TAX ON LIBERALISED REMITTANCES SCHEME

Copyright infringement not intended

Context: Banks are preparing their systems to track purchases made with foreign credit cards and mobilise tax collected at source (TCS) on outgoing remittances in anticipation of the Reserve Bank of India's Liberalised Remittances Scheme (LRS) 20% tax taking effect on 1st July.

Details

Banking sources reported that banks needed help determining and collecting TCS on exemptions when using credit and debit cards outside of India. On the other hand, the Reserve Bank of India (RBI) has left the banks to fend for themselves to collect the levy levied by the government in the FY23–24 budget.

Liberalised Remittances Scheme (LRS)

- The Liberalised Remittances Scheme (LRS) is a facility provided by the Reserve Bank of India (RBI) that allows resident individuals to remit up to USD 250,000 per financial year for any permissible current or capital account transaction or a combination of both.

- The scheme was introduced in 2004 with a limit of USD 25,000 and has been progressively liberalised over the years.

- The LRS covers various purposes such as education, travel, medical treatment, maintenance of relatives abroad, gifts and donations, investment in foreign securities and property, and opening foreign currency accounts.

- The LRS allows resident individuals to set up joint ventures or wholly owned subsidiaries outside India within the limit of USD 250,000.

Recent steps

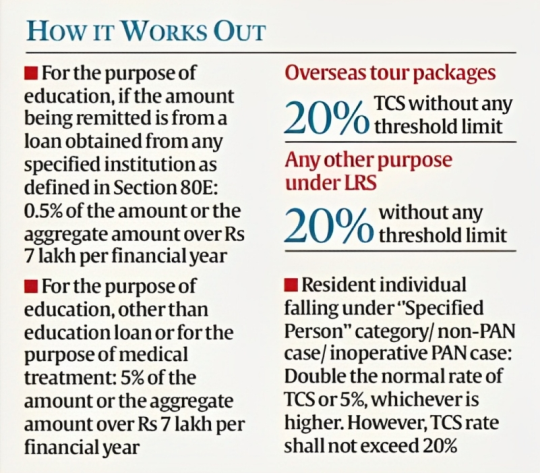

- On February 1, 2023, the government decided to impose a 20% tax on foreign remittances except for overseas education and medical treatment. It was announced as a measure to prevent tax evasion and widen the tax base.

- The TCS is not an additional tax but an advance tax that can be adjusted against the final tax liability of the remitter. The remitter can claim credit for the TCS paid while filing his or her income tax return.

- The banks will deduct the TCS from the remittance amount or the credit card bill and deposit it with the government. The banks will also issue certificates to their customers for the TCS paid.

Some of the significances and challenges are:

- It will increase the cost of remittances and foreign purchases for resident individuals and may discourage them from using these facilities.

- It will increase the compliance burden for resident individuals as they will have to keep track of their remittances and foreign purchases and claim credit for the TCS paid while filing their income tax returns.

- It will help the government monitor foreign exchange's outflow and curb tax evasion by resident individuals who may not report their foreign income or assets.

- It will also generate additional revenue for the government which can be used for public welfare and development.

Way Forward

- The way forward for resident individuals who use the LRS and foreign credit cards is to be aware of the new tax rules and plan their remittances and foreign purchases accordingly. They should keep their income tax returns updated and claim credit for the TCS paid. They should consult their tax advisors or bankers for any clarification or guidance on the matter.

Must Read Articles:

Tax Collection at Source under LRS: https://www.iasgyan.in/daily-current-affairs/tax-collection-at-source-under-lrs

|

PRACTICE QUESTION Q. Which of the following purposes are allowed under the LRS? 1. Education 2. Medical treatment 3. Gift 4. Donation How many of the above statements is/are correct? A) Only 1 B) Only 2 C) Only 3 D) All Answer: D Explanation: The LRS covers a wide range of purposes for which resident individuals can remit foreign exchange abroad. Some of the common purposes are education, medical treatment, gift, donation, the maintenance of relatives, travel, investment, etc. |

1.png)