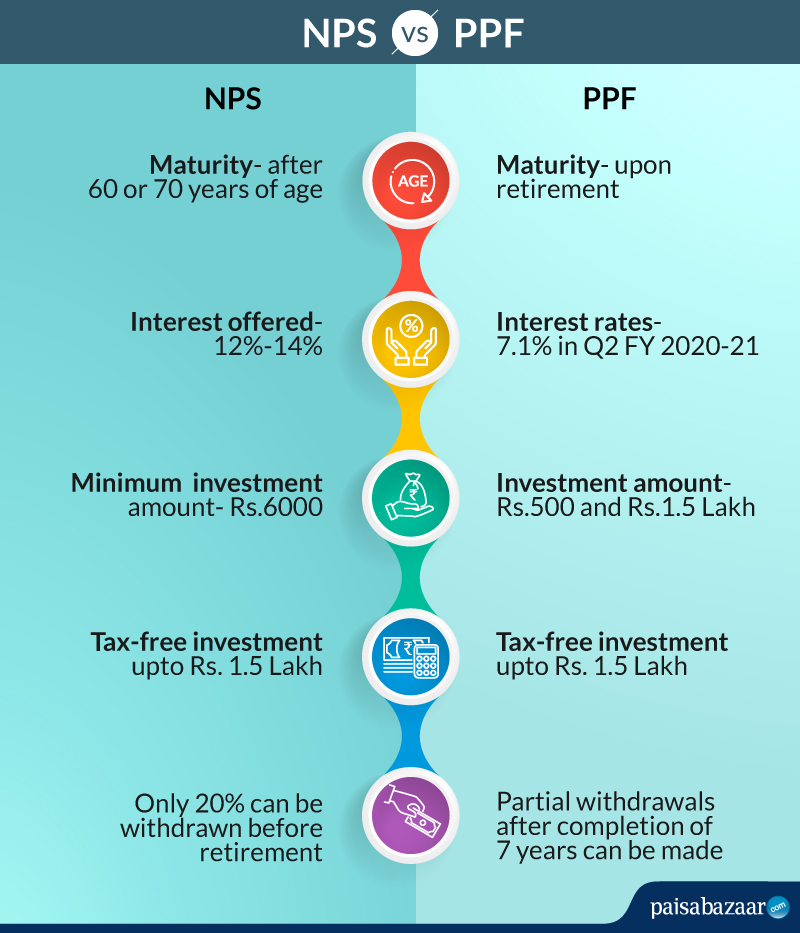

NPS (National Pension Scheme):

- The National Pension Scheme is a social security initiative by the Central Government.

- This pension programme is open to employees from the public, private and even the unorganized sectors except those from the armed forces.

- The scheme encourages people to invest in a pension account at regular intervals during the course of their employment.

- After retirement, the subscribers can take out a certain percentage of the corpus.

- Earlier, the NPS scheme covered only the Central Government employees. Now, however, the PFRDA has made it open to all Indian citizens on a voluntary basis.

- NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement.

- The scheme is portable across jobs and locations, with tax benefits under Section 80C and Section 80CCD.

EPF (Employees’ Provident Fund):

- The Employees’ Provident Fund (EPF) is a savings scheme introduced under the Employees’ Provident Fund and Miscellaneous Act, 1952.

- It is administered and managed by the Central Board of Trustees that consists of representatives from three parties, namely, the government, the employers and the employees.

- The Employees’ Provident Fund Organization (EPFO) assists this board in its activities.

- EPFO works under the direct jurisdiction of the government and is managed through the Ministry of Labor and Employment.

- EPF scheme aims at promoting savings to be used post-retirement by various employees all over the country.

- Employees’ Provident Fund or EPF is a collection of funds contributed by the employer and his employee regularly on a monthly basis.

- The employer and employee contribute 12% each of the employee’s salary (basic + dearness allowance) to the EPF. These contributions earn a fixed level of interest set by the EPFO.

https://www.thehindu.com/todays-paper/finmin-hints-at-review-of-tax-limit-on-epf/article33898985.ece

1.png)